Wells Fargo & Company’s stock stumbled by 4% after the official announcement of a formal agreement with the Office of the Comptroller of the Currency (OCC) regarding the enhancement of the bank’s anti-money laundering (AML) and sanctions risk management practices.

This agreement shed light on deficiencies within the bank’s internal controls related to anti-money laundering and risk management procedures. The areas of focus included reporting on suspicious activity and currency transactions, customer due diligence, as well as the implementation of customer identification and beneficial ownership strategies.

Revealed initially in the second-quarter Securities and Exchange Commission (SEC) filing, Wells Fargo highlighted its ongoing “resolution discussions” with the U.S. SEC concerning an inquiry associated with the cash sweep options offered to new investment advisory clients.

Embracing this agreement marks a significant stride for Wells Fargo in fortifying its AML and sanctions risk management capabilities. It aligns with the bank’s continuous drive to improve its risk management framework and operate in accordance with regulatory mandates.

WFC’s leadership emphasized, “We have dedicated efforts to address a substantial portion of the formal agreement’s requirements and are steadfast in completing the task with the same sense of urgency we apply to our other regulatory commitments.”

Exploring the Parameters of WFC’s Agreement With OCC

The agreement necessitates the formation of a Compliance Committee tasked with overseeing Wells Fargo’s compliance with the agreement’s provisions. The outlined action plan is expected to encompass aspects such as front-line risk management, independent risk management, independent testing, customer identification, and the detection of suspicious activity.

Moreover, the agreement dictates improvements in Wells Fargo’s AML and sanctions risk management protocols, requires OCC approval for assessing the AML and sanctions risks of new offerings, and mandates prior notification to OCC before expanding any such products.

Regulatory Challenges Faced by WFC

Beginning September 2016, Wells Fargo encountered substantial hurdles, including penalties and sanctions such as the imposition of an asset position cap by the Federal Reserve.

In a separate class action lawsuit filed in July 2024, accusations were made against the bank for mishandling its employee health insurance plan, resulting in overpayments by thousands of U.S.-based employees for prescription medications. Allegations pointed towards Wells Fargo’s health plan overpaying pharmacy benefit managers, consequently inflating prescription drug costs.

Another lawsuit in June 2024 alleged Wells Fargo’s involvement in a $300-million Ponzi scheme, affecting over 1,000 investors, predominantly seniors, leading to significant financial losses. The lawsuit argued that Wells Fargo was complicit in the fraudulent activities from 2011 to 2021, providing substantial support to the perpetrators while benefiting from the fraudulent scheme.

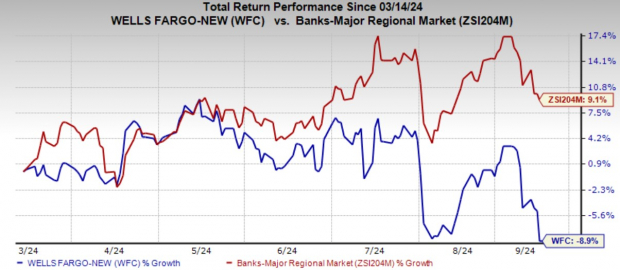

Over the last six months, Wells Fargo’s stock observed an 8.9% decline compared to the industry’s growth of 9.1%.

Image Source: Zacks Investment Research

Wells Fargo currently holds a Zacks Rank #3 (Hold).

Other Financial Institutions Facing Legal Scrutiny

Recently, on September 11, 2024, The Toronto-Dominion Bank agreed to settle with the Consumer Financial Protection Bureau (CFPB) by paying a $28 million penalty related to credit reporting issues. Allegations pointed towards the bank’s mishandling of customer credit information and failure to rectify these issues promptly.

In a similar vein, Robinhood Markets, Inc.’s cryptocurrency platform will be paying $3.9 million in a settlement with the California Department of Justice due to issues related to cryptocurrency withdrawals. The platform was accused of preventing customers from withdrawing their cryptocurrency holdings between 2018 and 2022, violating California law.

According to California’s Attorney General Rob Bonta, Robinhood Markets, Inc. failed to deliver cryptocurrencies purchased by customers, consequently hindering their ability to withdraw their assets, coercing them to sell their holdings to exit the platform.