The Ascend of Salesforce

Continuing its strategic evolution to fortify its financial standing, Salesforce excelled in Q2, exceeding expectations and elevating its profit outlook. This triumph also served to assuage concerns over intensified rivalry from technology giants like Microsoft and Oracle.

Remarkable Q2 Results

Driven by a surge in subscription and support revenue, Salesforce reported Q2 sales totaling $9.32 billion, an 8% year-over-year growth that surpassed estimates. Additionally, Q2 EPS soared by 21% to $2.56, outperforming projected figures by 9%.

Noteworthy is Salesforce’s Q2 operating cash flow of $892 million, reflecting a 10% increase year over year, and a substantial 20% spike in free cash flow, reaching $755 million.

Image Source: Zacks Investment Research

Advancements in AI

Highlighting the rapid integration of artificial intelligence across its product lineup, Salesforce revealed that new bookings for its AI offerings more than doubled quarter-over-quarter. In Q2 alone, the company secured 1,500 AI deals with major global brands.

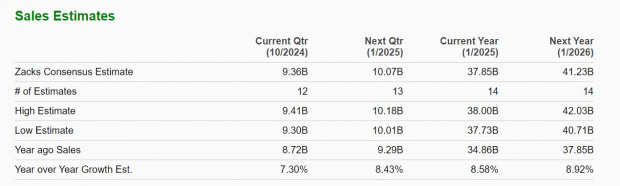

Guidance and Expansion Trajectory

For the current fiscal year, Salesforce maintains its forecast of total sales in the range of $37.7 billion to $38 billion, signaling 8% growth. Looking ahead to FY26, Zacks estimates predict an additional 9% uptick to $41.23 billion in Salesforce’s top-line performance.

Image Source: Zacks Investment Research

Ramping up the optimism, Salesforce has revised its EPS guidance for FY25 to $10.03-$10.11, up from the initial projection. Such an adjustment represents a 20% growth rate compared to previous estimates. Additionally, there is a forecast for a further 10% rise in EPS for FY26 based on Zacks estimates.

Image Source: Zacks Investment Research

Boasting record cash flow performance, Salesforce has upped its guidance for operating cash flow and free cash flow growth, with expectations of 23%-25% and 25%-27% expansion respectively.

Image Source: Zacks Investment Research

Stock Price Trends and Comparison

Despite facing intensified competition, Salesforce’s stock has lagged this year, down 4% compared to Microsoft and Oracle, which have seen increases of 9% and 33% respectively.

Image Source: Zacks Investment Research

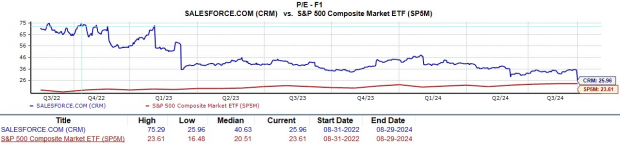

At present levels, Salesforce’s stock trades at a forward earnings multiple of 25.9X, holding a slight premium to the S&P 500, but trails behind Microsoft while leading Oracle in this valuation metric.

Image Source: Zacks Investment Research

Final Thoughts

Presently, Salesforce secures a Zacks Rank #3 (Hold). The trajectory of its stock will heavily rely on the movement of earnings estimates post its Q2 report, anticipated to be positive given the enhanced profit outlook. Highlighting Salesforce’s appealing growth prospects, concerns over heightened competition appear overstated, prompting a possible buy rating.