Alibaba Group BABA presents a concerning investment picture that should give potential investors serious pause. While the Chinese e-commerce giant reported revenue growth of 7% year over year to RMB236.5 billion and impressive adjusted EBITA gains of 36% in the last quarter, a deeper dive into the company’s financial health reveals troubling trends that suggest investors would be wise to steer clear of this stock in 2025.

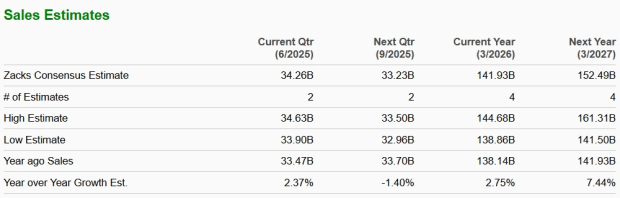

The Zacks Consensus Estimate for fiscal 2026 earnings indicates a downward revision of 18.1% over the past 30 days to $8.58 per share. The market appears to be pessimistic about Alibaba’s growth trajectory.

Alibaba Group Holding Limited Price and Consensus

Alibaba Group Holding Limited price-consensus-chart | Alibaba Group Holding Limited Quote

BABA Faces Alarming Cash Flow Deterioration

The most alarming development is the dramatic deterioration in free cash flow, which plummeted 76% to just RMB3.7 billion. While Alibaba’s revenues continued growing at 7%, the company’s ability to convert that revenues into actual cash has severely weakened, raising serious questions about the quality of earnings and operational efficiency.

This cash flow collapse is particularly troubling given that Alibaba has been aggressively repurchasing shares, spending $11.9 billion on buybacks in fiscal 2025 alone, reducing share count by 5.1%. While share repurchases can benefit shareholders when executed from a position of strength, doing so while free cash flow evaporates suggests poor capital allocation decisions. The company appears to be prioritizing financial engineering over addressing fundamental operational challenges that are impacting its ability to generate cash from operations.

Decelerating Growth Momentum

The second major concern is the company’s decelerating growth momentum across its core business segments. While management may highlight cloud revenue growth of 18% and customer management revenue growth of 12%, these figures mask a concerning trend of slowing expansion in Alibaba’s most critical revenue streams. The 7% overall revenue growth represents a significant deceleration from the company’s historical double-digit growth rates, suggesting that Alibaba’s best growth days may be behind it.

Even more concerning is that this growth slowdown is occurring despite massive investments in artificial intelligence and cloud infrastructure. The company’s AIDC segment showed 22% growth, but this represents a capital-intensive business with uncertain profitability prospects. Investors should question whether Alibaba’s heavy spending on AI initiatives will generate adequate returns, particularly given the intense competition in cloud services from both domestic and international players.

The competitive landscape in China’s e-commerce and cloud markets has intensified dramatically, with companies like ByteDance, Tencent, and emerging players eating into Alibaba’s market share. The modest growth in Taobao and Tmall platforms suggests that Alibaba is losing its grip on the Chinese consumer market, which has been its primary competitive advantage for over two decades.

Image Source: Zacks Investment Research

Valuation Concerns Amid Market Headwinds

The third compelling reason to avoid Alibaba stock centers on valuation concerns amid persistent market headwinds. Despite the company’s challenges, Alibaba continues to trade at a premium valuation with a Value Score of C, indicating that the stock is not cheap relative to its fundamentals.

Competition in China’s e-commerce and cloud markets continues intensifying. Domestic rivals like JD.com JD and Pinduoduo maintain pressure on e-commerce operations, while international cloud providers like Microsoft MSFT and Amazon AMZN compete for enterprise customers. With the stock generating only 1.1% returns over the past three months while underperforming the Zacks Internet-Commerce industry and the Zacks Retail-Wholesale sector, investors are paying elevated prices for a deteriorating business.

BABA Underperforms Peers & Sector in 3 Months

Image Source: Zacks Investment Research

Geopolitical tensions between the United States and China continue to create regulatory uncertainty for Chinese technology companies. These tensions have resulted in potential delisting risks, restricted access to U.S. capital markets, and ongoing scrutiny of Chinese tech firms’ data practices. For U.S. investors, these geopolitical headwinds add an additional layer of risk that makes Alibaba an unattractive investment proposition.

China’s broader economic challenges, including slowing consumer spending and deflationary pressures, create a difficult operating environment for e-commerce companies. While Alibaba maintains a strong net cash position of RMB366.4 billion, this massive cash hoard also suggests limited organic growth opportunities, forcing the company into financial engineering rather than productive investments.

Conclusion

The combination of deteriorating cash flow generation, slowing growth momentum, and persistent valuation premiums amid significant market headwinds creates a perfect storm for potential investors. While Alibaba’s brand recognition and market position remain formidable, the financial trends indicate a company in transition facing significant structural challenges. Prudent investors should avoid Alibaba stock in 2025 and consider more attractive opportunities in markets with clearer growth trajectories and less regulatory uncertainty. The risk-reward profile simply does not justify ownership of BABA shares in the current environment. BABA stock currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company’s customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners Up

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).