Wall Street analysts’ views can sway the stock market, prompting investors to ponder over their recommendations on whether to buy, hold, or sell. These sell-side analysts hold considerable power, but how reliable are their opinions when it comes to Tenet Healthcare (THC)?

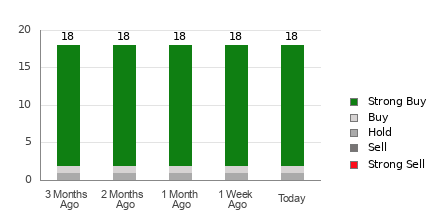

With an average brokerage recommendation (ABR) of 1.17, Tenet seems to be in a sweet spot between Strong Buy and Buy, based on assessments by 18 brokerage firms. Among these, 16 recommendations are Strong Buy, while one is Buy, making up 88.9% and 5.6% of all suggestions, respectively.

Interpreting the Trends in Brokerage Recommendations for THC

While the ABR points towards a bullish sentiment on Tenet, relying solely on this metric may not be prudent. Evidence suggests that broker recommendations often exhibit bias due to analysts’ vested interests, leading to a skewed positive outlook on stocks they cover, which may not align with retail investors’ best interests.

Brokerage firms often tend to shower stocks with “Strong Buy” ratings, while being hesitant to recommend selling, painting a picture that may not reflect the true market dynamics. To navigate this landscape effectively, investors are advised to complement ABR insights with other robust indicators, such as the Zacks Rank, known for its accuracy in predicting stock performance.

Understanding the Distinction Between Zacks Rank and ABR

Despite appearing similar in terms of a 1 to 5 scale, the Zacks Rank and ABR differ significantly in their methodologies. While ABR relies on brokerage recommendations, the Zacks Rank leverages earnings estimate revisions to gauge stock potential, providing a more quantitative and unbiased evaluation.

Empirical studies have shown that analysts, tied to brokerage firms, exhibit a consistent bias towards optimistic ratings, whereas the Zacks Rank primarily focuses on earnings estimates’ impact on stock prices, offering a more realistic perspective.

One critical aspect distinguishing the two metrics is their timeliness. While ABR may lag in reflecting the latest market dynamics, the Zacks Rank, driven by swift earnings estimate revisions, promptly adapts to changing trends, ensuring investors receive up-to-date insights.

Delving into the Investment Potential of THC

Tenet’s recent performance in earnings estimate revisions paints a promising picture, with the Zacks Consensus Estimate for the current year rising by 0.1% to $10.72 in the past month. This uptrend, accompanied by analysts’ growing confidence in the company’s earnings trajectory, has led to a Zacks Rank #1 (Strong Buy) for Tenet.

Given the upward trend in consensus estimates and the favorable Zacks Rank, Tenet’s ABR may indeed serve as a valuable insight for investors looking to capitalize on the stock’s potential.