The anticipation is palpable with the upcoming earnings season, where juggernauts from various sectors will reveal their financial performance. Notably, PepsiCo (PEP), a stalwart in the consumer staples domain, is slated to report on Tuesday, October 8th.

Reviewing PepsiCo’s Prospects

PEP shares have meandered in 2024, registering a humble 1.2% uptick and predominantly moving sideways throughout the year. It’s intriguing to observe how investors have shied away from Consumer Staples as the tech sector blazes ahead in this fiscal year.

Comparing PEP’s year-to-date performance against Zacks Consumer Staples sector and S&P 500, we witness a visual tale of its journey.

Image Source: Zacks Investment Research

Market analysts have subtly adjusted their earnings projections downwards in recent months. The current Zacks Consensus EPS estimate of $2.30 indicates a 2.2% growth from the previous year, albeit a 2% decline from mid-July.

Image Source: Zacks Investment Research

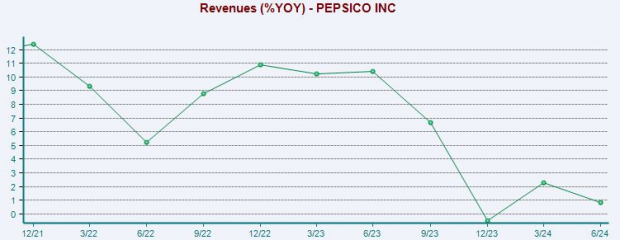

Similar recalibrations are evident in revenue projections, with an expected $23.9 billion reflecting a negligible 1% decrease over the same period. The figures suggest a modest 1.9% increase from the corresponding year-ago timeframe, underscoring a perceptible deceleration in revenue growth.

Please bear in mind that the subsequent chart delineates the year-over-year percentage deviation and not the absolute revenue numbers.

Image Source: Zacks Investment Research

At present, PEP shares don’t command a lofty valuation compared to historical metrics. The prevailing 19.6X forward 12-month earnings multiple falls significantly below the five-year median of 23.6X and the peak of 27.8X. This subdued multiple mirrors investors’ tempered growth expectations.

Evaluating Investment Potential

Looking ahead to PepsiCo’s imminent earnings release, the forecast doesn’t appear overtly encouraging, with analysts cautiously trimming their earnings and revenue forecasts. Although PEP shares have been lackluster in 2024, a favorable guidance post-earnings could inject a fresh spark.

This seems to be a moment of vigilance, especially considering the downward revisions. Given PepsiCo’s defensive nature, any deviation from projections is less likely to trigger substantial downside movement in the stock.