Zacks Thematic Screens lets you dive into 30 dynamic investment themes shaping the future. Whether you’re interested in cutting-edge technology, renewable energy, or healthcare innovations, our themes help you invest in ideas that matter to you.

For those interested in viewing the Thematic lists, please click here >>> Thematic Screens – Zacks Investment Research.

Let’s take a closer look at the ‘Nuclear’ theme and analyze a few stocks that the screen returned, such as Constellation Energy CEG and Vistra VST.

Nuclear Overview

Nuclear energy stands at the cusp of the global push for a low-carbon, greener, and more resilient energy future.

This investment theme encapsulates companies engaged in uranium mining, nuclear reactor construction and maintenance, and the generation of electricity from nuclear sources, alongside firms providing essential technology and services to the nuclear industry.

CEG and Microsoft Team Up

Constellation Energy found itself in the spotlight following news earlier in the year that it’d be restarting a nuclear plant in a deal with mega-cap technology giant Microsoft. Microsoft will purchase power from the plant to meet its data center needs, a theme we’ve all become familiar with amid the AI frenzy.

Up 130% YTD, CEG shares have delivered a remarkable performance relative to the S&P 500’s 27% gain. The outlook for its current fiscal year remains constructive, with the $8.14 Zacks Consensus EPS estimate up 21% over the last year and suggesting 60% growth year-over-year.

Image Source: Zacks Investment Research

Vistra Upgrades Nuclear Capabilities

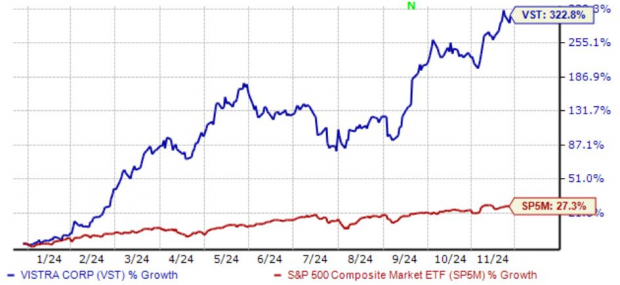

Vistra safely operates a reliable, efficient power generation fleet of natural gas, nuclear, coal, solar, and battery energy storage facilities. Shares have been scorching hot in 2024, gaining nearly 320% and widely outperforming.

Image Source: Zacks Investment Research

Vistra closed an acquisition of Energy Harbor earlier in 2024, which added more than 4,000 MW of nuclear generation to its portfolio alongside roughly one million retail customers. Further, the company also inked two new power purchase agreements with both Amazon and Microsoft, adding to its already favorable stance.

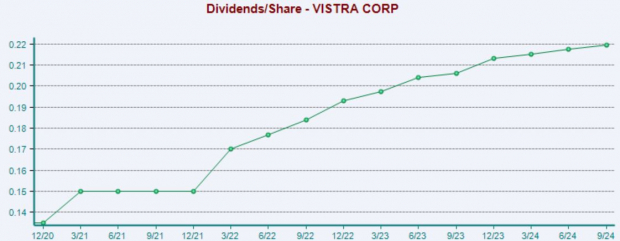

Shares could also attract income-focused investors, with its current 14% five-year annualized dividend growth rate reflective of a shareholder-friendly nature. Below is a chart illustrating the company’s quarterly payouts.

Image Source: Zacks Investment Research

Bottom Line

Thematic investing has emerged as a powerful way for investors to sync their portfolios with emerging trends. A mix of long-term and short-term themes is increasingly dictating which companies lead as economies expand and markets shift.

While stocks in each theme aren’t direct recommendations, they offer a solid starting point. Leverage the Zacks Rank and other metrics to identify the best stocks for your strategy. Each featured stock comes with a Zacks report, giving you the tools to analyze performance and potential.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Constellation Energy Corporation (CEG) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report