This week, tech stocks surged as anticipation for US interest rate cuts grew.

Amidst the market buzz, OpenAI introduced a groundbreaking AI model that is said to possess advanced reasoning capabilities, contrasting with Apple’s latest product reveal which failed to excite investors.

Simultaneously, the value of Bitcoin climbed past the US$60,000 mark, while Google is entangled in a legal battle, defending itself against allegations of monopolistic practices in the ad tech sector.

Stay updated on the latest trends in the tech industry with the Investing News Network’s overview.

1. Wall Street Wraps Up Week on a Positive Note

On Monday (September 9), Wall Street was calm following Friday’s (September 13) job report, leaving investors pondering potential aggressive rate cuts from the US Federal Reserve during its upcoming meeting on September 17 and 18.

The Nasdaq Composite (INDEXNASDAQ:.IXIC) started slightly up by 0.88 percent from Friday’s close, with the S&P 500 (INDEXSP:.INX) also opening 0.62 percent higher than the previous session. By day end, the indexes recorded gains of 0.29 and 0.53 percent, respectively.

Market activity was subdued on Tuesday (September 10) as traders awaited US inflation data for August and the debate between presidential hopefuls Donald Trump and Kamala Harris. By midday, all indexes saw a decline, with the Nasdaq Composite experiencing the largest drop, 1.32 percent below the opening price, though it closed flat.

Wednesday brought the US consumer price index (CPI) report, indicating a 0.3 percent increase in the index for all items, excluding food and energy, for August, compared to a 0.2 percent rise in July, signaling a rising inflation trend.

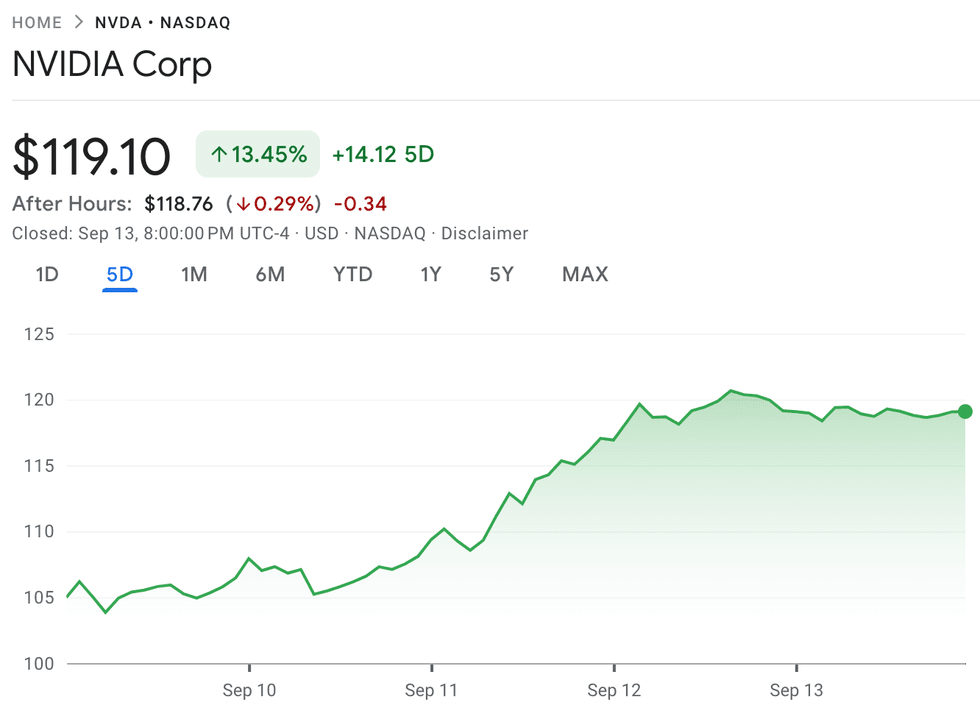

Despite this, the all-items index rose by 2.5 percent for the 12 months ending in August, its smallest increase since February 2021, suggesting a slower pace of price growth. The mixed signals temporarily impacted the market, but a surge in tech stocks, spurred by a 7 percent surge in NVIDIA’s (NASDAQ:NVDA) stock, offset the downturn.

2. NVIDIA Performance Soars Amid Tech Stock Recovery

Chart courtesy of Google Finance.

NVIDIA performance, September 9 to 13, 2024.

Thursday (September 12) witnessed a…

The Economic Tale of Rising Numbers and Surging Fortunes

A Wholesome Rally: August PPI and Unemployment Claims

For the month of August, the producer price index (PPI) trotted along, showcasing a modest 0.2 percent increase, aligning precisely with Dow Jones’ anticipations. Meanwhile, the core rate, excluding food and energy, took a cue from the CPI core rate, escalating by 0.3 percent – a smidgen beyond the predicted 0.2 percent.

Additional data regarding initial unemployment claims for the week ending September 7 unveiled figures of 230,000, surpassing initial estimates, painting a picturesque scene of an economy on the move.

Following this inflation tango, all major indexes revelled in notable profits, with the Nasdaq Composite leading the dance with a 1 percent leap, closely followed by a 0.75 percent swell for the S&P 500. However, the prize for the day was nabbed by the Russell 2000, pirouetting to a joyful 1.22 percent rise.

The Crypto Chronicles: Bitcoin’s Turbulence and Triumph

Setting the stage for the week, Bitcoin stood like a stoic sentinel over the weekend, lingering serenely in the US$54,000 to US$55,000 realm.

As the new trading week unfolded, the cryptocurrency began its upward journey, pushed skyward by factors like the CPI revelation and the presidential debate. It reached its zenith on Monday, touching US$57,635 around 6:00 p.m. EDT, attracting gazes and whispers from seasoned investors.

Notable market insights were revealed on a captivating Monday, as Broker Bernstein forecasted a Bitcoin utopia with a potential valuation of US$90,000 if a certain incumbent repeats his stay at the presidential office. Contrastingly, a different future occupant might steer Bitcoin into a more modest price territory, with projections ranging between exhilarating US$30,000 and US$40,000.

Prior to the intense Tuesday debate, Bitcoin made strides by 1.59 percent within trading hours, only to scoot back to US$56,247 overnight as both candidates refrained from undressing the topic of cryptocurrencies. (In hindsight, the data seems to validate the breadcrumbs.)

With emotions running high, a CNN poll painted a vivid picture, showcasing the audience’s favor towards one debater over the other. As Bitcoin’s price wavered in the uncertainty, a dip to US$55,901 greeted traders on a Wednesday morning, lingering like a subtle whisper in the trading air.

Since the midweek reveal of the PPI, Bitcoin’s tale has been spun with delicate threads of volatility, revealing a persistent upward climb. By the time Thursday kissed goodbye, Bitcoin had crossed the US$58,200 milestone, a tale tipping towards the stars after a modest hiatus.

The climax was saved for Friday, where Bitcoin danced in rhythm with the stock market, breaking through the US$60,000 barrier for the first time since the bygone August days. With grace and might, it stood at US$60,557.20, a testament to its 4.3 percent elevation in price over a mere 24-hour span and a remarkable 13.7 percent surge over the past seven sunlit days.

The AI Odyssey: OpenAI Unveils the Fabled “Strawberry” Model

A week of fervor enveloped OpenAI, the beacon of the startup universe. Reports circulated on a Tuesday, revealing tidbits about an AI creation termed “Strawberry,” rumored to spin into reality within weeks.

Reuters had initially shed light on this creation back in July, sparking imaginations and curiosity across the AI landscape.

In a well-choreographed revelation two days hence, OpenAI unfurled a sneak peek of OpenAI o1, the pioneer in a lineage of AI colossi primed to ruminate at deeper lengths before furnishing their responses. Intent on tackling complex dilemmas in realms like math, science, and coding, these models embody a new horizon in AI evolution.

As the week concluded, whispers of a remarkable tale persisted, echoing across digital realms and human minds, a saga of innovation and intrigue amidst a backdrop of economic flourish and technological transcendence.

Current Insights into AI, Tech, and Gadgets

OpenAI O1 Impressiveness vs GPT-40

OpenAI recently pitted its latest AI model, OpenAI O1, against the formidable GPT-40. The results were stark. In a grueling test at the International Mathematics Olympiad, GPT-40 could only muster a correct solution rate of 13 percent. In sharp contrast, the champion of the day, OpenAI O1, astounded with an 83 percent success rate. A staggering difference that speaks volumes of the remarkable prowess of OpenAI’s latest creation.

OpenAI O1’s Coding Prowess and Limitations

Beyond math wizardry, OpenAI O1 ventured into the coding realm and flexed its digital muscles. A standout performance at the Codeforces competition saw the software secure a respectable spot in the lofty 89th percentile. However, amidst the applause lies a limitation – the AI’s inability to trawl the vast expanses of the web for information hinders its practicality for the average user, especially when compared to the omniscient ChatGPT. Nonetheless, this quantum leap in AI reasoning capabilities heralds a new era of extraordinary AI achievements.

Google’s Antitrust Battle with DOJ

Enter the arena where tech giants clash – Google, embroiled in its second antitrust trial this year on U.S. soil, commenced proceedings in Virginia. The battle is over allegations by the U.S. Department of Justice accusing Google of employing ‘anticompetitive and exclusionary conduct’ to lord over the advertising tech domain since January 2023. Accusations paint a picture of a tech behemoth wielding its massive influence to subjugate rivals and seize control of the digital advertising sphere.

Google, at the receiving end, refutes these claims, arguing that the case initiated by the DOJ fails to encapsulate the broad vista of online advertising. The search engine colossus cites stiff competition from the likes of Comcast, Microsoft, Walmart, Meta Platforms, and Disney as evidence of a fiercely competitive ecosystem.

Apple’s Unimpressive iPhone 16 Reveal

Apple, the harbinger of innovation, hosted the “It’s Glowtime” event at its Cupertino headquarters, unveiling a dazzling array of products. Amongst the stars of the show were the iPhone 16 series, powered by the groundbreaking Apple A18 chip developed in collaboration with Softbank Group’s Arm subsidiary. The spectacle also included the latest Apple Watch Series 10, upgrades in the Apple Watch Ultra 2, and a refreshed AirPods lineup replete with advanced features.

Despite the grandiose unveiling, the reception was tepid. The new iPhone 16 failed to make waves, criticized for its lackluster hardware upgrades, save for the novel Camera Control button. Onlookers also bemoaned the restricted access to Apple Intelligence, a feature set to roll out in beta exclusively to select device owners come October, leaving many underwhelmed by the lack of substantial enhancements.

Apple Faces Competitive Landscape Amid Huawei’s Mate XT Release

Apple Competes Against Huawei’s Innovative Mate XT

Apple recently found itself battling against the winds of competition as Huawei Technologies introduced its latest innovation – the Mate XT tri-foldable phone equipped with an AI assistant. This unveiling came hot on the heels of Apple’s own event, creating a clash of techno-titans in the smartphone arena. Moreover, Apple’s ambitions to unveil Apple Intelligence in Mainland China were thwarted by stringent data privacy regulations in the region, further heightening the stakes in this high-tech rivalry.

Legal Setback for Apple in Europe

In a separate arena, Apple faced a setback when the European Court of Justice delivered a damning verdict. The tech giant was ordered to pay a staggering 13 billion euros in back taxes to Ireland, following a decade-long legal battle initiated by the European Commission. At the crux of the matter was the accusation that Ireland had provided Apple with unlawful tax advantages, leading to a hefty bill that Apple must now settle.

Stock Performance Amidst Challenges

Amidst these challenges and developments, Apple’s stock performance remained a point of interest for many investors. Despite the turbulence in the tech landscape and the legal woes faced by the company, Apple shares managed to eke out a gain of 0.71 percent by the end of the week, closing at US$222.50. This resilience in the face of adversity showcases the robustness of Apple’s market position and investor confidence in the brand.

Don’t forget to follow us on Twitter @INN_Technology for real-time news updates!