The crypto market in Q3 2024 resembled a rollercoaster ride, with sharp price swings and changing investor sentiments creating a storm of volatility.

The quarter began with the ever-dominant Bitcoin facing significant price corrections, setting the stage for a tumultuous period. July and August witnessed Bitcoin’s value tumble by over 12 percent each month, painting a perplexing picture of uncertainty in the market.

On the horizon, Ethereum, often seen as a challenger to Bitcoin’s dominance, experienced a dip in user interactions and network activities during Q3. In contrast, blockchain platforms like Solana witnessed a surge in user engagement, hinting at a potential shift away from Ethereum among users.

July: The Crypto Sector’s Dance of Contradictions

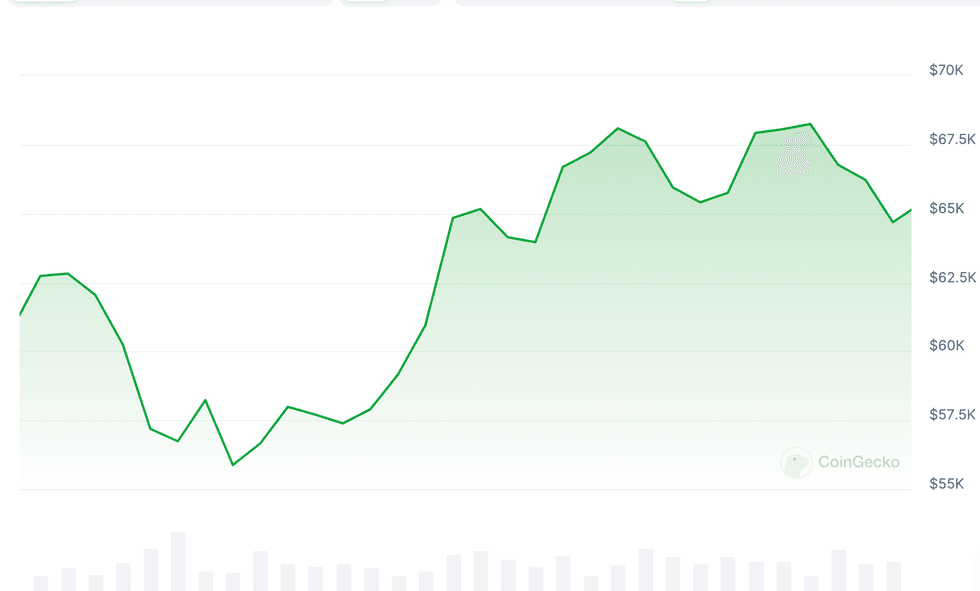

July saw the crypto market dancing to an unpredictable tune, with shifting trends and price fluctuations leading the way. Cryptocurrency gained political notoriety after Joe Biden’s withdrawal from the Democratic nominee race, catapulting Bitcoin’s price upwards. However, the month’s price gyrations highlighted its sensitivity to external events, emphasizing how news and external factors influenced the ebb and flow of Bitcoin’s popularity.

Chart via CoinGecko.

Bitcoin price, July 2024.

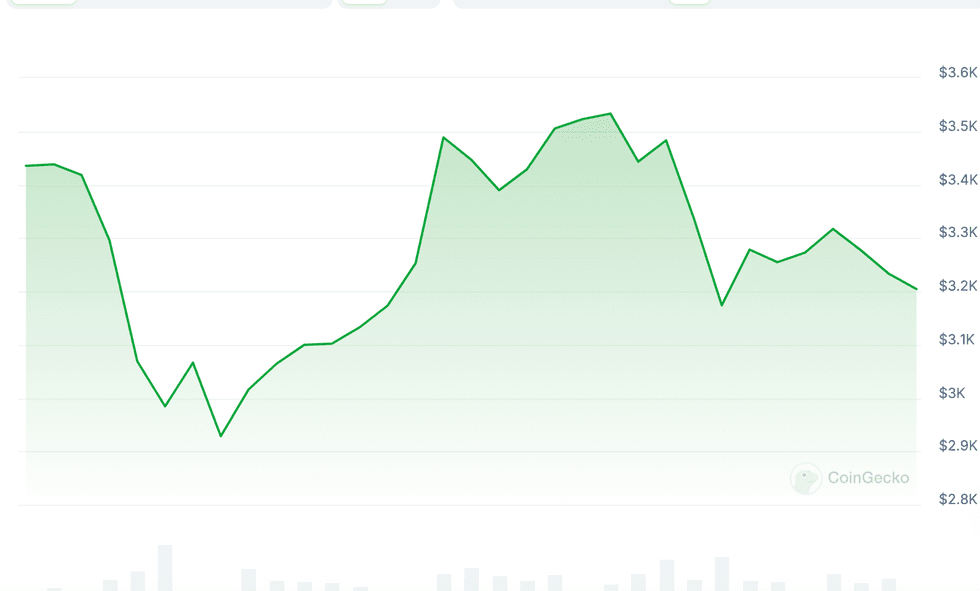

Conversely, Ether stumbled into an 8 percent slump immediately following the launch of Ethereum exchange-traded funds (ETFs) on July 23. Despite this setback, the ETFs surprised everyone, showing a robust daily growth rate by the month’s end.

Chart via CoinGecko.

Ether price, July 2024.

Meanwhile, Solana rose as a star performer, driven by the soaring popularity of liquid staking protocols. Between July 11 and 21, Solana outpaced Bitcoin and Ether in a crypto surge. Talks of a potential Solana ETF emerged, but analysts dismissed this as a distant possibility for now. Surprisingly, Solana’s decentralized exchanges outstripped Ethereum in monthly on-chain volume in July.

Amidst the turbulence, the CoinDesk 20 Index closed the month with 1.98 percent growth.

August: Crypto Unravels, Lagging Behind Stocks’ Rebound

August arrived with a storm as macroeconomic forces triggered a slew of sell-offs that reverberated through the economy after the Bank of Japan raised interest rates unexpectedly on July 31.

Stateside, employment data rattled nerves, leading to a widespread stock market sell-off. By August 5, the cryptocurrency world had hemorrhaged $510 billion, with Bitcoin dipping below $50,000 – its lowest point since February. While traditional markets quickly rebounded, Bitcoin and Ether struggled to pick up the pieces. Bitcoin’s price action even signaled a “death cross,” historically signaling further declines.

Chart via CoinGecko.

Crypto sector market cap, August 2024.

The downturn worsened with a surge in short-selling activities. While institutional investors initially swooped in to buy the dip, hoping for a reversal, this proved short-lived. As August progressed, momentum shifted decisively in favor of sellers, leading many to capitalize on bearish sentiment, amplifying downward pressure on Bitcoin and other cryptocurrencies.

Despite a beacon of hope in Ethereum ETFs,

Cryptocurrency Market Insights: Q4 2024 Overview

Bitcoin and Ether Defy Odds in September

September, known for its historical bearish tendencies in the crypto market, surprised observers as Bitcoin and Ether broke through resistance levels after the US Federal Reserve’s interest rate cut on September 18. The month saw stablecoin valuations soar, notably for XRP, following the launch of Grayscale’s XRP Token Trust. Rekt Capital’s analysis hinted at a potential bullish trend for Bitcoin heading into Q4, ending the month up 7.39 percent, exceeding US$64,540.

BlackRock’s Ethereum ETF Hits Milestone

At the close of Q3, BlackRock’s spot Ethereum ETF surpassed the significant milestone of US$1 billion in total value for the first time, underscoring the growing mainstream interest in cryptocurrency investments.

Key Factors Influencing Q4 Crypto Market

WonderFi’s report on Q4 crypto market dynamics highlighted Bitcoin’s evolving volatility and showcased longer periods of stability, indicating a potential maturation as an asset class. Analysts like Matt Hougan and Ric Edelman foresee a successful Q4 for Solana and Ethereum, aligning with optimistic projections made by other industry experts.

Regulatory Climate and Political Impact

Bernstein Private Wealth Management’s September report speculated on Bitcoin’s price trajectory based on the outcome of the US presidential election. Regulatory scrutiny, particularly from the US Securities and Exchange Commission (SEC), and policy shifts based on the election results are anticipated to significantly influence the future of the crypto industry. Calls for regulatory clarity via bills like FIT21 and the introduction of the BRIDGE Digital Assets Act by Congressman John Rose indicate an ongoing effort to establish a regulatory framework for the digital asset industry.

Implications for Investors

The final quarter of 2024 holds immense potential for growth and innovation in the cryptocurrency market. With increasing institutional participation, evolving regulations, and a rising interest in alternative coins, investors are advised to monitor this period closely for possible investment opportunities amidst the changing landscape of the digital asset sector.

Don’t forget to follow us @INN_Technology for real-time updates!