Ark Funds, led by Cathie Wood, is one of the most well-known fund managers thanks to its actively managed ETFs that focus on future growth areas of innovation.

Two of the fund’s ETFs celebrate their 10th anniversaries on Thursday. Here’s a look back at the funds’ launch and how they’ve performed over the last 10 years.

Ark Innovation: Wood and Ark Funds launched the Ark Innovation ETF ARKK on Oct. 31, 2014. The fund has grown to become the most well-known and largest of the company’s funds, with $5.78 billion in assets under management.

“ARRK is an actively managed ETF that seeks long-term growth of capital by investing under normal circumstances primarily in domestic and foreign equity securities of companies that are relevant to the Fund’s investment theme of disruptive innovation,” the company’s website says.

Disruptive innovation themes include autonomous mobility, precision therapies, next gen cloud, neural networks, intelligent devices, digital wallets, digital assets, smart contracts and multiomic technologies, according to the company.

“ARK defines ‘disruptive innovation’ as the introduction of a technologically enabled new product or service that potentially challenges the way the world works.”

Here are the current top 10 holdings in the ARKK ETF and their percent of net assets:

- Tesla Inc TSLA: 14.1%

- Roku Inc ROKU: 10.8%

- Coinbase Global COIN: 8.1%

- Roblox Corporation RBLX: 6.2%

- Palantir Technologies PLTR: 5.1%

- Robinhood Markets HOOD: 5.0%

- Block Inc SQ: 4.9%

- CRISPR Therapeutics CRSP: 4.5%

- Shopify Inc SHOP: 3.9%

- UiPath Inc PATH: 2.9%

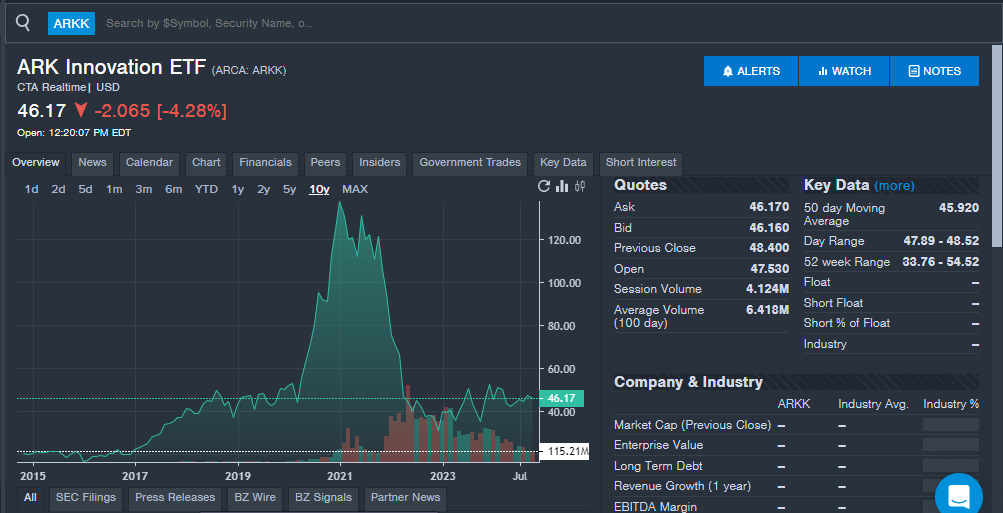

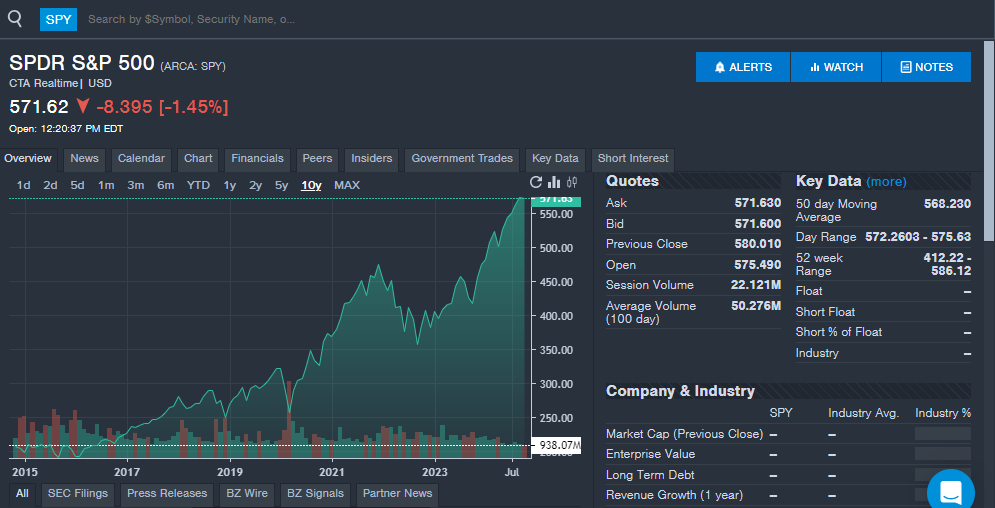

Since the fund’s inception, the ETF is up 161.4%. This return trails the current 10-year return of the SPDR S&P 500 ETF Trust SPY, which tracks the S&P 500.

Here’s a look at how the returns of ARKK stack up against SPY, which is the oldest and largest U.S. ETF, over time:

| Average Annual Returns | ARKK | SPY |

| 1-Year | +19.9% | +36.2% |

| 3-Year | -24.3% | +11.8% |

| 5-Year | +2.6% | +15.8% |

| Since ARKK Inception 10/31/14 | +10.2% | +13.2% |

The chart below from Benzinga Pro shows the 10-year return of ARKK.

For comparison, here is the 10-year chart of the SPY.

Read Next: EXCLUSIVE: Cathie Wood Tells Benzinga Why Tesla Should Trade As A Tech Stock

ARK Genomic: The Ark Genomic Revolution ETF ARKG was also launched by Ark Funds on Oct. 31, 2014. The fund currently has $1.33 billion in assets under management.

“ARKG is an actively managed ETF that seeks long-term growth of capital by investing under normal circumstances primarily in domestic and foreign equity securities of companies across multiple sectors, including health care, information technology, materials, energy, and consumer discretionary, that are relevant to the Fund’s investment theme of the genomics revolution,” the company’s website says.

Themes for the genomics ETF include precision therapies, multiomic technologies, programmable biology, neural networks, next gen cloud and adaptive robotics, according to the company.

Here are the current top 10 holdings in the ARKG ETF and their percent of net assets:

- Twist Biosciences TWST: 8.7%

- Recursion Pharmaceuticals RXRX: 7.0%

- CRISPR Therapeutics: 7.0%

- CareDx CDNA: 5.1%

- Adaptive Biotechnologies ADPT: 4.7%

- Veracyte Inc VYCT: 4.6%

- Ionis Pharmaceuticals IONS: 4.3%

- Nurix Therapeutics NRIX: 4.1%

- Natera Inc NTRA: 3.8%

- 10x Genomics TXG: 3.8%

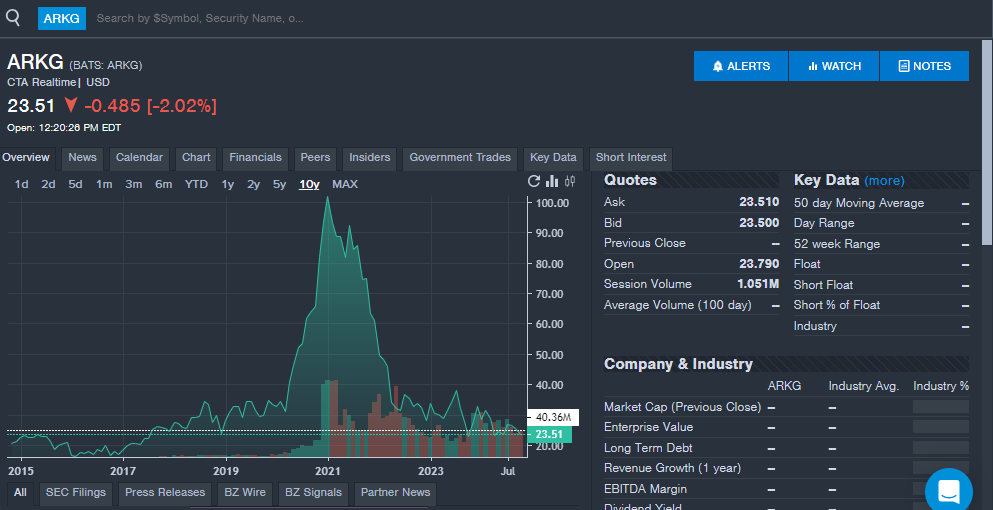

Since the fund’s inception, the ETF is up 38.9%. This return trails the current 10-year return of the SPDR S&P 500 ETF Trust.

Here’s a look at how the returns of ARKG stack up against SPY over time.

| Average Annual Returns | ARKG | SPY |

| 1-Year | -7.9% | +36.2% |

| 3-Year | -29.9% | +11.8% |

| 5-Year | -1.9% | +15.8% |

| Since ARKG inception 10/31/14 | +3.3% | +13.2% |

Here is the 10-year chart of ARKG.

Why It’s Important: The charts above show that ARKK and ARKG both experiences several years of strong growth and returns for investors, but have underperformed the broader S&P 500 market index in recent years.

The ETFs were once among the most talked about funds, and the company’s daily trading activity often moved stocks higher, given Wood’s outperformance years ago.

While the S&P 500 ETF rebalances quarterly, the actively managed funds complete trades almost every day. Often, the average cost of shares rises over time for stocks that are going up, potentially hurting the gains.

Ark Funds typically invests in companies that it believes will have strong growth over the next five to ten years, which means the funds’ returns can sometimes take years to pay off.

Wood has been early to many themes, including buying shares of NVIDIA Corporation for around $5 in 2014, before the most recent stock split. The fund later sold out of its position in late 2022 and early 2023 and missed out on huge gains over the last nearly two years.

The fund manager was also early in the Tesla growth story, predicting a $4,000 price target for the electric vehicle company back in February 2018. While Wood was laughed at for the price prediction at the time, the stock would hit the target on a split-adjusted basis in January 2021.

Getting the Tesla prediction right helped elevate Wood’s status as a fund manager and led to increased interest in the Ark Funds ETFs.

Although interest in Ark Funds ETFs may have cooled in recent years, many investors still recall their impact and continue to track daily trading activity, watching closely which stocks Wood selects to hold for the next five to 10 years.

Read Next:

Image courtesy of Ark Invest and Shutterstock.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.