$200 billion. The mighty Apple (NASDAQ: AAPL) reeled in from iPhone sales in the last year. A staggering sum, indeed, but Apple’s enigmatic allure extends far beyond those iconic devices.

Amidst its towering stacks of cash, few delve into the inconspicuous corner where Apple splurges generously on an unexpected enterprise, silently overlooked by the masses.

Join us as we unravel the labyrinth of Apple’s revenue streams and dissect the perplexing realm of its clandestine expenditures, oft-forgotten by even the savviest investors.

Image source: Getty Images.

Revenue Dynamics: Beyond Products to Services

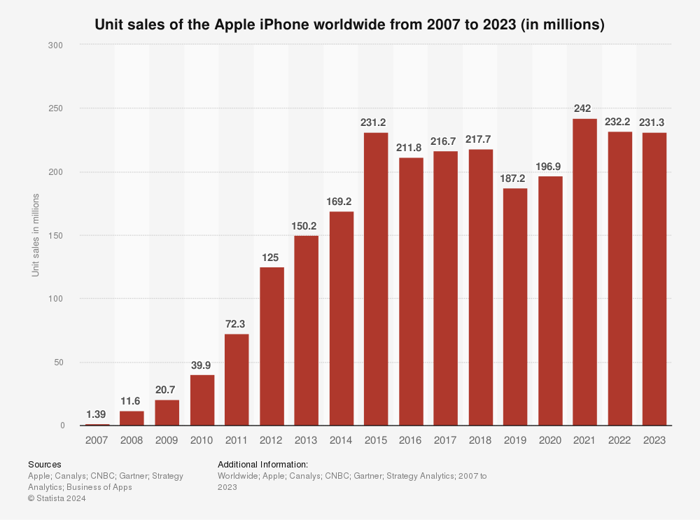

In the realm of Apple, the prevailing notion centers on a singular icon – iPhones. Despite this prevailing image, it may come as a shock that Apple’s iPhone sales have plateaued for nearly a decade.

Image source: Getty Images.

To Apple, the iPhone has waned, much like its other hardware kin – iPad, Macs, wearables. These gadgets bolstered revenue, but paled against the iPhone’s bygone glory from 2007 to 2015.

The real juggernaut propelling Apple’s recent conquests is its services division. This segment thrives on App store sales, iTunes, AppleCare+, ads, alongside app subscriptions such as iCloud+, Apple Fitness, and AppleTV+.

Crucially, Apple’s services arm boasts a colossal 75% gross profit margin, far surpassing the 33% reaped from its product ensemble encompassing iPhones, iPads, and Macs.

Ergo, Apple’s sights are fixated on amplifying services revenue and profit, the linchpin of its current success saga.

But why squander $20 billion on a hidden domain?

Apple’s $20 Billion Gamble on Apple TV+ Ventures

Apple shrouds its services unit’s financial intricacies, relegating investors to mere approximations. Reports suggest Apple lavished over $20 billion on Apple TV+, vying against titans like Netflix, Amazon, and Disney.

Regrettably, the colossal investments appear to have yielded scant rewards. While Coda snagged a 2022 Best Picture accolade, numerous high-budget ventures floundered, failing to uplift Apple TV’s viewership. Reportedly, Apple TV’s monthly viewers barely rival Netflix’s daily counts.

Tales of Apple’s austere measures echo through the grapevine, hinting at tightened belts and slashed budgets for streaming initiatives. Sensibly pivoting towards pioneering artificial intelligence tools to bolster services revenue further, Apple’s dalliance with AI promises a pricey yet promising diversion. It seems Apple’s lavish streaming sprees may be on the wane.

Apple veered into the treacherous waters of streaming wars, sinking billions that could have nurtured cutting-edge AI. Acknowledging this misallocation, Apple now recalibrates its fiscal reins, funneling resources into fortifying its services and AI domains – the former driving current growth, the latter heralding the future.

The Path Ahead: A Prudent Investment?

Before plunging funds into Apple shares, contemplate this:

The Motley Fool Stock Advisor analysts unearthed what they deem as the best investment:

Analyzing Top Stock Picks with Potential for Investors

Stock Picks with Promise

When considering investment opportunities, the allure of top-performing stocks can be irresistible. However, finding the right mix of equities is an art that requires a keen eye and meticulous analysis.

The Nvidia Success Story

Reflecting on past stock performances can provide valuable insights into future possibilities. Take, for instance, Nvidia’s appearance on a coveted list back in April 15, 2005. A hypothetical $1,000 investment at that time could have grown exponentially to a staggering $792,725. This remarkable growth showcases the transformative power of strategic investments.

The Role of Stock Advisor

For investors seeking guidance in navigating the complex world of equities, services like Stock Advisor can serve as beacons of light. By offering a clear roadmap for success, including tailored portfolio building strategies and regular updates from market experts, Stock Advisor has proven its worth over time.

Outpacing the S&P 500

A key metric to evaluate investment success is the ability to outperform benchmark indices such as the S&P 500. Stock Advisor has exceeded this standard by more than quadrupling the returns of S&P 500 since its inception in 2002. This consistent outperformance underscores the value it provides to investors looking to maximize their gains.

Exploring Opportunities

While Apple might not have made the recent list of top stocks for investors, there is a plethora of other opportunities waiting to be explored. Diversifying one’s portfolio with carefully selected equities can unveil hidden gems that have the potential to deliver significant returns in the years to come.

Conclusion

As the investment landscape continues to evolve, staying informed about top stock picks and leveraging expert guidance can be crucial for building a robust portfolio. By delving into past success stories like Nvidia’s meteoric rise and embracing services like Stock Advisor, investors can chart a path towards financial prosperity.