Woody Harrelson counts not investing in Elon Musk‘s EV company Tesla Inc. TSLA as one of his big investment mistakes to date, the actor said in a recent interview.

The Missed Opportunity

In an interview with Marketwatch published on Friday, Harrelson revealed that he had the chance to invest in Tesla pre-IPO.

One of Musk’s associates visited Harrelson with a “really fancy, superfast car” offering an investment opportunity. However, Harrelson declined the offer, now labeling it a significant investment blunder. This missed chance to invest in Tesla is just one of many regrets, according to the actor.

Reflecting on the encounter, Harrelson described the car as resembling a “Ferrari-type” vehicle, which seems to be Tesla’s inaugural 2008 Roadster.

Historical Progress

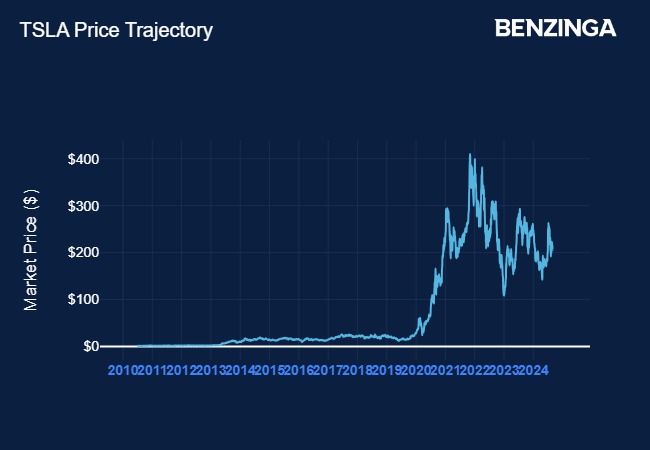

Established in 2003, Tesla entered the public market in 2010. On its trading debut on the Nasdaq exchange on Jun. 29, 2010, Tesla’s shares closed at a split-adjusted price of $1.59.

As of Friday, Tesla shares concluded at $214.11, signifying a remarkable increase of about 135 times from its initial listing price. The stock even surpassed $400 in November 2021.

Despite its historical rise, Tesla’s stock has experienced a 13.8% decline year-to-date, per data from Benzinga Pro.

Explore more of Benzinga’s Future Of Mobility coverage by following this link.

Summary and Lessons

Harrelson’s decision to pass on the opportunity to invest in Tesla, which has seen colossal growth in its stock value over the years, underscores the unpredictability and hindsight bias that characterize investment choices.

While regret is a natural part of investing, the story serves as a valuable lesson for aspiring investors to carefully evaluate opportunities presented to them, as they could be turning down the next big success story.

As Tesla continues to navigate the volatile markets with its innovative approach to electric vehicles and sustainable energy solutions, Harrelson’s missed opportunity stands as a cautionary tale in the ever-challenging world of investments.