A Shift in Momentum: Marathon Digital’s Potential Uptrend

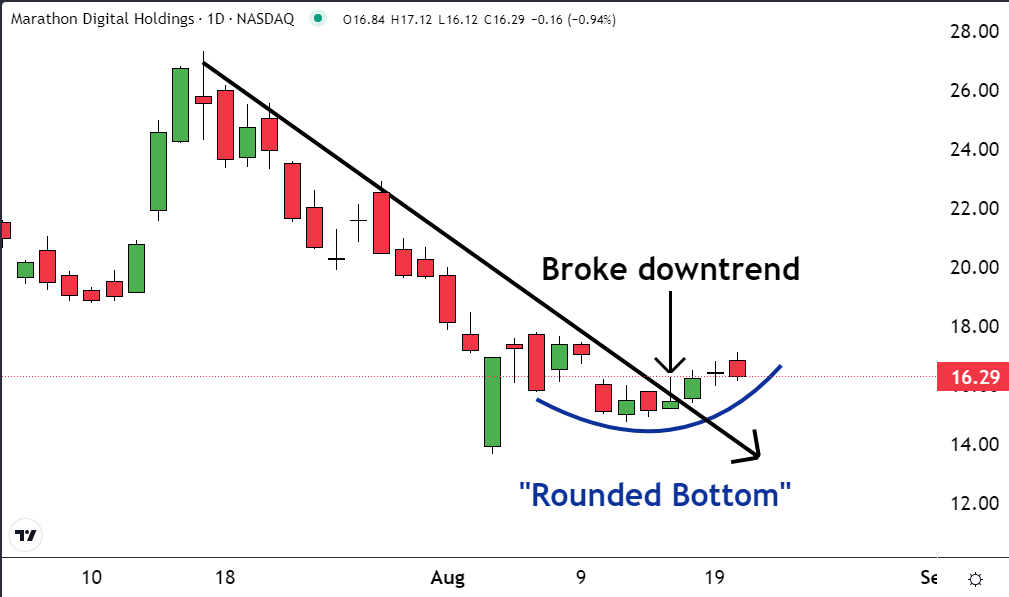

After a month-long downtrend in Marathon Digital Holdings, Inc. (NASDAQ: MARA), a significant development has caught the attention of investors. The downtrend that has been prevailing seems to have finally reached its endpoint. Breaking the downtrend line on the chart is a crucial indicator of a possible turnaround. Additionally, the formation of a ‘Rounded Bottom’ pattern further solidifies the potential for a bullish reversal.

Observing the recent market activity, it’s evident that shares of MARA have successfully breached the downtrend line in the past few days, marking a crucial point in its trajectory.

When a stock has been on a downward trend, a necessary precursor for an upward movement is for it to halt its decline. A period of consolidation or sideways movement typically leads to a breakthrough of the downtrend line, indicating a potential shift towards an uptrend.

Such a development signifies the possibility of a new uptrend taking shape or, at the very least, a temporary halt in the stock’s decline.

Furthermore, the emergence of a reversal pattern adds another layer of positive signals for MARA.

Reversal patterns serve as visual representations of the shifts in market sentiment between bulls and bears. These changes can occur abruptly in a single trading day or over multiple volatile sessions, manifesting as various patterns like ‘bullish engulfing,’ V-top, or inverted V-bottom.

However, when the transition in leadership occurs gradually over several trading sessions, it often materializes as a ’rounded’ top or bottom on the chart.

Analysis of MARA’s chart suggests that a ’rounded bottom’ formation has taken place, indicating a gradual transfer of control from bears to bulls.

With the alignment of breaking the downtrend line and forming a ’rounded bottom’ reversal pattern, there is a strong indication that a new uptrend may be on the horizon.

Historically: Market shifts like these have often been precursors to extended bullish runs for companies with similar price actions.

Photo: Shutterstock