Intel Corp INTC garnered attention for its substantial downsizing plans while vying for a significant share of the $20 billion U.S. Chips Act subsidy.

The Battle for Economic Stimulus

The U.S. subsidy explicitly aims to generate more than 10,000 manufacturing roles and 20,000 construction positions across projects in Arizona, New Mexico, Ohio, and Oregon.

Set against the backdrop of decreasing reliance on Asian rivals, particularly China, for semiconductor technology, the subsidy holds critical weight in bolstering domestic tech infrastructure.

Consequently, Republican Senator Rick Scott raised concerns over the potential displacement of Intel’s American workers and how this might intertwine with the company’s strategic semiconductor manufacturing endeavors.

A Downward Spiral

Intel recently faced setbacks with Lip-Bu Tan resigning from the board after a tenure of almost two years chiefly on the mergers and acquisitions committee.

The departure aligned with Intel’s disappointing second-quarter performance, marked by a 0.9% drop in revenue, missing the projected $12.94 billion. Additionally, unveiling a $10 billion cost-reduction scheme, including a workforce reduction exceeding 15%, exacerbated the company’s challenges.

Comparing Strategies

In stark contrast, Nvidia Corp NVDA shines with CEO Jensen Huang’s approach of incentivizing and retaining employees amidst rigorous work demands, portraying a unique employee-friendly stance.

Future Projections and Market Realities

Despite recent challenges, Intel retains ambitious goals, targeting chip shipments for over 100 million AI-equipped personal computers by 2025, including more than 40 million in 2024.

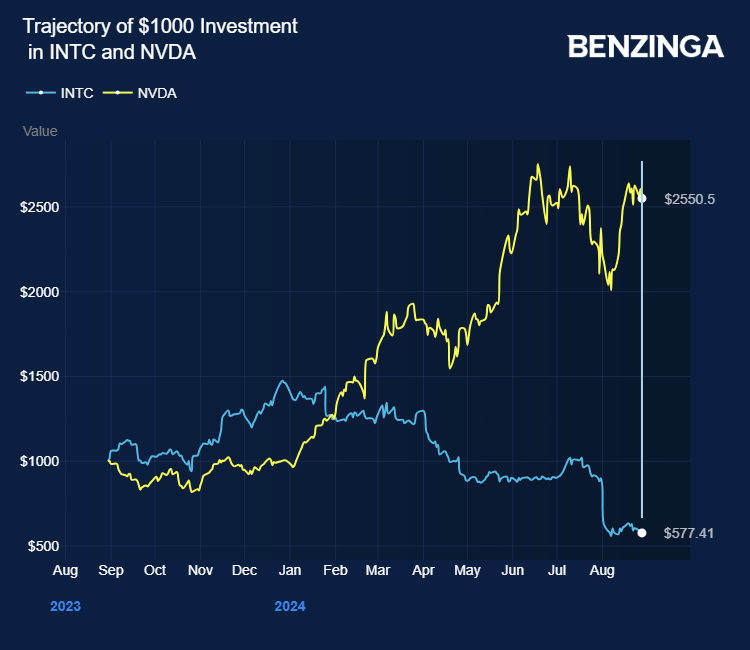

Intel’s stock witnessed a 43% decline in the past year owing to AI-driven shifts impacting its PC and data center sectors, trailing Nvidia’s remarkable 158% surge fueled by AI market dynamics.

Price Action: INTC stock saw a modest 0.25% premarket increase, reaching $19.66 at the latest trading update on Thursday.

Image via Shutterstock