Following the recent rate cut by the U.S. Federal Reserve, the stock market has experienced a remarkable surge, hitting all-time highs.

The Path Unveiled by Historical Trends

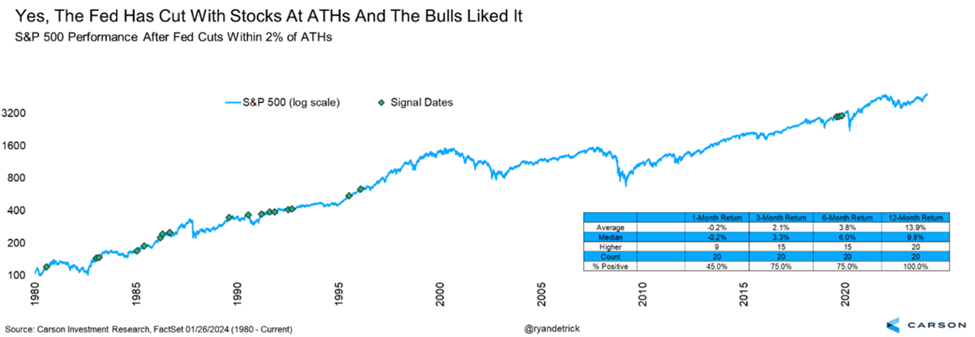

With the initiation of the current rate-cutting cycle while stocks are at all-time highs, historical data reveals a familiar path. Over the past approximately 45 years, there have been around 20 instances where the Fed has reduced interest rates when stocks were within 2% of all-time highs.

Remarkably, in every single one of these instances, stocks were trading higher one year later, boasting an average return of nearly 15%.

Therefore, historical data suggests a strong likelihood that stocks will witness a significant upsurge over the coming year. The recent confluence of events aligns with this pattern, raising the optimism for a bullish trajectory.

Forecasting Market Trends Amid Economic Growth

The recent rate cut by the Federal Reserve against a backdrop of the U.S. economy showcasing steady growth and low unemployment sets the stage for a promising outlook.

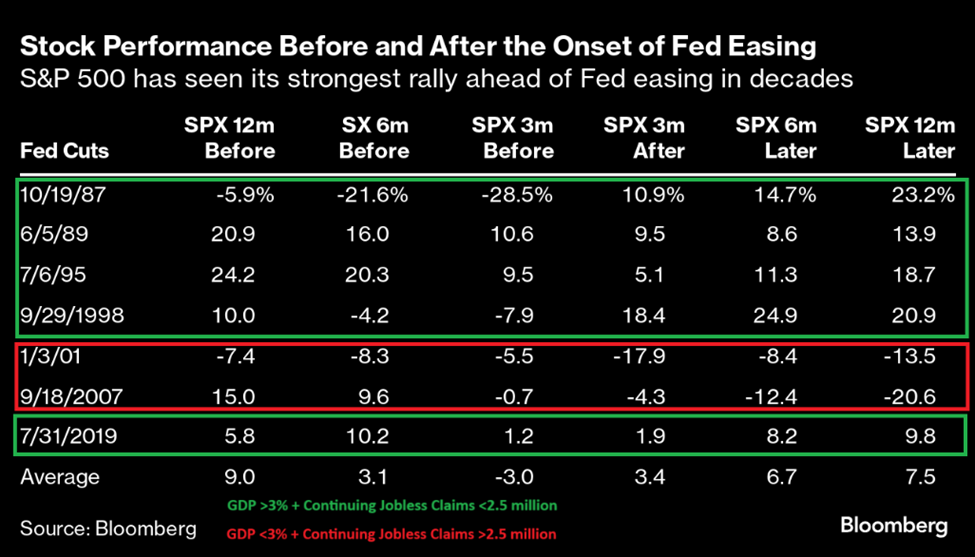

Considering past instances in 1987, 1989, 1995, 1998, and 2019 where rate-cutting cycles commenced amidst robust GDP figures and low jobless claims, stocks saw substantial gains over the ensuing year, averaging a 17% return.

In a world rife with unpredictability, historical trends offer a compelling insight into the potential upswing in stocks over the next year. While not foolproof, the data hints at a high likelihood of market gains in the near future, supported by a robust economic backdrop.

The Rise of Tech Stocks: Analyzing the Impact of Rate Cuts on Market Dynamics

Historical Parallels: 1998/99 vs. Current Market Trends

Cutting rates in a market poised at all-time highs, thriving on a robust 3% economic growth rate, and boasting record-low unemployment levels is a bold move. Such a powerful concoction of factors historically paints a promising picture for stock performance in the foreseeable future.

Examining historical data, there is a striking resemblance between the rate-cutting cycle the market has just entered and the one observed in 1998/99. Back then, this monetary tactic ignited a significant surge in tech stocks, particularly those at the forefront of artificial intelligence (AI) innovation.

The Internet Boom of the Late 1990s

During the late 1990s, the stock market buzzed with the emergence of groundbreaking internet technologies. Companies were heavily investing in expanding internet infrastructure and developing cutting-edge products and services. Consequently, internet stocks soared, fueled by investor optimism.

By mid-1998, the economy experienced a slight slowdown, triggering concerns among investors and prompting the Federal Reserve to intervene with interest rate cuts. These actions not only stabilized the economy but also supercharged the internet boom, propelling related stocks to unprecedented heights throughout 1999 and 2000. Notably, the Nasdaq 100 index surged over 300% during this period.

The AI Revolution of Today

Fast forward to today, and the stock market is witnessing a similar fervor surrounding AI technologies. Companies are pouring resources into developing advanced AI infrastructure and groundbreaking products, resulting in a surge in AI-related stocks.

Amid a modest economic slowdown, prompting market volatility and necessitating rate cuts by the Fed, parallels are drawn to the late ’90s scenario. The current rate cuts are expected to re-stabilize the economy, providing further momentum to the ongoing AI revolution. This surge is anticipated to drive AI stocks to new highs well into 2025 and 2026.

The Road Ahead: Tech Stocks Positioning for Growth

As market optimism thrives fueled by historical analogs and current economic dynamics, tech stocks, particularly those in the AI domain, are poised for significant growth. While different stocks may exhibit varying growth trajectories during this rally, the prevailing sentiment favors tech stocks as frontrunners in the impending market upswing.

Regards,

Luke Lango

Editor, Hypergrowth Investing