The Chipmaking Powerhouse Expands Horizons

Expanding its reach beyond the island of Taiwan, Taiwan Semiconductor Manufacturing Co (TSM) has ventured into the heartlands of Arizona, USA, to kickstart the production of the critically acclaimed Apple Inc (AAPL) A16 System-on-Chip (SoC) at Phase 1 of Fab 21. This strategic move marks the commencement of an era where tech innovation transcends borders.

Paving the Path to Technological Marvels

Amidst whispers of industry disruption, the 5nm N4 chip family, silently made its grand entrance in 2022 through the sleek iPhone 14 Pro, mesmerizing tech enthusiasts worldwide. Taiwan Semiconductor’s board echoed a resounding approval in 2024 by infusing $7.5 billion into the Arizona facility, setting the stage for groundbreaking technological advancements.

A Vision Unveiled

Tim Culpan unveils a visionary outlook as Taiwan Semiconductor gears up to escalate production volumes upon the completion of the fab’s second phase. Reports suggest that the Arizona facility’s production yields harmonize seamlessly with its Taiwan counterparts, reflecting a tapestry of dedication and precision.

Market Moves and Global Shifts

As the semiconductor saga unfolds, Apple confronts market share turmoil in China, with a 14% market share in the second quarter of 2024. A fierce competitor emerges as Huawei Technologies Co grasps for Apple’s premium market slice by introducing the Mate X tri-fold smartphone hot on the heels of the iPhone 16 series, while Apple’s stocks witnessed a commendable 22% surge over the past year.

Smooth Sailing Amidst the Storm

While Apple navigates turbulent seas, the tide seems favorable for Taiwan Semiconductor. The resurgence of the smartphone market coupled with the unwavering demand for Nvidia Corp’s (NVDA) AI chips paints a rosy picture of growth and stability for the industry stalwart. Recent rumblings hint at Taiwan Semiconductor clinching a monumental deal with Alphabet Inc (GOOG, GOOGL) for Google’s Pixel 10 and Pixel 11 chips, as Samsung Electronics’ Samsung Foundry falters in its commitments.

Price Actions and Future Prospects

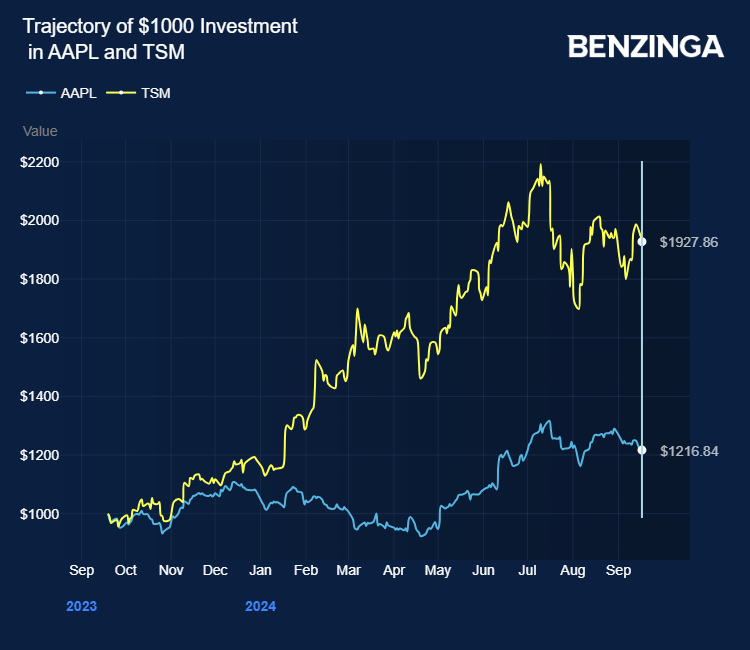

As the sun sets on Wall Street, Apple’s stock shines brightly with a 1.4% increase, peaking at $219.88, while Taiwan Semiconductor dances to the tune of a 0.23% rise, closing at $167.74. Over the past year, Taiwan Semiconductor has enjoyed a meteoric 89% uptick, portraying resilience and promise in a volatile market landscape.

Explore the latest trends, seize the opportunities, and buckle up for a riveting ride through the exhilarating realm of tech innovation.