The Momentum Battle: AMD’s Bullish Surge

The AI supercycle has ignited a fierce contest between Advanced Micro Devices (AMD) and Nvidia Corp (NVDA) as they vie for supremacy in the burgeoning AI market.

Over the past year, AMD’s stock has soared by 39.98%, while Nvidia has outshined with an impressive 161.90% surge. The divergence is even more stark year-to-date, with AMD up 8.80% and Nvidia skyrocketing by 147.33%. Nvidia’s early entry into the AI arena has propelled its market cap to over $2.9 trillion, leaving AMD playing catch-up at around $245 billion.

AMD’s CEO, Lisa Su, has reaffirmed the company’s accelerating AI roadmap. In contrast, Nvidia has confirmed solid expectations for its forthcoming Blackwell AI GPUs. How do these tech giants measure up from a technical standpoint?

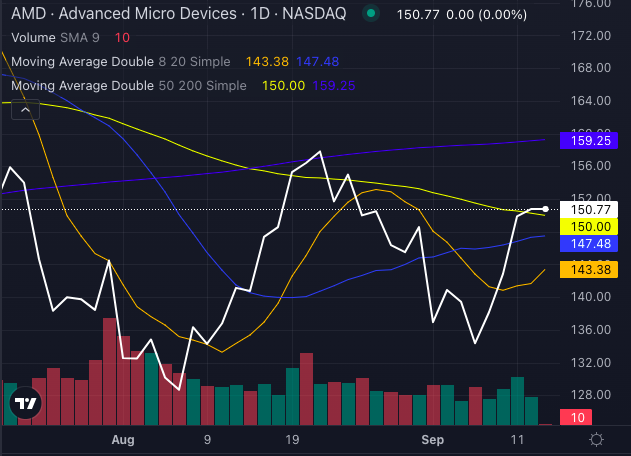

AMD has been riding a bullish wave, with its stock price of $150.77 surging above its five, 20, and 50-day exponential moving averages (EMAs), indicating robust buying pressure.

The eight-day simple moving average (SMA) of $143.38 and 20-day SMA of $147.48 both point to a bullish trend, with the reinforcing effect of the 50-day SMA of $150.00 enhancing the short-to-medium term bullish sentiment.

However, a moderate red flag is raised by AMD’s 200-day SMA of $159.25, positioned above the current stock price, signaling a long-term bearish trend. Despite potential resistance in the long term, the near-term outlook for AMD stock remains promising, making it an appealing choice within the AI landscape.

Nvidia’s AI Prowess and Market Dominance

Nvidia continues to assert its dominance in the AI realm, with technical indicators reflecting a bullish trajectory. Currently priced at $119.11, Nvidia’s stock is trading above its five, 20, and 50-day EMAs, hinting at moderate buying pressure.

Nvidia’s eight-day SMA of $110.75 and 20-day SMA of $118.74 both emit bullish signals, with the 50-day SMA at $117.55 reinforcing this positive outlook. In contrast to AMD, Nvidia’s 200-day SMA resting at $90.74, well below its current price, provides a strong bullish signal for the future. The company is poised for further growth, fueled by its upcoming Blackwell chips and AI leadership.

Both AMD and Nvidia exhibit bullish momentum in the short term, supported by robust technical foundations. While AMD is aggressively closing in on Nvidia’s AI dominance, the latter’s market leadership remains firm, buoyed by strong technical indicators and an advanced product roadmap.

Investors may identify opportunities in both stocks, yet Nvidia currently maintains the edge in this high-stakes tech duel.