Key Points

-

Alphabet uses AI in multiple ways, revolutionizing how its advertisers build campaigns and cloud users develop AI apps.

-

Amazon is using AI to speed up fulfilment in e-commerce, and the AI development business through AWS is a huge opportunity.

-

Taiwan Semiconductor is supporting AI growth with its manufacturing facillities, and it’s moving more work to the U.S.

- 10 stocks we like better than Alphabet ›

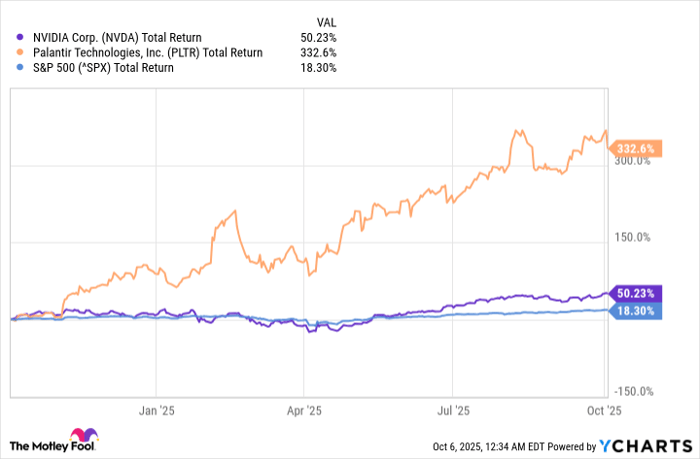

Artificial intelligence (AI) stocks continue to drive market gains, with companies like Nvidia and Palantir Technologies outpacing the S&P 500.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

NVDA Total Return Level data by YCharts

But there’s still time to find bargain stocks that are engineering the AI revolution and have massive long-term opportunities. Consider Alphabet (NASDAQ: GOOG), Amazon (NASDAQ: AMZN), and Taiwan Semiconductor (NYSE: TSM).

1. Alphabet: The world’s search engine

Alphabet is the parent company of Google, the largest search engine in the world. But it’s a lot more than that, and it’s moving AI forward with its Gemini large-language model (LLM) that brings the internet search to a new level. It also offers AI solutions for advertising clients to up their game and achieve greater success, putting more money in Alphabet’s pockets, too, and its cloud computing clients benefit from the strength of the LLM in creating their own AI apps.

Image source: Getty Images.

Companies like Target and Wayfair are using AI through Google Cloud to gather data, personalize the user experience, and improve cybersecurity.

Google has many businesses and varied revenue streams, including devices like smartphones, subscription services like storage, and self-driving cars. Revenue increased 14% year over year in the 2025 second quarter, demonstrating the power of its interconnected platform. But it has a long growth runway as advertisers are just touching the potential in AI-powered campaigns, and cloud users experiment with AI to build better businesses.

It’s also highly profitable, and operating income increased 14% over last year with a 32.4% margin.

Despite its robust performance and long-term potential, Alphabet stock trades at a bargain price of 26 times trailing-12-month earnings.

2. Amazon: E-commerce and cloud rolled into one

Amazon is the leader in e-commerce, by far, but it’s also tops in cloud computing. That’s a combination that’s nearly impossible to beat, and both of these industries continue to grow as companies make deeper inroads into these markets and use AI to improve in both spaces.

E-commerce is still less than a fifth of total retail spending in the U.S., but around 40% of that spending goes to Amazon. As e-commerce increases as a percentage of retail sales, Amazon will benefit organically. But the company is not waiting around for that to happen. It’s spearheading the shift through its incredible value proposition, especially through the Prime program, which generates loyalty and volume. Fulfillment times keep speeding up, with the percentage of same or next-day deliveries up 30% year over year in the second quarter.

The generative AI business is largely within the Amazon Web Services (AWS) cloud segment, and as of the second quarter, it had a $123 billion run rate. Yet, CEO Andy Jassy thinks it’s still in its early innings.

“It’s a very unusual opportunity that we’re very bullish about,” he said.

Amazon stock trades at a P/E ratio of 34. That’s the highest on this list, but it’s below its one, three, and five-year averages.

![]()

Image source: Taiwan Semiconductor.

3. Taiwan Semiconductor

Taiwan Semiconductor (TSMC) produces the chips that make AI possible. When you hear of companies like Nvidia and its peers making chips, it’s actually designing the chips and partnering with TSMC to bring them to life. That gives TSMC incredible exposure to AI, and gives investors access to many different AI stocks leading the charge.

TSMC has been around since well before the recent generative AI takeover of technology, and its other categories, like gaming and autonomous vehicles, are still an important part of its business, giving it more stability and protection. But the AI business has become its largest, accounting for 60% of the total, and sales increased 14% year over year in the 2025 fiscal second quarter (ended June 30).

Total revenue increased 44% over last year, and both gross margin and operating margin expanded significantly, to 58.6% and 49.6%, respectively.

To get around tariff issues and generally expand its global reach and cost-efficiency, TSMC is opening an Arizona production location, and the company is well positioned to keep supporting and benefiting from advances in AI.

Taiwan Semiconductor stock trades at a P/E ratio of 33, an attractive entry point for new investors.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $642,328!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,134,270!*

Now, it’s worth noting Stock Advisor’s total average return is 1,064% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of October 7, 2025

Jennifer Saibil has positions in Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Amazon, Nvidia, Palantir Technologies, Taiwan Semiconductor Manufacturing, and Target. The Motley Fool recommends Wayfair. The Motley Fool has a disclosure policy.