Earnings season is slowly winding down, with just a small chunk of S&P 500 companies yet to reveal their quarterly results. The period has remained positive, with the growth trend expected to continue in the coming periods.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

And throughout the period, several popular companies, including Advanced Micro Devices AMD and Tesla TSLA – enjoyed a profitability boost, seeing their margins improve on a year-over-year basis. Let’s take a closer look at the releases.

AMD Forecasts Record Annual Sales

Concerning headline figures in the release, AMD posted a 1.1% beat relative to the Zacks Consensus EPS estimate and reported sales 1.5% ahead of expectations, reflecting growth rates of 31% and 17%, respectively.

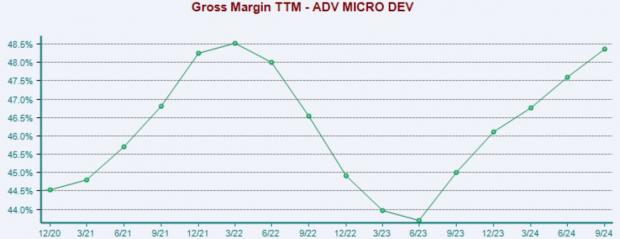

Margin expansion aided the results in a big way, with a gross margin of 54% well above the 47% mark in the year-ago period. Margin expansion has been present for several periods, as shown below.

Below is a chart illustrating the company’s margins on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Notably, the company is now on track to deliver record annual revenue for 2024 thanks to significant growth among its Data Center and Client segments. In fact, Data Center revenue of $3.5 billion reflected a quarterly record, up an astonishing 122% on a year-over-year stack.

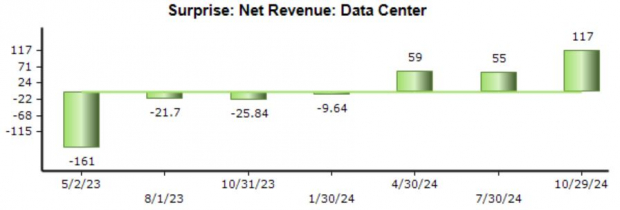

AMD’s data center results have regularly exceeded our consensus expectations in recent quarters, as we can see below.

Image Source: Zacks Investment Research

Tesla’s Margins Recover

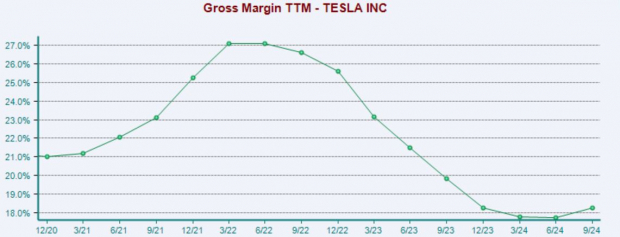

While the company’s EV numbers are important, the real highlight of the Tesla release was margin expansion, with the company’s gross margin expanding nicely to 19.8% vs. a 17.9% print in the same period last year. As shown below, margins have finally begun recovering.

Please note that the chart’s values are calculated on a trailing twelve-month basis.

Image Source: Zacks Investment Research

While margins remain well below highs set in 2022, the recent uptick is undoubtedly encouraging, further underpinned by the fact that Tesla reported its lowest-ever level of cost of goods sold (COGS) per vehicle throughout the period.

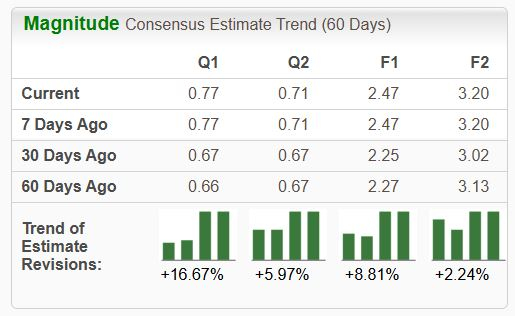

The favorable commentary surrounding profitability and results vaulted the stock into the highly-coveted Zacks Rank #1 (Strong Buy), with analysts revising their EPS expectations across the board following the release.

Image Source: Zacks Investment Research

Bottom Line

Margin expansion is a bullish signal, allowing a company to enjoy higher profits. Companies generally see margin expansion through successful cost-cutting measures or from a favorable economic operating environment, just as we’ve seen in the cases above with Advanced Micro Devices AMD and Tesla TSLA.

Must-See: Solar Stocks Poised to Skyrocket

The solar industry stands to bounce back as tech companies and the economy transition away from fossil fuels to power the AI boom.

Trillions of dollars will be invested in clean energy over the coming years – and analysts predict solar will account for 80% of the renewable energy expansion. This creates an outsized opportunity to profit in the near-term and for years to come. But you have to pick the right stocks to get into.

Discover Zacks’ hottest solar stock recommendation FREE.

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report