Record Highs and Potential Challenges

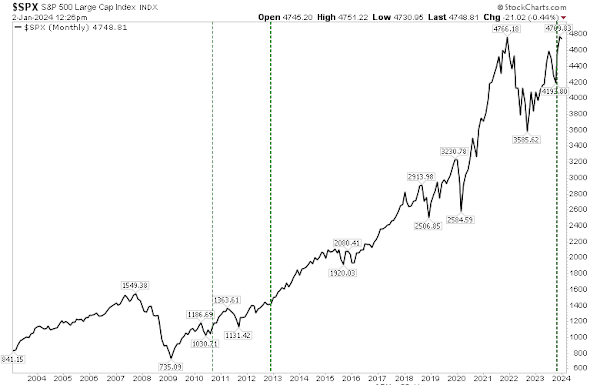

With the exception of the Russell 2000 ($IWM), major indices like the S&P and the Nasdaq are positioned near all-time highs, setting the stage for a potential bullish run. A critical factor to consider is the likelihood of some indices forming double tops, especially evident when analyzing monthly charts such as the S&P.

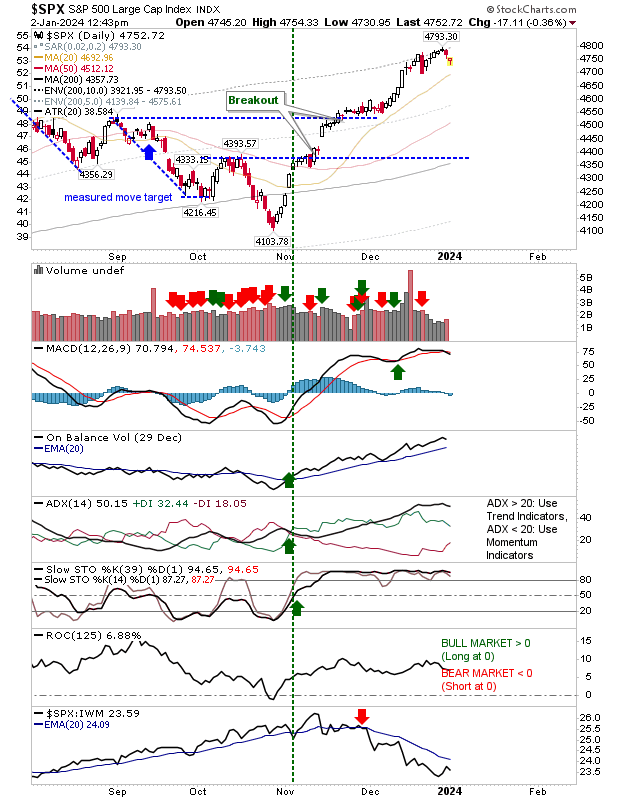

If the 2021 high is surmounted in the upcoming weeks, marking any gain beyond January, the risk of a double top could diminish. While this holds true, it’s essential to acknowledge the lack of substantial profit-taking from the markets since the October rally. Focusing specifically on the S&P, keen attention to the 50-day moving average is advisable to identify potential buying opportunities amidst any profit-taking at the beginning of 2024.

Technical Indicators and Market Sentiment

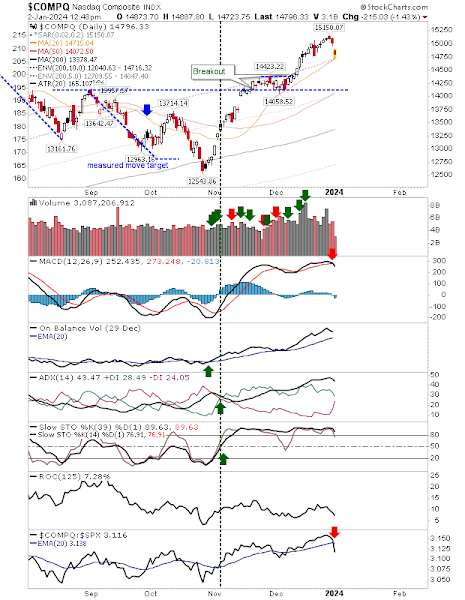

Comparatively, the Nasdaq has not reached the same level of extension as the S&P, implying a higher reservoir of pent-up demand in case sellers attempt to influence the index’s movement. Despite a ‘sell’ signal for the Moving Average Convergence Divergence (MACD), other technical indicators remain robust with a distinct decline in selling volume compared to recent buying activities.

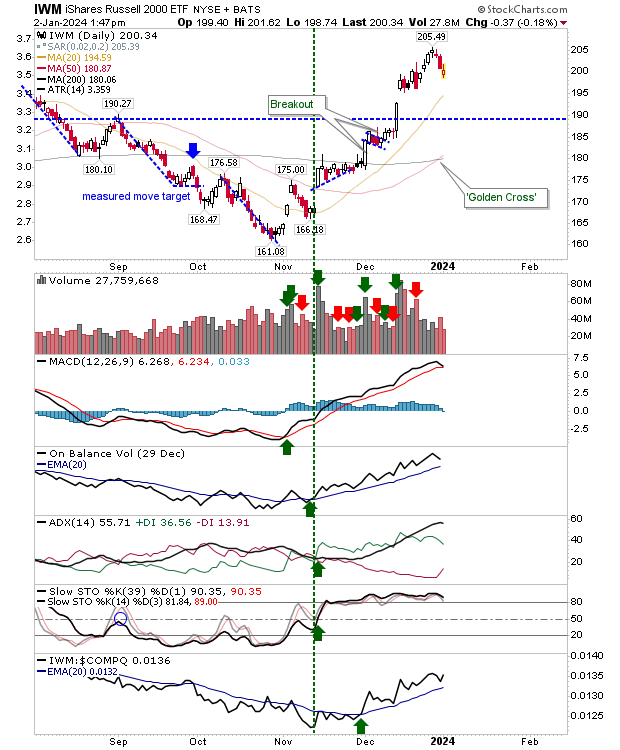

Addressing the Russell 2000 ($IWM), it lags behind in its journey to reclaim 2021 highs. Notably, the end of the year witnessed a ‘golden cross’ crossover between the 50-day and 200-day moving averages, signifying a trend reversal favoring the bullish camp—the same reversal achieved by the S&P and Nasdaq. As with the latter two indices, the Russell 2000 exhibits robust technicals amidst light selling volume.

Prospective Trends and Market Dynamics

Moving forward, investors anticipate the continuation of the favorable October trend, albeit after allowing ‘weak hands’ the opportunity to harvest their profits. Among the major indices, the Russell 2000 ($IWM) stands as the prime candidate to attract buyers due to its positioning as a “value” index compared to the S&P and Nasdaq. The market eagerly anticipates the return of active traders next week to observe the ensuing developments.