Artificial intelligence (AI) is Wall Street’s new obsession, with companies discussing the technology in a snowballing fashion and helping keep market sentiment positive.

The robust quarterly results we’ve received from NVIDIA over the last year have added further fuel to the fire, with the company flexing the scorching-hot demand it’s been witnessing regarding its AI chips.

Let’s take a closer look at a few other stocks – Comfort Systems USA FIX, Vertiv VRT, and Amazon AMZN – that investors can buy to ride the data center wave.

Amazon Maintains Dominant Cloud Position

Amazon shares reflect an excellent opportunity for investors to obtain exposure to the data center thanks to Amazon Web Services (AWS). Many are familiar with AWS, whether through the many advertisements across TV or in their own professional work.

AWS is the dominant player in the cloud computing market, flexing a significant market share globally. It provides various services, including computing power, storage, databases, and AI/ML tools.

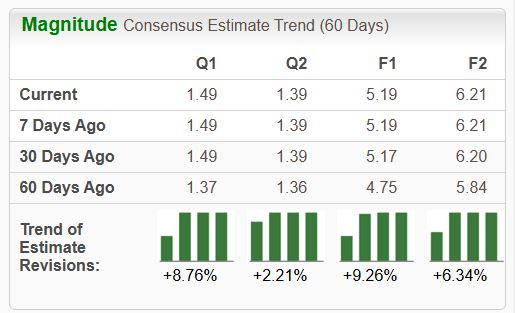

Earnings expectations across the board have moved higher for the mega-cap giant, reflecting an optimistic outlook from analysts. The $5.19 Zacks Consensus EPS estimate suggests nearly 80% growth year-over-year, with the stock also sporting a bullish Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Vertiv Keeps Data Center Cool

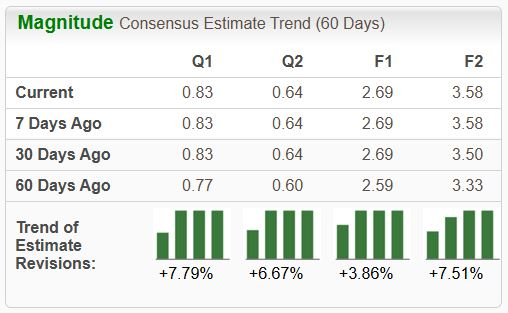

Vertiv provides services for data centers, communication networks, and commercial and industrial facilities with a portfolio of power, cooling, and IT infrastructure solutions and services. Analysts have taken their earnings expectations higher across all timeframes thanks to robust quarterly results, landing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Scorching-hot demand for the company’s solutions has allowed it to post the above-mentioned robust quarterly results, with Vertiv exceeding the Zacks Consensus EPS estimate by an average of 10% across its last four releases. The company’s top line has expanded nicely amid the frenzy, with VRT posting double-digit percentage year-over-year revenue growth in seven consecutive releases.

FIX Boasts Bullish Outlook

Comfort Systems USA provides comprehensive heating, ventilation, and air conditioning installation, maintenance, repair, and replacement services. The company provides chillers, cooling towers, and other critical components found within data centers.

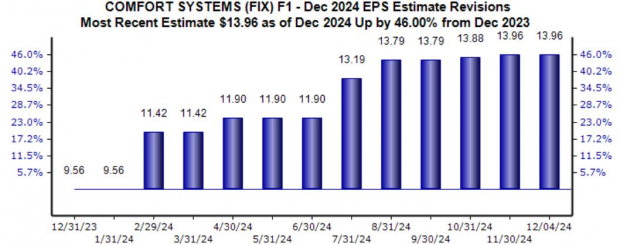

The stock boasts a Zacks Rank #1 (Strong Buy), with the revisions trend for its current fiscal year considerably bullish, up 46% over the last year and suggesting 60% year-over-year growth.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

NVIDIA continues to be the dominant market story thanks to its robust quarterly results fueled by unrelenting demand for AI-related applications.

The company yet again blew away expectations in its latest release, continuing its recent hot streak.

And for those seeking exposure to the data center in general, all three stocks above – Vertiv VRT, Comfort Systems USA FIX, and Comfort Systems USA FIX, would provide precisely that.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Comfort Systems USA, Inc. (FIX) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report