All eyes will be glued on Nvidia NVDA this week with the chip giant set to release its third-quarter results on Wednesday, November 20.

Investors hope that strong Q3 results from Nvidia will reignite a broader rally. To that point, the tech leader had recently overtaken Apple AAPL for the largest market cap at over $3 billion.

Image Source: Zacks Investment Research

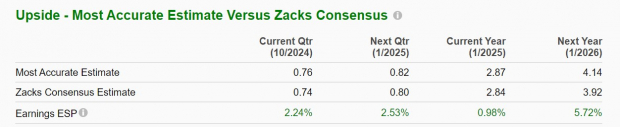

Nvidia’s Q3 Expectations

Optimistically, Nvidia’s Q3 sales are thought to have increased 82% to $33.1 billion versus $18.12 billion in the comparative quarter. On the bottom line, Q3 EPS is expected to soar 85% to $0.74 compared to $0.40 per share a year ago.

Even better, the Zacks ESP (Expected Surprise Prediction) indicates Nvidia could once again surpass earnings expectations with the Most Accurate Estimate having Q3 EPS pegged at $0.76 and 2% above the Zacks Consensus.

Image Source: Zacks Investment Research

Nvidia most recently beat earnings estimates by 6% in August with Q2 EPS at $0.68 compared to expectations of $0.64. Becoming the clear leader in chips that power artificial intelligence, Nvidia has exceeded earnings expectations for seven straight quarters posting an average EPS surprise of 12.7% in its last four quarterly reports.

Furthermore, Nvidia has surpassed top line estimates for 22 consecutive quarters posting an average sales surprise of 8.36% in the last four quarters.

Image Source: Zacks Investment Research

Tracking NVDA:

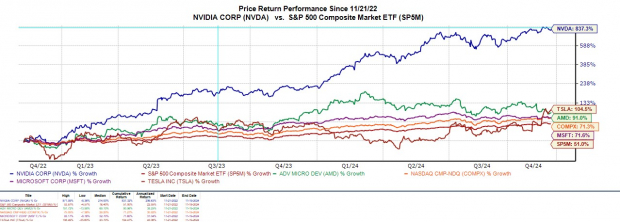

Price Performance

Year to date, Nvidia’s price performance has led its Magnificent Seven-themed tech peers with NVDA up nearly +200% to easily edge Meta Platforms META and Tesla TSLA at +57% and +38% respectively. This has also vastly outperformed its closest competitor AMD AMD which has seen its stock dip -6% this year.

Image Source: Zacks Investment Research

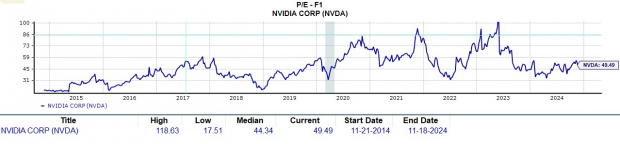

Valuation Comparison (P/E)

At current levels of around $144 a share, NVDA trades at 49.4X forward earnings which is a premium to the S&P 500’s 24.9X with AMD at 42X. However, NVDA has been in a league of its own in terms of price performance and does trade near its decade-long median of 44.3X and nicely beneath the high of 118.6X during this period.

Image Source: Zacks Investment Research

NVDA EPS Revisions

Perhaps the deciding factor on whether now is a good time to buy NVDA is the biggest indicator of more upside in a stock which is the trend of earnings estimate revisions. In this regard, EPS estimates for Nvidia are noticeably higher over the last 90 days and are slightly up in the last week for its current fiscal 2025 and FY26.

Based on Zacks estimates, Nvidia’s annual earnings are now slated to increase 118% in FY25 to $2.84 per share versus EPS of $1.30 in FY24. Plus, FY26 EPS is projected to expand another 38% to $3.92.

Image Source: Zacks Investment Research

Bottom Line

Nvidia’s stock does look poised for another leg higher if the company can reach or exceed its lofty Q3 expectations while offering favorable guidance. NVDA currently sports a Zacks Rank #1 (Strong Buy) considering the positive trend of earnings estimate revisions along with the Zacks ESP suggesting the semiconductor leader could surpass earnings expectations.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +23.7% per year. So be sure to give these hand picked 7 your immediate attention.

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report