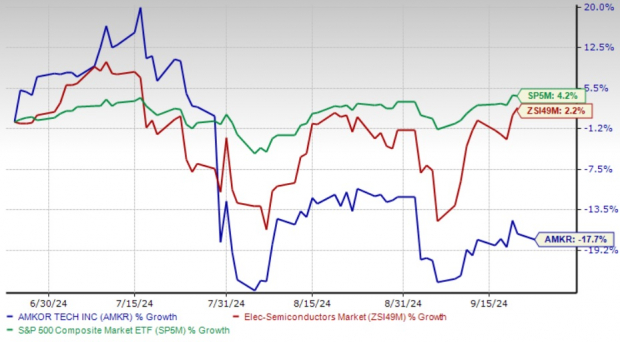

Amkor Technology AMKR has seen a significant 17.7% decline in its stock value over the past three months, a stark underperformance compared to the Zacks Electronics – Semiconductors industry and the S&P 500 index.

Amkor’s struggles stem from a multitude of challenges, including supply chain disruptions, geopolitical tensions, macroeconomic issues like inflation and high interest rates, and an ongoing semiconductor shortage.

The company’s difficulties were further compounded by slow recovery in key sectors such as automotive and industrial spaces, alongside weakening demand from traditional data center clients. Operating at less than full capacity due to several factory constraints has hindered Amkor’s revenue growth.

Moreover, a decrease in demand for its 2.5D integrated circuit and increased operational expenses related to a new Vietnam factory construction have further impacted Amkor’s financial performance.

Amkor Technology Three Month Performance

Image Source: Zacks Investment Research

AMKR Faces Stiff Competition in the OSAT Market

Amkor, known as a key player in the outsourcing semiconductor packaging and test services (OSAT) sector, provides innovative solutions with a reputation for high-volume manufacturing. Amid global operations, Amkor collaborates with tech giants like Apple, Qualcomm, and Intel.

In 2023, Apple entered a significant partnership with Amkor, marking the latter as its primary chip packaging solutions provider. Despite such alliances, Amkor contends with fierce competition in the OSAT market from Taiwan Semiconductor Manufacturing Company (TSM) and ASE Technology Holding (ASX).

While TSM focuses on chip manufacturing and advanced packaging, ASX specializes in IC packaging, testing, and assembly with offerings in System-in-Package and 3D IC technologies.

Despite challenges, Amkor projects third-quarter fiscal 2024 revenues around $1.835 billion. The company aims for a slight year-over-year improvement in fiscal 2024 revenues to $6.51 billion.

Conclusion

Given macroeconomic hurdles, heightened costs, tough competition, and a slow growth trajectory, Amkor currently holds a Zacks Rank #5 (Strong Sell). For investors, considering the current scenario, divesting from the stock appears prudent.