As NVIDIA Corporation‘s earnings take center stage this week, the semiconductor sector finds itself at a crossroads where fortunes are diverging due to the rise of artificial intelligence, robust demand from China, and geopolitical headwinds.

Financial Projections for Nvidia

Analysts anticipate Nvidia to unveil second-quarter revenue of $28.7 billion, a substantial leap from last year’s $13.5 billion, continuing its streak of surpassing revenue estimates in recent quarters.

Earnings per share for the quarter are expected to be 64 cents, up from 27 cents a year ago, showcasing Nvidia’s consistent outperformance in earnings as well.

Tracking the company’s progress, Cantor Fitzgerald analyst C.J. Muse identifies Nvidia as a top contender for investment in the latter half of 2024, emphasizing the importance of AI within the semiconductor sphere.

The AI Divide in Semiconductor Sector

Muse aptly notes that within the semiconductor landscape, the AI segment is a clear divider of success, with companies either excelling in this area or lagging behind due to the cyclical nature of other technologies.

Despite concerns of geopolitical tensions impacting the industry, China’s strong demand remains a positive indicator for Nvidia and its peers, showing resilience against external pressures.

While acknowledging the setback caused by the delay of Nvidia’s Blackwell project, Muse downplays its significance, highlighting the overall robust demand and constrained supply in the market.

Diverse Picks in Semiconductor Space

Besides Nvidia, Muse champions other semiconductor giants like Broadcom Inc, Micron Technology, Western Digital Corporation, NXP Semiconductors, ASML Holdings, and Teradyne Inc as top selections for the ongoing AI wave.

While emphasizing the financial strength within this sector, Muse singles out Intel Corporation as a potential value play due to its attractive book value, despite facing challenges in driving stock upside.

Regarding Intel, Muse notes a historical low in book value but underscores the uphill battle ahead for the company to regain market traction.

Market Performance and Future Outlook

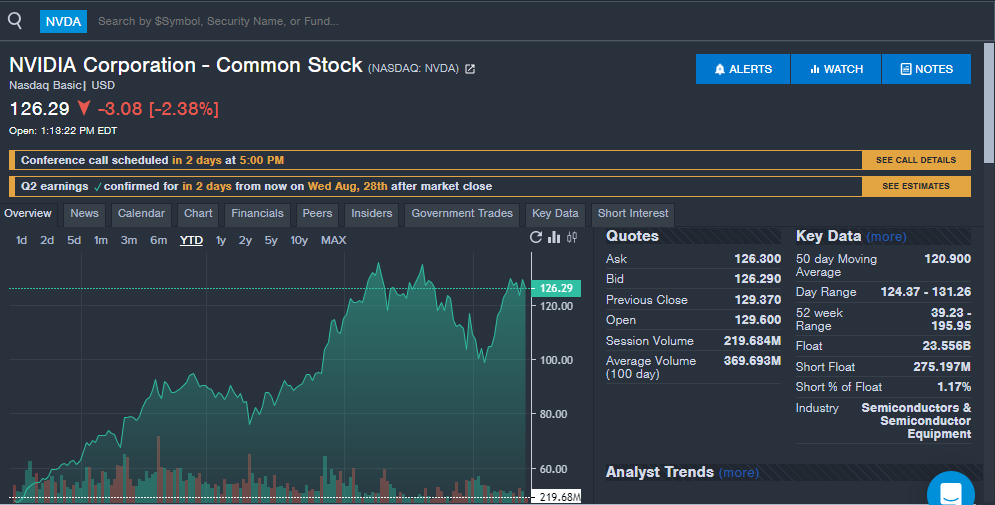

As of the latest trading session, Nvidia’s stock is down to $126.90, within a wide 52-week range. However, the stock has seen a remarkable surge of over 150% year-to-date, showcasing investor confidence in the company’s future prospects.

It is evident that the semiconductor sector stands at a crossroads, with AI-led companies like Nvidia poised for success amidst a rapidly evolving technological landscape. As investors navigate through this dichotomy, the importance of staying abreast of AI trends remains paramount.