Anticipation Builds

The latest buzz on the street surrounds Paychex, Inc. as the clock ticks down to the release of its first-quarter earnings. In a financial dance where every move counts, this Rochester-based establishment is set to unveil its results on Tuesday, Oct. 1. Investors are om the edge of their seats, waiting with bated breath to see the numbers unfurl.

Forecasts and Figures

Analysts have their pencils sharpened, with expectations pinned at $1.14 per share for quarterly earnings, a status quo from the year-ago period. Revenue projections echo an upward trajectory, poised at $1.32 billion, compared to $1.29 billion in the same quarter last year. The figures are etched in stone or so it seems, according to data from industry authority, Benzinga Pro.

Recent Reflections

This tale of numbers weaves back to June 26, when Paychex last spoke its truth about a 5% year-over-year sales growth, reaching $1.295 billion. The figure was a mirror to the analyst consensus, standing at $1.296 billion. But now, as the clock ticks onward, the impending revelation of Q1 results holds the market in thrall.

Analysts at Play

In the realm of analysts, a dueling ground where foresight meets calculation, the scene is ablaze with activity. Let’s peek behind the curtain as the most-accurate analysts at Benzinga play their hand:

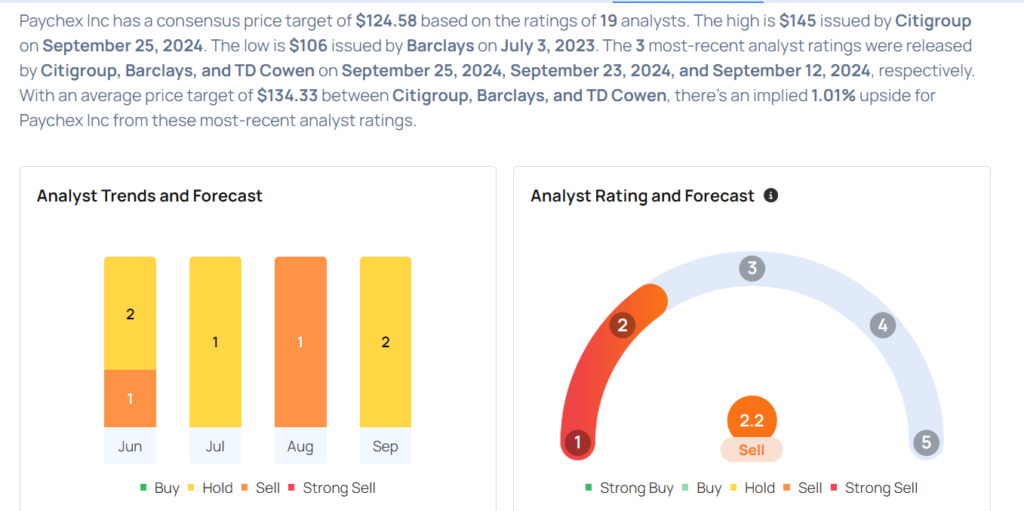

- Citigroup’s Peter Christiansen, with a Neutral stance, ups the price target from $125 to $145 on Sept. 25. His precision stands at 66%.

- Barclays’ Ramsey El-Assal, flying the flag of Equal-Weight, hoists the price target from $118 to $132 on Sept. 23, boasting a 68% accuracy rate.

- TD Cowen’s Bryan Bergin keeps a Hold title, while nudging the price target from $121 to $126 on Sept. 12. Bergin’s accuracy tap dances at 61%.

- JP Morgan’s Tien-Tsin Huang stays in the Underweight lane but raises the price target from $120 to $128 on Aug. 20, holding steady at a 66% accuracy rate.

- Morgan Stanley’s James Faucette shifts to Equal-Weight, trimming the price target from $125 to $122 come June 27, with a stead fast 65% accuracy rate.

Opinions in View

For those contemplating the delicate art of buying PAYX stock, the analysts offer a cacophony of voices. Each a maestro in their own right, the stage is set for a symphony of numbers, patterns, and gut feelings. Investors tread this path with caution, listening carefully to the whispers of these financial soothsayers.

Read This Next: