Serve Robotics SERV shares have experienced a tumultuous ride, plummeting 37% in the past month. This sharp decline stands in stark contrast to the Zacks Computer & Technology sector’s 4.5% gain and the Zacks IT Services industry’s return of 3.2%.

Following its public equity offering on April 18, SERV shares soared by a staggering 197.8%. However, the company hit a roadblock with disappointing second-quarter 2024 results, leading to a 9.8% drop since August 13.

Despite a remarkable year-over-year revenue improvement, with reported revenues of $0.47 million surpassing the prior year figure by a significant margin, SERV faced a 50.5% sequential drop, triggering concern among investors.

The recent turbulence in SERV shares has prompted investors to ponder – is now the opportune moment to dive into this stock? Let’s delve deeper into the analysis.

SERV Shares Trail Sector Performance Over the Last Month

Image Source: Zacks Investment Research

The recent downturn in SERV shares raises the crucial question of whether this AI-powered last-mile robot delivery service provider presents an attractive investment opportunity amidst the current dip.

Serve Robotics Embraces Strong Last-Mile Delivery Prospects

SERV’s foundation is built on the burgeoning demand for last-mile delivery services for a variety of products, including food, facilitated through partnerships with major platforms like Uber Eats and 7-Eleven. Formerly a part of Uber Technologies before its spin-off in 2021, SERV boasts strategic investments from key players such as NVIDIA, Uber, 7-Ventures, and Delivery Hero.

The company’s robust liquidity position is poised to support its extensive strategic roadmap, including the deployment of 2000 robots across the United States by 2025. Notably, SERV has concluded the design phase for its third-generation robot.

Having raised substantial gross proceeds from a public equity offering and a private placement, SERV stands equipped with cash reserves to pursue its ambitious objectives. With a vision to drive down delivery costs, SERV aims to make on-demand delivery more accessible by leveraging the efficiency of robotics technology.

According to ARK Invest, the anticipated global market for food and parcel delivery services via robots and drones is set to reach $450 billion by 2030, underscoring the vast potential of this market segment.

Expanding its partner ecosystem, which includes prominent names like Shake Shack and Magna, SERV is rapidly scaling its operations. By broadening its geographic footprint and production capabilities, SERV is poised to challenge the dominance of industry giants like DoorDash and Amazon in the last-mile delivery landscape.

Evaluating the Prospects of SERV Stock for Investors

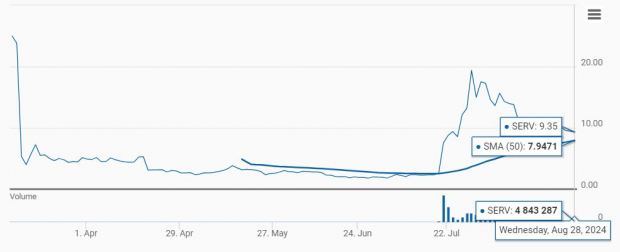

Technical indicators paint a positive picture for SERV, with shares trading above the 50-day moving average.

SERV Demonstrates Strength Above 50-Day SMA

Image Source: Zacks Investment Research

While the Zacks Consensus Estimate for SERV’s 2024 earnings has shown improvement, forecasting a narrower loss, the current valuation of SERV stock seems inflated with a Value Score of F.

Although SERV faces challenges such as revenue slumps and customer concentration risks, the expansion of its robotics fleet presents promising opportunities for long-term investors. Existing shareholders may anticipate fruitful growth prospects in the coming years.

Despite the recent dip in its stock price holding potential for investors seeking a bargain, the inherent risks associated with SERV indicate a cautious approach. With a Zacks Rank #3 (Hold), prudence may dictate waiting for a more favorable entry point into SERV stock.