Reign of the Chinese E-Commerce Juggernaut

Alibaba Group (BABA) stands tall, a Chinese e-commerce titan reigning over digital marketplaces like AliExpress and Taobao. Since its inception in 2009, the Alibaba Cloud has surged to become a significant revenue source, rivaling even the mightiest of competitors in the realm. Like a phoenix, Alibaba diversifies beyond e-commerce, delving into terrain such as the international wholesale, digital payments, and logistics, soaring to new heights in the global market.

A Tale of China’s Economic Rebirth

China’s economic resurgence in 2024 signaled a triumphant reversal of fortunes through massive stimulus injections. The promise of more stimulus gifts from the People’s Bank of China Governor Pan casts a promising glow on the future. With robust growth figures and impressive retail sales, investors lean in, absorbing the riches of a thriving Chinese economy. Pulsating with liquidity and vigor, China’s stocks, particularly BABA, emerge as prime players ready to dominate the market arena.

The Lure of BABA’s Bargain Valuation

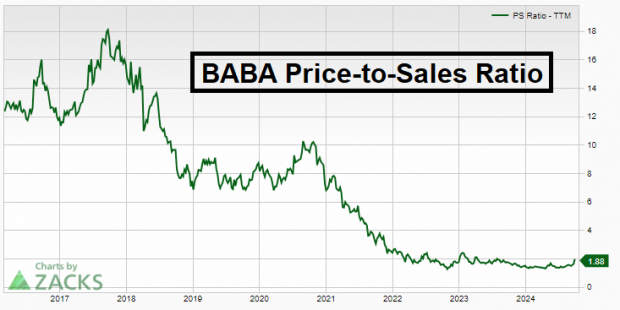

BABA’s climb of 34% year-to-date might hint at riches, but its valuation remains a hidden gem buried deep in the bargain bin. With a price-to-sales ratio hanging at 1.88x, almost scraping the all-time lows, BABA beckons investors with promises of untapped value hidden beneath a facade of neglect.

Image Source: Zacks Investment Research

Alibaba’s Strategic Share Repurchase Program

Like a master strategist, Alibaba orchestrates a grand symphony of share repurchases, swaying the market with each purchase. The recent acquisition of over $17 million worth of shares on October 17th sends ripples through the financial landscape, a move indicative of shareholder-friendly maneuvers akin to that of Apple in the past.

Embrace of Institutional Bigwigs in BABA

As the curtain draws back, unveiling the 13F disclosures, the presence of luminaries like Michael Burry and David Tepper mark Alibaba as a darling of the smart money. These institutional giants bet big on BABA, tipping the scales in favor of this Chinese juggernaut.

Expanding Investor Access through HK Listing & Stock Connect Program

With a Hong Kong listing and China’s Stock Connect program opening gates to millions, BABA becomes the apple of every investor’s eye. The projections of inflows ranging from $10-$20 billion by stalwarts like Goldman Sachs (GS) and Morgan Stanley (MS) further heighten the allure.

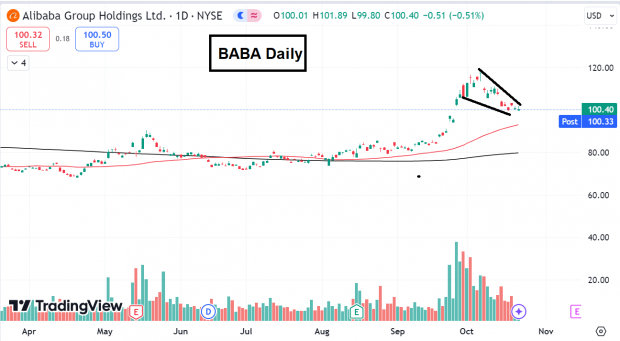

Anchors Aweigh: The First Pullback After Breakout

BABA’s shares now waltz towards their 50-day moving average, marking the first retreat post the stimulus-driven surge. While uncertainty looms, such a pullback often signals a buying opportunity, a beacon of light amidst shifting tides.

Image Source: TradingView

Epilogue

The phoenix of Chinese e-commerce, Alibaba, rises from the ashes, carried aloft on the wings of international success. Its undervaluation, institutional backing, and expanding horizons beckon investors to the table, promising a feast of opportunities in the tumultuous world of finance.