Big names in the tobacco industry, including Altria Group MO and Philip Morris International (PM), have witnessed impressive stock surges of over +30% this year. Luring investors with robust dividends and nearing 52-week highs, these tobacco giants are certainly creating a buzz in the market.

Image Source: Zacks Investment Research

Riding the Profit Wave

Embracing smoke-free products has bolstered the market presence of Philip Morris and Altria, propelling their expansions into various international markets. Innovative offerings like heated non-burn tobacco, vapor, and oral nicotine products have driven profitability upwards. In a notable feat, the Zacks Tobacco Industry presently ranks within the top 10% of over 250 Zacks industries.

Image Source: Zacks Investment Research

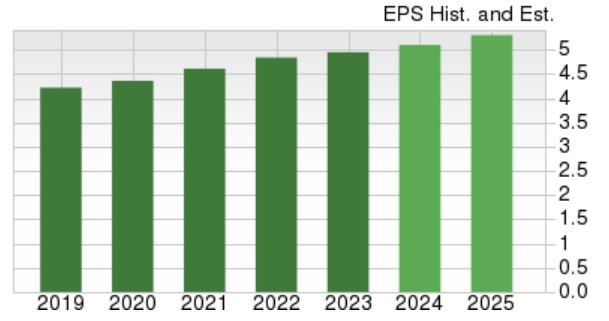

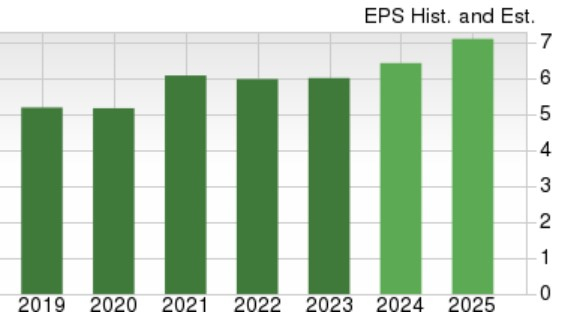

Earnings Momentum

Altria is anticipated to witness a 3% increase in annual earnings for fiscal year 2024, with a further 4% growth projected for FY25 amounting to $5.30 per share. This reflects a substantial 25% surge from pre-pandemic levels of $4.22 per share in 2019.

Image Source: Zacks Investment Research

Assessing Value

Altria’s stock, trading at $54, carries a 10.6X forward earnings multiple, slightly below the industry average of 12.7X. Meanwhile, Philip Morris shares at $125 are valued at 19.5X forward earnings, a premium to the industry but below the S&P 500’s 23.2X.

Image Source: Zacks Investment Research

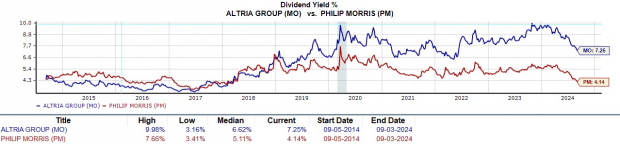

Diving into Dividends

The allure of hefty dividends from Philip Morris and Altria aligns with their promising earnings outlook. Altria, with an annual dividend yield of 7.25%, outshines the industry average of 5.74% and Philip Morris at 4.14%. Noteworthy is both companies’ dividends far surpass the S&P 500’s 1.28% average. Moreover, Altria enjoys the coveted title of Dividend King, having raised payouts for over 50 consecutive years.

Image Source: Zacks Investment Research

The Verdict

With a brighter earnings outlook, Philip Morris International secures a Zacks Rank #2 (Buy), while Altria Group holds a Zacks Rank #3 (Hold). Although earnings estimates have advanced for Philip Morris compared to Altria, the allure of dividends and reasonable valuations make both tobacco giants appealing long-term investment options.