Stocks such as Nvidia have basked in the limelight on Wall Street, but as the saying goes, what goes up must come down. Eventually, every meteoric rise plateaus, and it’s time to search for the next shooting star.

Enter three intrepid minds from Motley Fool who ventured forth on a quest to unearth the future gems of the tech world.

Palantir Technologies (NYSE: PLTR), Affirm (NASDAQ: AFRM), and MercadoLibre (NASDAQ: MELI) have emerged as prime contenders. These companies boast enticing growth prospects while remaining in the nascent stages of development, promising handsome returns for investors in the years to come.

If you’re seeking to fortify your investment portfolio, consider acquiring and holding shares of these three burgeoning tech disruptors for the next half-decade.

Palantir’s Radiant Ascent Continues

Jake Lerch (Palantir Technologies): Palantir Technologies stands out prominently in my mind when contemplating tech companies that show promise for the long haul.

Palantir has been firing on all cylinders, culminating in its much-lauded inclusion in the S&P 500 index. The announcement sent Palantir’s stock soaring by 14%, with shares more than doubling year-to-date. In its most recent quarter, Palantir posted a revenue of $678 million, marking a 27% year-over-year increase. The company’s net income surged by 87% to $134 million.

PLTR Revenue (Quarterly) data by YCharts

In addition, Palantir’s customer base and free cash flow have seen a meteoric rise, sealing over 27 deals valued at over $10 million as the demand for its AI-powered platform escalates.

As 2024 unfolds triumphantly for Palantir, investors still have an opportunity to seize a portion of its stock. With the stock yet to reclaim its all-time high of $45 set in 2021, the current landscape presents an enticing prospect for potential investors.

Affirm’s Strategic Alliance with Apple: A Game-Changer for Investors

Justin Pope (Affirm): Affirm, a pioneer in the buy now, pay later space, shines like a beacon as an obvious victor over the long term. Their algorithm-driven lending approach, coupled with a commitment to customer-centricity by eschewing late fees, has garnered them a substantial user base of 18.7 million.

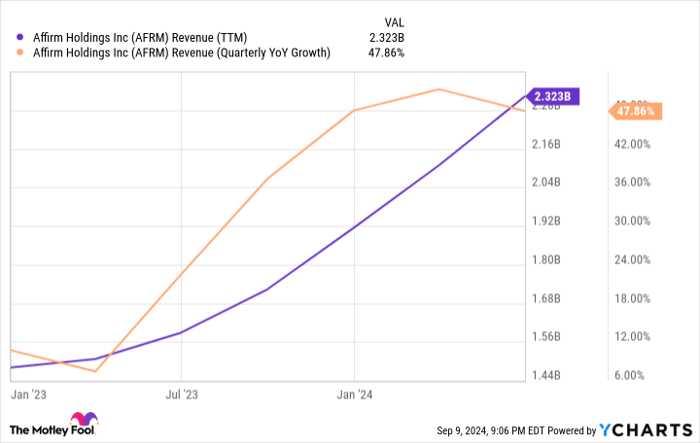

With an array of more than 300,000 merchant partners, including retail titans like Amazon and Shopify, Affirm has witnessed a noteworthy surge in revenue growth, nearing the 50% mark since early last year.

AFRM Revenue (TTM) data by YCharts

Underpinning its stellar growth trajectory, Affirm struck a pivotal deal with Apple in June, securing integration into Apple Pay. This move exposes Affirm to approximately 153 million iOS users in the United States, paving the way for exponential expansion in the years ahead.

Bolstered by the Apple collaboration and its improving financial performance, Affirm is poised for substantial growth over the foreseeable future. Currently trading down by 77% from its 2021 peak, the company’s recent attainment of its first operating profit signals a trajectory towards enhanced bottom-line performance.

A Second Chance at Amazon-like Success with MercadoLibre

Will Healy (MercadoLibre): Many investors bemoaned missing the boat on Amazon’s meteoric rise from online bookstore to tech juggernaut driven by e-commerce and cloud services.

However, as Amazon’s growth story eluded many, a second chance may be in the offing with MercadoLibre.

The Dynamic Growth of MercadoLibre in Latin America

As the sun sets on the bustling cityscape of Latin America, a new financial giant emerges from the shadows, casting a long shadow of success in the e-commerce landscape. While many investors remained impervious to its meteoric rise, MercadoLibre, often dubbed as the Amazon of the South, has been quietly revolutionizing the digital sphere from Tijuana to Tierra del Fuego.

Overcoming Unique Challenges

In a world where plastic reigns supreme, Latin America’s cash-based society presented MercadoLibre with a conundrum. With millions excluded from the banking system, innovation was imperative. In a stroke of genius, the company birthed Mercado Pago, heralding a new era of digital finance to facilitate online transactions beyond their e-commerce platform.

Furthermore, the logistical hurdles of fulfillment and shipping in this vast region prompted the inception of Mercado Envios. With a pioneering spirit, MercadoLibre introduced lightning-fast shipping options, like same-day and next-day delivery, to regions previously untouched by such convenience.

Explosive Growth and Financial Performance

Despite its modest market cap of around $100 billion, a fraction of Amazon’s colossal $1.9 trillion, MercadoLibre’s smaller size has become a catalyst for nimble growth. Notably, revenue surged by an impressive 39% in the first half of 2024, soaring to $9.4 billion.

Moreover, by exercising prudence in cost management, the company reaped significant rewards, boasting an 89% increase in net income to $875 million in the same period. This stellar performance has propelled the stock to soar over 40% in the past year, reaching historic highs and capturing the attention of a multitude of investors.

A Beacon of Opportunity

Despite its remarkable success, MercadoLibre trades at a P/E ratio of 73. Nevertheless, with a PEG ratio of under 0.9, the stock appears reasonably priced, presenting a compelling opportunity for investors. As the company continues to leverage its growth potential with a comparatively smaller market cap, the allure of MercadoLibre persists as a beacon of untapped potential in the Latin American market.