Nvidia NVDA and Salesforce CRM highlighted this week’s earnings lineup but among them, Victoria’s Secret VSCO shouldn’t be overlooked with its stock sporting a Zacks Rank #1 (Strong Buy).

Standing out in terms of value now appears to be a good time to buy Victoria’s Secret’s stock after surpassing Q2 top and bottom line expectations on Wednesday.

Victoria’s Secret’s Return to Glory

Victoria’s Secret’s return to prosperity as an intimate specialty retailer has become more apparent after delivering year-over-year quarterly operating income growth for the first time since 2021.

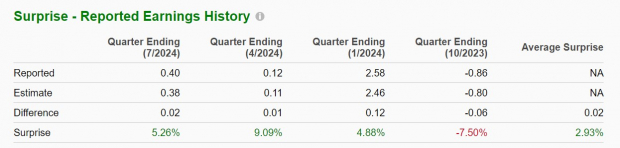

The company attributed its continued resurgence to new merchandise deliveries including the launch of its Victoria’s Secret Dream Bra collection. For the second quarter, Victoria’s Secret posted Q2 sales of $1.41 billion which met expectations despite dipping from $1.42 billion in the comparative quarter. Still, Q2 EPS of $0.40 climbed 66% from $0.24 per share a year ago and beat expectations by 5%.

Image Source: Zacks Investment Research

Full-Year Guidance

More compelling was that Victoria’s Secret raised its guidance for fiscal 2024 in several key areas with adjusted operating income now expected at $275-$300 million compared to prior guidance of $250-$275 million.

Victoria’s Secret now forecasts FY24 adjusted free cash flow to be approximately $200-$225 million compared to previous guidance of $175-$200 million.

EPS Revisions & Attractive PE Valuation

Attributing to its strong buy rating is that Victoria’s Secret’s stock trades at a very reasonable 12.6X forward earnings multiple with FY24 and FY25 EPS estimates spiking 14% and 10% in the last 30 days respectively.

Image Source: Zacks Investment Research

The Bright Side

The Victoria’s Secret brand appears to be making a strong comeback and now may be a good time to buy its stock considering its attractive valuation and improving financial figures. Notably, VSCO checks an “A” Zacks Style Scores grade for both Value and Momentum.

Forecasted Prosperity

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.