The 2024 Q4 earnings season is slowly winding down, with over 98% of S&P 500 companies already delivering quarterly results.

And throughout the period, several stocks, including Philip Morris PM, Meta Platforms META, and Netflix NFLX, all posted results that had shares up nicely post-earnings. For those interested in post-earnings momentum, let’s take a closer look at each report.

PM Innovation Remains Strong

Philip Morris shares have benefited nicely from its latest set of better-than-expected results, with EPS growing 14% alongside a strong 7% move higher in sales. Demand has remained strong for the tobacco titan, with product innovations remaining key for its future.

Notably, smoke-free products exceeded 40 billion units for the first time throughout its FY24, with full-year net revenues for its Smoke-free Business (SFB) increasing by 14.2% alongside an 18.7% move higher in gross profit.

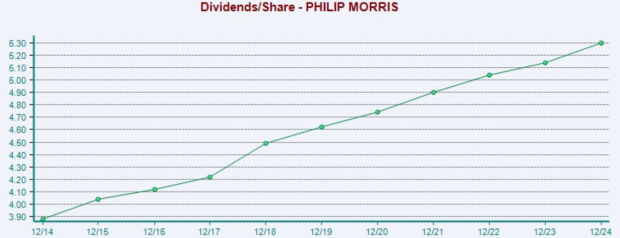

Shares also provide a high level of passive income, currently yielding a market-beating 3.5% annually. Dividend growth has been rock-solid, with PM also holding the ranks of a Dividend King. Below is a chart illustrating the company’s dividends paid on an annual basis.

Image Source: Zacks Investment Research

Meta Reports Record Profit

Concerning headline figures in its release, Meta Platforms posted adjusted EPS of $8.02 and record sales of $48.4 billion, reflecting growth rates of 50% and 21%, respectively. Net income of $20.9 billion was the company’s highest read ever.

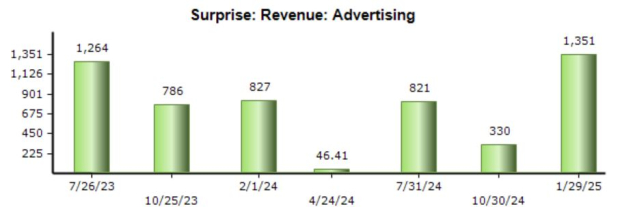

Notably, the company’s ad business continued to perform at a high level, with revenue of $46.8 billion again exceeding our consensus estimate and reflecting 20% year-over-year growth. As shown below, META’s advertising results have regularly crushed our consensus expectations as of late.

Image Source: Zacks Investment Research

In addition, META continues to see nice user growth, with Family Daily Active People (DAP) improving 4% year-over-year to roughly 3.4 billion. Average revenue per user has increased likewise amid the strong advertising efforts, improving by a sizable 41% year-over-year.

Netflix Ad-Supported Tiers Provide Tailwinds

Continued user growth and tailwinds from ad-supported memberships have been driving forces behind Netflix’s recent success, with shares delivering a stellar performance over the last year. The stock currently sports a favorable Zacks Rank #2 (Buy).

In Q4, ad-supported plans accounted for over 55% of sign-ups in supported countries, and membership in ad plans grew by nearly 30% quarter over quarter.

Image Source: Zacks Investment Research

Bottom Line

Though the market’s performance as of late has been forgettable, the results of all three companies above – Philip Morris PM, Meta Platforms META, and Netflix NFLX – in the Q4 reporting cycle were all highly positive, with shares of each seeing momentum post-earnings.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).