Among the Zacks Rank #1 (Strong Buy) list, several stocks are standing out from the oils & energy sector. Most appealing, these energy stocks are trading under $30 a share and offer generous dividend yields that are over 3%.

Making now an ideal time to buy these top energy stocks is that crude oil prices tend to rise leading up to the summer months in correlation with increased demand for gasoline.

This seasonal trend is driven by higher travel activities along with increased industrial operations. Suggesting more upside in these top energy stocks in particular is a trend of rising earnings estimate revisions.

With crude oil prices likely to rise to over $70 a barrel in the coming months, these companies are already taking advantage of what should be a more favorable operating environment. Keeping this in mind, here are three of these highly ranked energy stocks to consider now.

CrossAmerica Partners – CAPL

We’ll start with CrossAmerica Partners (CAPL), which engages in the wholesale of motor fuels, consisting of gasoline and diesel fuel. CrossAmerica also owns and leases real estate used in the retail distribution of motor fuels.

Most daunting is that CrossAmerica’s stock offers a whopping 8.95% annual dividend which towers over the S&P 500’s 1.3% average and its Zacks Oil and Gas-Refining and Marketing-Master Limited Partnerships Industry average of 3.96%.

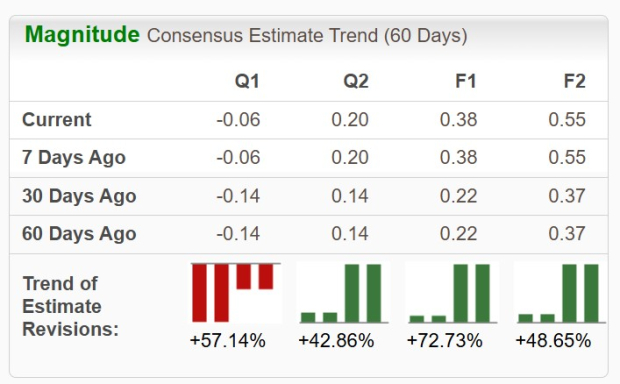

Image Source: Zacks Investment Research

Notably, CAPL has soared more than +200% in the last five years but at under $25, CrossAmerica’s robust dividend and earnings potential should keep investors engaged. Formerly known as Lehigh Gas Partners LP, CrossAmerica went public in 2012 with the company bringing in about $3 billion in annual sales.

In regards to profitability, CrossAmerica’s annual earnings are expected to dip 27% in fiscal 2025 to $0.38 a share but are projected to rebound and soar 45% next year to $0.55 per share. More intriguing, in the last 30 days, FY25 and FY26 EPS estimates have soared over 70% and 40% respectively.

Image Source: Zacks Investment Research

Crescent Energy Company – CRGY

Next up is Crescent Energy Company CRGY, an independent oil and natural gas company that produces crude oil and natural gas in the shallow waters of the Gulf of Mexico. Furthermore, Crescent Energy has onshore operations in Texas, Oklahoma, Louisiana, and Wyoming.

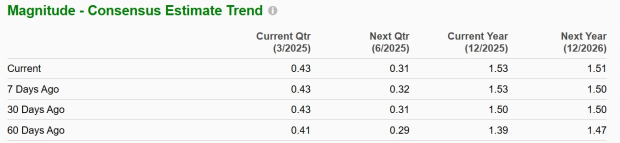

Standing out in terms of valuation, Crescent Energy’s stock trades at $11 and just 4.9X forward earnings which is a sharp discount to the S&P 500’s 21.2X and its Zacks Alternative-Energy Other Industry average of 19.9X. Even better, Crescent Energy’s EPS is expected to increase 24% this year and is projected to rise another 2% in FY26 to $2.26. Plus, FY25 and FY26 EPS estimates are nicely up in the last 60 days with CRGY offering a 4.4% annual dividend.

Image Source: Zacks Investment Research

Plains All American Pipeline – PAA

Rounding out the list is another Master Limited Partnership in Plains All American Pipeline PAA. At the moment, Plains All American’s Zacks Oil and Gas-Production Pipeline-MLB Industry is in the top 2% of over 240 Zacks industries.

Benefiting from its strong business environment, Plains All American is involved in the transportation, storage, and marketing of crude oil, natural gas, natural gas liquids (NGL), and refined products in the U.S. and Canada.

Although Plains All American’s annual earnings are expected to be virtually flat for the foreseeable future, EPS estimates for FY25 and FY26 are up 10% and 3% in the last two months respectively. This comes as the company’s robust top line is now projected to increase by 3% in FY25 and is forecasted to expand another 1% in FY26 to $52.02 billion.

Image Source: Zacks Investment Research

Reassuringly, PAA shares trade under $20 and at a reasonable 12.2X forward earnings multiple. Better still, PAA has a 7.71% annual dividend with an annualized growth rate of 11.57% over the last five years.

Image Source: Zacks Investment Research

Bottom Line

It’s plausible that earnings estimate revisions could keep trending higher for these top energy stocks as crude oil prices are likely to spike as the summer approaches. Making their generous dividends more appealing is the diverse operations these companies have within the oils & energy sector. This suggests they should prosper even if crude prices don’t get the sharp seasonal uptick as expected.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Plains All American Pipeline, L.P. (PAA) : Free Stock Analysis Report

CrossAmerica Partners LP (CAPL) : Free Stock Analysis Report

Crescent Energy Company (CRGY) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).