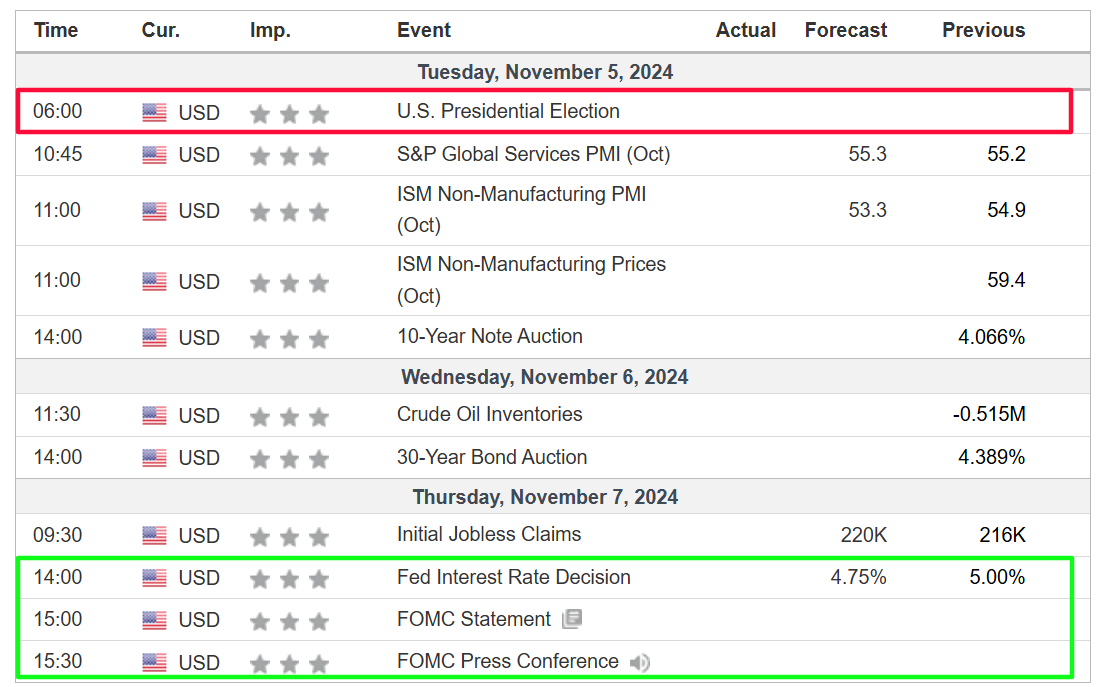

• U.S. presidential election, Fed FOMC meeting, and more earnings will be in focus this week.

• Arista Networks is a buy with a strong beat-and-raise quarter expected.

• CVS Health is a sell with declining profitability and weak guidance on deck.

Source: Investing.com

The important week ahead is expected to be a volatile one given the sizable market-moving events taking place.

Firstly, Tuesday is election day, with the presidential race between Kamala Harris and Donald Trump too close to call. Voters also will decide hundreds of congressional and state elections.

The Fed’s November meeting then kicks off the following day. An announcement is due Thursday. With a 25-basis point rate cut seen as nearly certain, investors will scrutinize comments from Fed Chair Jerome Powell amid speculation of a December pause.

Source: Investing.com

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, November 4 – Friday, November 8.

Stock To Buy: Arista Networks

Arista Networks stands out as a top buy this week, as the networking infrastructure company will likely deliver another quarter of strong sales growth and provide upbeat guidance.

The tech company has benefited immensely from booming demand in data centers as cloud providers and AI-driven companies invest heavily in infrastructure upgrades.

Arista is scheduled to deliver its third-quarter earnings update after the U.S. market close on Thursday at 4:05PM ET.

Market participants expect a sizable swing in ANET stock after the print drops, according to the options market, with a possible implied move of 6.2% in either direction. Shares gapped up 8.1% after its last earnings report in late July.

Source: InvestingPro

With 19 upward revisions to its profit forecasts over the last 90 days, Arista is projected to maintain its growth trajectory and deliver optimistic guidance for the quarters ahead.

Arista Networks is seen earning $2.08 per share, improving 13.6% from EPS of $1.83 in the year-ago period. Revenue is forecast to increase 15.9% year-over-year to $1.75 billion amid robust demand for cloud infrastructure from large corporations, small businesses, government agencies and educational institutions.

But as is usually the case, it is more about forward guidance than results. Taking that into account, I reckon Arista CEO Jayshree Ullal will provide a solid outlook for the current quarter as the company continues to benefit from growing demand for its suite of cloud-based networking products and data center solutions.

The company has been successful in leveraging AI to enhance its networking offerings, with a particular emphasis on automation and optimization.

Source: Investing.com

ANET stock ended at $394.17 on Friday, not far from a recent record high of $422.73 reached on October 14. Shares have gained 64.7% year-to-date. At current levels, the Santa Clara, California-based tech company has a market cap of $123.8 billion.

As InvestingPro points out, Arista Networks sports a near perfect ‘Financial Health’ score thanks to its compelling earnings and sales growth trajectory, robust cash flow, and pristine balance sheet.

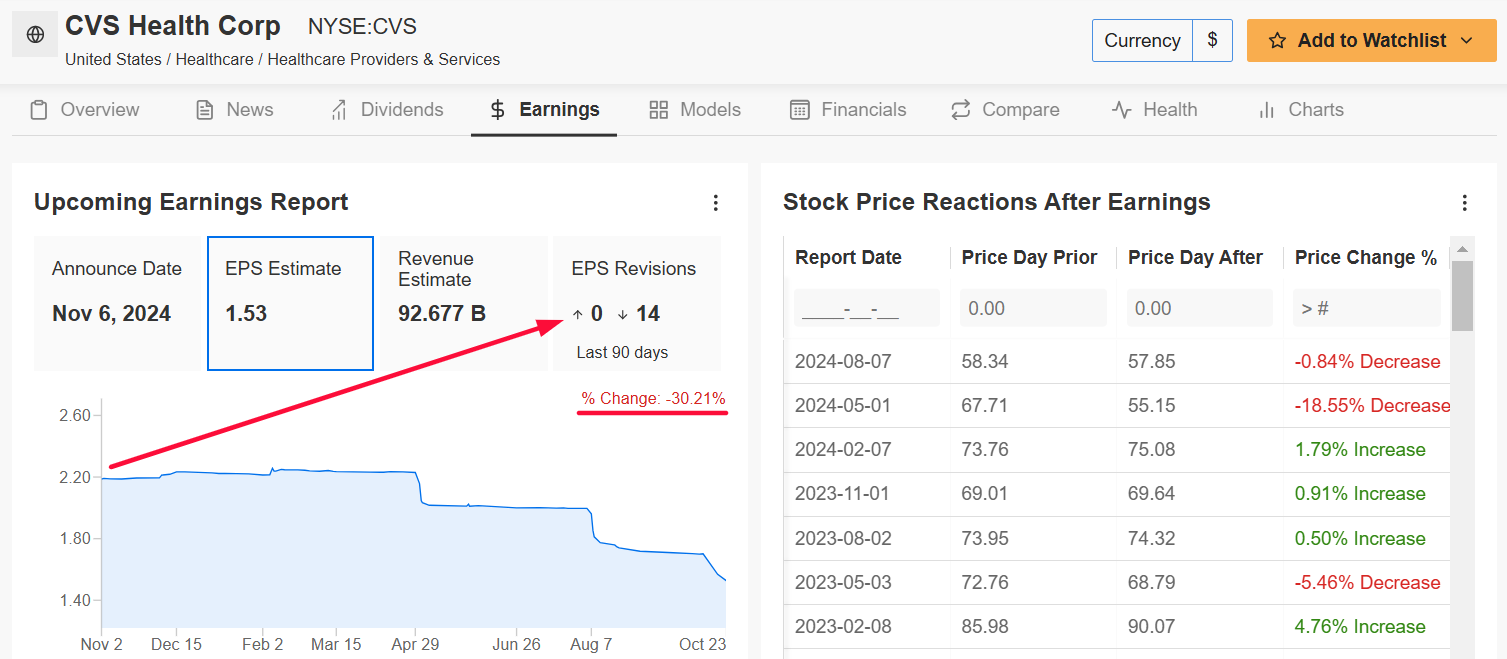

Stock to Sell: CVS Health

CVS Health, on the other hand, is facing significant hurdles. Challenges in its retail and healthcare segments, coupled with rising operating costs, have hampered CVS’s profitability, raising concerns about its future outlook.

The retail and healthcare giant, set to release its Q3 earnings before the market opens on Wednesday at 6:30AM ET, has recently seen analyst sentiment turn bearish.

All 14 analysts surveyed by InvestingPro have lowered their profit expectations, projecting a 30% drop from initial estimates.

According to the options market, traders are pricing in a swing of approximately 7% in either direction for CVS stock following the print.

Source: InvestingPro

Wall Street sees the drugstore chain operator and pharmacy services provider earning $1.53 per share, plunging 30.8% compared to EPS of $2.21 in the year-ago period, amid higher cost pressures and declining operating margins. Meanwhile, revenue is forecast to tick up 3.1% year-over-year to $92.7 billion.

Adding to its woes, CVS is expected to provide soft guidance as it struggles to adapt to the rise in popularity of online pharmacy and direct to consumer platforms.

Given the challenges it faces in a competitive market and the sharp downward revisions in earnings forecasts, CVS may be a stock to approach cautiously this week.

Source: Investing.com

Shares ended Friday’s session at $55.81, their lowest closing price since May 29. CVS is down -29.3% in 2024. At its current valuation, the Woonsocket, Rhode Island-based healthcare specialist has a market cap of $70.2 billion.

It is worth mentioning that CVS stock is overvalued heading into its earnings report according to the AI-backed valuation models in InvestingPro, and could see a potential downside of -8.3% to a ‘Fair Value’ price of $51.19 per share.

• ProPicks AI: AI-selected stock winners with proven track record.

• InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

• Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

• Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.