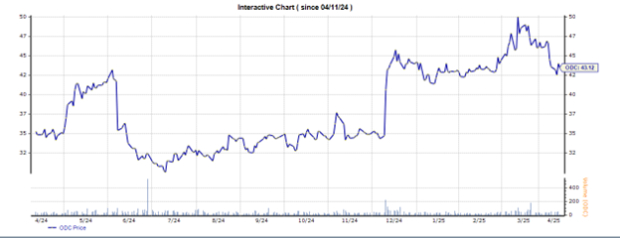

Having diverse product lines with uncorrelated end markets can be advantageous during these times of economic uncertainty. Coupling this with a strong balance sheet replete with proverbial dry powder is also advantageous, providing the groundwork for a possible slow and defensive grind of appreciation with optionality for opportune acquisitions. Here we highlight 2 small caps under Zacks coverage which meet these conditions. Oil-Dri Corporation (ODC) is a leader in developing, manufacturing and marketing sorbent products. Cat litter is a major product line and historically has proven fairly recession-resistant. Additionally, the company’s purchase of Ultra Pet back in May of 2024 will continue to add incremental YOY sales for at least the next quarter.

Image Source: Zacks Investment Research

Also noteworthy is the fluid purifications segment of Oil-Dri Corporation (ODC) which grew 17% YOY to $26.5 m in the latest quarter and now comprises nearly 23% of total revenue. This segment is benefitting from the arguably underappreciated growth of renewable diesel throughout the US punctuated by major plant openings accommodated by incentives at both the state and Federal level. The US EIA (Energy Information Administration) projects daily renewable diesel production to increase 8.7% to 250K barrels in 2026 vs. 2025. Zacks recently upgraded ODC to Outperform based on a solid topline growth prognosis and EBITDA growth of 16% YOY for the quarter. Income investors will appreciate annual dividend growth of 4.9% over the past 10 years. Since most of the company’s operations and sales are US-based with vertical integration, the company believes it should be able to thwart any direct impact from possible tariffs. The stock is currently trading at 7.61X trailing 12-month EV/EBITDA TTM, which compares to 8.19X for the Zacks sub-industry, 10.46X for the Zacks sector and 14.66X for the S&P 500 index.Over the past five years, the stock has traded as high as 12.72X and as low as 4.81X, with a 5-year median of 7.64X. Shares of Oil-Dri are up 27.1% in the past six months and 22% over the trailing 12-month period. Stocks in the Zacks chemical – diversified subindustry are down 35.9%, while the Zacks basic materials sector is down 20.6% in the six-month period. Over the past year, the Zacks sub-industry is down 32.1%, while the sector is down 20.4%. Steel Partners Holdings L.P. (SPLP) is a diversified global holding company. Steel Partners Holdings has 4 main verticals: Industrial (49.9% of sales), Financial (18.4%), Energy (10.5%), and Supply Chain (10%). It’s probably fair to say SPLP seems to have their hands in everything.

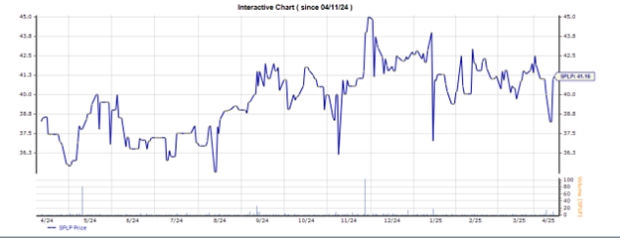

Image Source: Zacks Investment Research

Joining materials, tubing, building materials, performance materials, electrical products, blades, and metalized film comprise the Industrial segment with a focus on niche products. The Financial segment consists of WebBank, a Utah-based industrial bank that offers the usual gamut of banking services. The Energy business provides drilling and production services to the oil and gas E&P players. The Supply Chain segment, through its subsidiary Modus Link, leverages its global footprint to provide services such as material sourcing and planning, warehouse and transportation management, and packaging design. One can see how these pieces can provide natural hedges against one another based on macro dynamics such as commodity pricing, interest rates, and global trade. Q4 Industrial revenue grew 8% YOY while Supply Chain and Financial Services grew 9.1% and 2.9% YOY respectively. Energy grew 4.7% YOY for the quarter but declined 19.2% YOY for the full year 2024. Total revenue for the quarter grew 6.6% YOY. Q4 Adj. EBITDA grew 43% YOY to $84.7 m due to Gross Margin and SG&A leverage. The company has net cash of $62.2 m, which includes deducting the preferred unit liability of $155.6 m. And the company has access to a $470 m senior credit agreement. The stock is currently trading at 1.20X trailing 12-month EV/EBITDA TTM, which compares to 10.02X for the Zacks sub-industry, 10.02X for the Zacks sector and 14.66X for the S&P 500 index.Over the past five years, the stock has traded as high as 20.85X and as low as 1.04X, with a 5-year median of 3.97X. The stock is currently trading at 0.62X trailing 12-month P/B TTM, which compares to 5.04X for the Zacks sub-industry, 5.04X for the Zacks sector and 7.01X for the S&P 500 index.Over the past five years, the stock has traded as high as 1.50X and as low as 0.26X, with a 5-year median of 0.90X. Shares of Steel Partners are up 7.1% in the past six months and 9.7% over the trailing 12-month period. Stocks in the Zacks multi-sector conglomerates subindustry are down 15.5%, while the Zacks diversified operations sector is down 15.5% in the six-month period. Over the past year, the Zacks subindustry and sector are down 2.7% and 2.7%, respectively. Lastly, note that the market betas are 1 for SPLP and .5 for ODC.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Steel Partners Holdings LP (SPLP): Free Stock Analysis Report

Oil-Dri Corporation Of America (ODC): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).