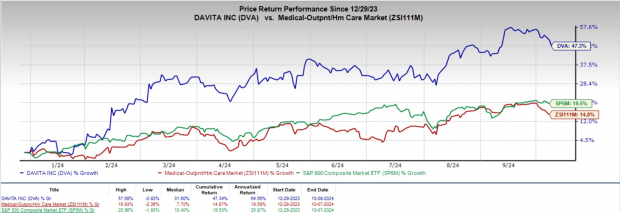

DaVita, Inc. has been making significant strides this year, with its stock soaring by an impressive 47.3%, greatly outpacing the industry’s growth of 14.8%. This surge comes against the backdrop of a 19.5% increase in the S&P 500 composite during the same period.

Currently holding a Zacks Rank #2 (Buy), DaVita’s upward trajectory is fueled by a robust business model. The company’s stellar performance in the second quarter of 2024, coupled with strategic acquisitions of dialysis centers, has garnered considerable investor confidence.

DaVita is a dominant player in the dialysis services sector in the United States, catering to patients afflicted with end-stage renal disease. Operating across a network of kidney dialysis centers and hospitals, the company’s services encompass a wide array of dialysis treatments and ancillary medical services.

Image Source: Zacks Investment Research

Key Drivers of DaVita’s Growth

The surging value of DaVita’s shares can be primarily attributed to the robust performance of its dialysis and laboratory services. Bolstered by a stellar second quarter and promising growth prospects, DaVita is poised for further expansion.

Central to DaVita’s growth strategy is its patient-centric care approach, which leverages its kidney care platform to offer diversified treatment models and modalities. The company’s focus on value-based partnerships in kidney health has streamlined collaboration among healthcare professionals, leading to enhanced patient care and early interventions.

DaVita’s aggressive acquisition strategy, evidenced by partnerships like the one with Nuwellis, underscores its commitment to expanding operations. The company’s foray into new markets in countries like Brazil, Colombia, Chile, and Ecuador reflects its growing global footprint.

The second-quarter results for 2024 have surpassed expectations, signaling a positive trend in revenue growth and patient services. DaVita’s proactive approach in expanding its U.S. dialysis treatments and overseas acquisitions poises it for sustained growth.

In a bullish move, DaVita has revised its earnings outlook for fiscal 2024, now projecting an adjusted EPS between $9.25 and $10.05, up from the previous range of $9 to $9.80, garnering heightened investor interest.

Risk Assessment

While DaVita’s growth prospects appear robust, a potential risk looms in the form of reduced profitability should patients transition from commercial insurance to government programs with lower reimbursement rates. Economic factors such as rising unemployment could trigger this shift, impacting DaVita’s financial performance.

Market Projections

Analysts forecast an 18% and 14.4% year-over-year upswing in DaVita’s bottom line for 2024 and 2025, with earnings expected to reach $9.99 and $11.42 per share, respectively. Revenue projections anticipate a 5.4% and 4% increase in 2024 and 2025, climbing to $12.8 billion and $13.3 billion on a year-over-year basis.

Top Contenders

Among other prominent players in the medical sector, which include Rockwell Medical, Quest Diagnostics, and RadNet, DaVita stands out as a top performer. While Rockwell Medical boasts a Zacks Rank #1 (Strong Buy), Quest Diagnostics and RadNet both hold a Zacks Rank #2.

Rockwell Medical has consistently surpassed earnings estimates over the past four quarters, with an average beat of 87.9%. The company’s stock has surged by 79.7% year to date, outshining industry growth.

Quest Diagnostics, with an estimated long-term growth rate of 6.8%, continues to deliver earnings beats, averaging 3.3% over the past four quarters. The company’s stock has also shown a commendable 7.9% increase this year.

RadNet has exceeded earnings expectations in each of the trailing four quarters, boasting an average surprise of 98.2%. Its shares have skyrocketed by 93.7% this year, outperforming industry peers.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.