AMD’s Strategic Shift

Advanced Micro Devices, Inc. (AMD) is embarking on a daring journey in the gaming GPU market. The company is steering away from head-to-head competition with Nvidia Corp’s highest-end gaming GPUs, showing a new vision. AMD now sets its sights on capturing 40%-50% of the vast market by prioritizing mainstream and mid-range GPUs, as revealed by Tom’s Hardware.

Moving towards Market Share

AMD’s decision marks a sea change in approach, with the company currently holding only 12% of the discrete GPU market compared to Nvidia’s commanding 88%. The intensified focus on market share aims to reshape the landscape, challenging the dominance long held by Nvidia.

The Pursuit of Scale

Seeking to amplify its presence, AMD is tapping into various strategies to enhance shareholder value. This comes amidst analysts advocating Nvidia as the primary AI beneficiary, intensifying the battle for supremacy in the tech realm.

Surprising Moves

Noteworthy maneuvers by AMD include recruiting ex-Nvidia executive Keith Strier, a key player in enhancing Nvidia’s global commercial relations. Additionally, AMD’s recent acquisition plans include the purchase of AI server company ZT Systems for a significant amount, in response to challenges faced by its Ryzen 9000 series.

Market Performance

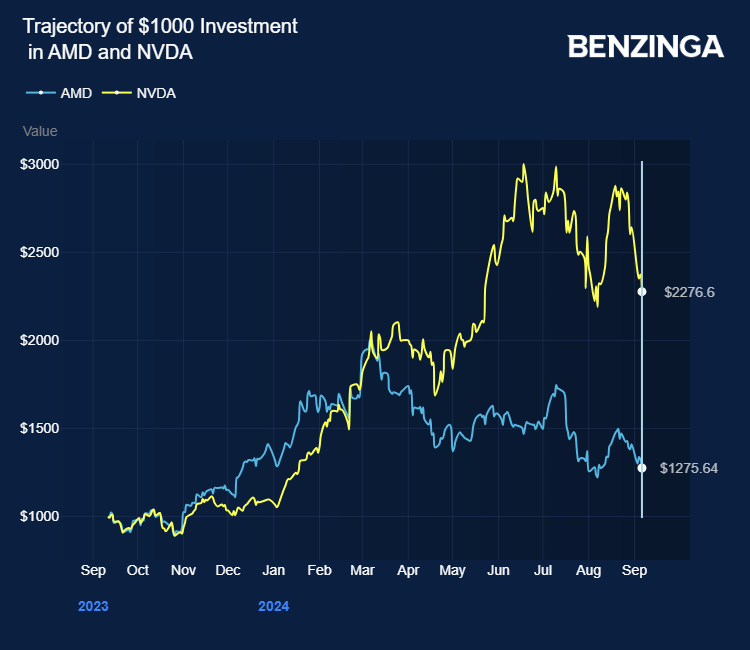

AMD’s stock has shown resilience with a 28% growth over the past year, while Nvidia excelled with a remarkable 128% surge in the same period. However, semiconductor stocks, including AMD and Nvidia, felt the brunt of a widespread selloff, despite positive quarterly results from Nvidia and Broadcom Inc. The VanEck Semiconductor ETF (SMH) and iShares Semiconductor ETF (SOXX) faced steep declines.

Price Actions: AMD stock surged by 1.37% to $136.20, while Nvidia (NVDA) climbed 1.22% to reach $104.05 in the latest market check on Monday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock