Key Points

As a Ford Motor Company (NYSE: F) investor, I’ve found it difficult to swallow the pill of its recalls. It’s unfortunate that the derogatory backronym for Ford — Found on Roadside Dead — rings a little too true lately.

Not only have recalls and rising warranty costs dinged the automaker’s bottom line over the past couple of years, but Ford’s sheer recall numbers alone are also staggering when compared to the rest of the industry’s.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Here’s a look at just how big a deal it’s become (Ford has recalled over 7 million vehicles in 2025) and a silver lining in its most recent recall.

An unfortunate record

Ford is recalling more than 355,000 trucks in the U.S. over a problem with the instrument display panel, according to the National Highway Traffic Safety Administration (NHTSA). The recall affects the Ford 2025-2026 models of the F-550 SD, F-450 SD, F-350 SD, F-250 SD and the 2025 F-150.

Image source: Ford Motor Company.

First, some of the bad news and staggering figures: So far this year, Ford has issued more recalls than any other automaker in the U.S., generating 39% of this year’s recalls, according to the NHTSA. Just as staggering is the fact that the runner-up is RV manufacturer Forest River, with only 9% of this year’s recalls.

Ford has issued 105 recalls so far in 2025, with electrical system problems accounting for 23 of the total, while backover-prevention rearview cameras and power train recalls accounted for 14 and 13, respectively. In terms of number of vehicles recalled, Ford’s figure has now topped over 7 million, which is the record for any full year, according to Barron’s.

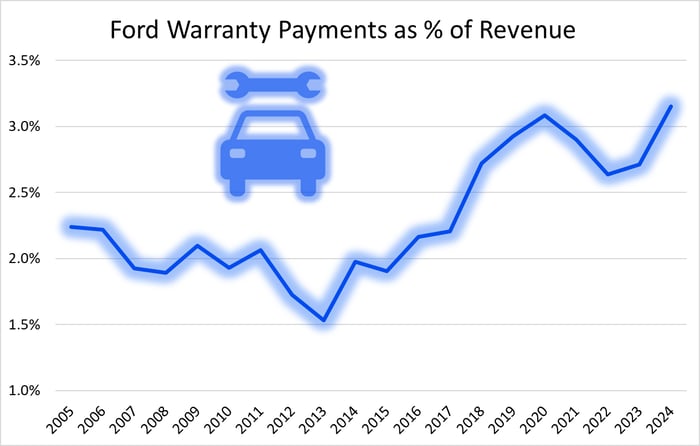

If those numbers didn’t make enough of an impression, let’s look at Ford’s warranty payments as a percentage of revenue over time.

Data source: Ford SEC filings. Graphic source: Author.

You can see that in the early 2000s, Ford’s payments-to-revenue percentage was much lower, before spiking to 4% during last year’s second quarter, a high percentage for an automaker. For a quick comparison, consider that rival General Motors‘ warranty payments as a percentage of revenue checked in at 2.4% and 2.3% in 2024 and 2023, respectively.

“Clearly our strategic advantages are not falling to the bottom line the way they should,” CEO Jim Farley said nearly a year ago on a call with analysts. “Cost, especially warranty, has held back our earnings power. But as we bend that curve, there is significant financial upside for investors.”

The silver lining

But not all recalls are created equal. Depending on whether the problem is fixable with updates to software or requires laborious hardware work at a dealership, the volume of vehicles in each recall can vary widely.

In this case, this most recent recall can be fixed free with a software update, making this recall mostly a nonissue when it comes to company financials. Furthermore, management’s spin on this recall development is that it’s tightening its quality controls, which is resulting in better vehicles for consumers at the expense of higher recall numbers in the near term.

The upside is just as Farley stated: If Ford can slowly but surely turn around its quality problem, those warranty payment costs will trickle down to the bottom line, giving investors more earnings power. That said, despite years of efforts to improve quality, it’s sometimes difficult to see progress on paper, and that’s absolutely something investors should keep an eye on over the next 12 to 18 months.

Should you invest $1,000 in Ford Motor Company right now?

Before you buy stock in Ford Motor Company, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ford Motor Company wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $651,599!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,067,639!*

Now, it’s worth noting Stock Advisor’s total average return is 1,049% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 25, 2025

Daniel Miller has positions in Ford Motor Company and General Motors. The Motley Fool recommends General Motors. The Motley Fool has a disclosure policy.