Alibaba Group Holding Limited BABA is scheduled to report second-quarter fiscal 2025 results on Nov. 15.

For the fiscal second quarter, the Zacks Consensus Estimate for revenues is pegged at $33.47 billion, suggesting an 8.63% rise from the year-ago quarter’s reported figure.

The Zacks Consensus Estimate for earnings is pinned at $2.26 per share, indicating an increase of 5.61% from the prior-year quarter’s reported figure. The figure has moved north by 8.1% over the past 30 days.

Image Source: Zacks Investment Research

Alibaba has a mixed earnings surprise history. In the last reported quarter, the company delivered an earnings surprise of 2.73%. Its earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed the same once, the average surprise being 3.71%.

Alibaba Group Holding Limited Price and EPS Surprise

Alibaba Group Holding Limited price-eps-surprise | Alibaba Group Holding Limited Quote

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Alibaba this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

BABA has an Earnings ESP of 0.00% and sports a Zacks Rank #1 at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors to Focus on Ahead of Q2 Results

Alibaba’s International Digital Commerce Group appears poised for strong performance, driven by robust momentum across its key platforms. The company’s overseas e-commerce operations, particularly AliExpress, Trendyol and Alibaba.com, are likely to have benefited from strategic market investments and enhanced brand recognition.

The integration of AI technology has significantly improved the user experience through advanced features like cross-platform listings, multilingual search capabilities and personalized recommendations. This technological advancement, coupled with the AI Business Assistant, has strengthened Alibaba’s relationships with SMEs globally.

The company’s B2B cross-border trade initiatives show promising developments. The Alibaba Guaranteed platform has gained traction by simplifying international trade operations for SMEs through improved supply-chain reliability. Additionally, the introduction of Logistics Marketplace, an affordable logistics solution targeting U.S.-based SMEs, is likely to have contributed positively to the company’s international commerce metrics.

In the domestic market, Alibaba’s China commerce retail business, anchored by Taobao and Tmall Group, demonstrates resilience through strategic investments in price competitiveness and enhanced user experience. A notable development is the “Star Cube Plan,” a partnership between Taobao and Tmall Group with Douyin, leveraging Alimama and Xingtu for digital marketing. This initiative, aimed at converting Douyin users into active customers, is expected to have boosted platform traffic, although persistent macroeconomic challenges in China might have partially offset these gains.

The company’s logistics and cloud segments present mixed indicators. The Cainiao Smart Logistics Network benefits from strong domestic consumer logistics services and cross-border fulfillment solutions. While Alibaba Cloud maintains momentum in key sectors like financial services, education and automotive industries, its aggressive international pricing strategy, including up to 59% price reductions across five major categories for customers outside mainland China, might have impacted revenues despite potentially expanding market share.

However, intense competition from global cloud leaders like Amazon AMZN, Microsoft and Google continues to challenge Alibaba’s cloud expansion efforts.

Price Performance & Valuation

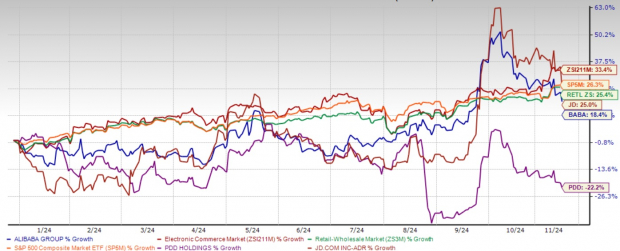

Alibaba’s shares have gained 18.4% on a year-to-date basis, underperforming the industry, the Zacks Retail-Wholesale sector and the S&P 500 index’s return of 33.4%, 25.4% and 26.3%, respectively.

Alibaba has underperformed its peer JD.com JD, which returned 25% while outperforming PDD Holdings PDD, which lost 22.2% year to date, respectively.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

It is also important to consider whether the stock’s current valuation accurately reflects the company’s long-term growth potential and ability to navigate the competitive landscape. Currently, BABA is trading at a discount with a forward 12-month P/S of 1.49X compared with the industry’s 1.8X.

BABA’s P/S F12M Ratio Depicts Discounted Valuation

Image Source: Zacks Investment Research

Investment Thesis

Alibaba presents a compelling investment opportunity ahead of its second-quarter fiscal 2025 earnings, underpinned by robust international commerce expansion through AliExpress and Trendyol, enhanced by AI integration and strengthened SME relationships. The company’s domestic e-commerce business benefits from strategic partnerships, notably the Douyin collaboration, while its logistics segment shows promising growth through Cainiao’s expanding services. Alibaba Cloud’s aggressive pricing strategy and strong sector-specific momentum, particularly in the financial services and automotive industries, position it for potential market share gains. Despite macroeconomic headwinds in China, the company’s diversified revenue streams and strategic initiatives across multiple segments support a positive growth trajectory.

Conclusion

Ahead of Alibaba’s second-quarter fiscal 2025 earnings report, investors should consider establishing positions given the company’s compelling growth catalysts across international commerce, cloud services and logistics segments. The strategic integration of AI technology, expanding global footprint through platforms like AliExpress and Trendyol, and aggressive cloud pricing initiatives demonstrate Alibaba’s commitment to market share expansion and revenue diversification. Despite Chinese macroeconomic challenges, the company’s robust ecosystem development, strategic partnerships, including the Douyin collaboration, and focus on SME relationships position it favorably for sustained growth, making current price levels an attractive entry point for long-term investors.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

PDD Holdings Inc. Sponsored ADR (PDD) : Free Stock Analysis Report