Artificial intelligence (AI) is Wall Street’s new obsession, with companies discussing the technology in a snowballing fashion and helping to keep market sentiment positive.

The robust quarterly results we’ve received from NVIDIA over the last year have added further fuel to the fire, with the company flexing the scorching-hot demand it’s been witnessing regarding its AI chips.

Still, outside of NVIDIA, there are several other stocks investors can tap into for AI exposure, including Vertiv VRT, Arista Networks ANET, and Comfort Systems USA FIX. For those interested in exposure to the technology, let’s take a closer look at each.

Vertiv

Vertiv provides services for data centers, communication networks, and commercial and industrial facilities with a portfolio of power, cooling, and IT infrastructure solutions and services.

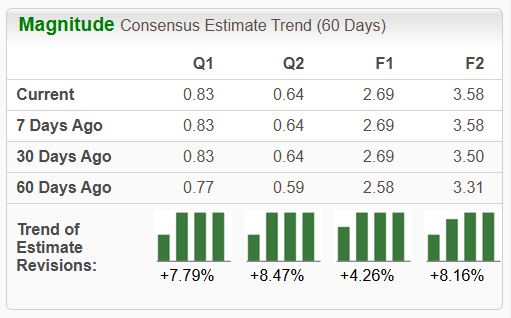

Analysts have taken their earnings expectations higher across all timeframes thanks to robust quarterly results, landing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Scorching-hot demand for the company’s solutions has allowed it to post the above-mentioned robust quarterly results, with Vertiv exceeding the Zacks Consensus EPS estimate by an average of 10% across its last four releases. The company’s top line has expanded nicely amid the frenzy, with VRT posting double-digit percentage year-over-year revenue growth in seven consecutive releases.

Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Arista Networks

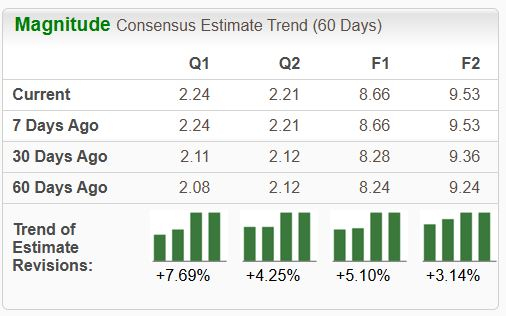

Arista Networks is an industry leader in data-driven, client-to-cloud networking for large data centers, campus, and routing environments. Similar to VRT, analysts have raised their earnings expectations across the board.

Image Source: Zacks Investment Research

Jayshree Ullal, CEO, on the company’s latest set of quarterly results:

‘Arista remains at the forefront of next generation centers of data across client-to-cloud and AI focused locations.’

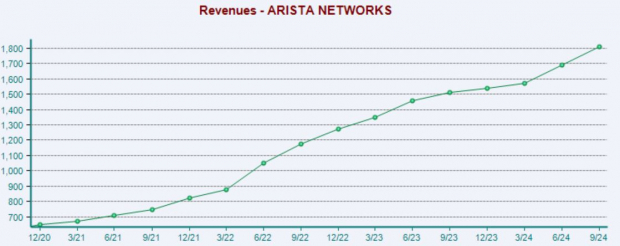

The growing AI landscape has benefited the company’s top line in a big way, with the company posting sequential revenue growth in each of its last ten periods. Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment Research

Comfort Systems USA

Comfort Systems USA provides comprehensive heating, ventilation, and air conditioning installation, maintenance, repair, and replacement services. The company provides chillers, cooling towers, and other critical components found within data centers.

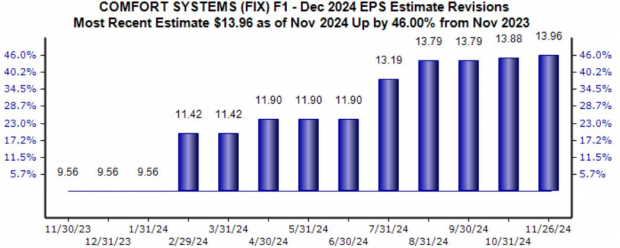

The stock boasts a Zacks Rank #1 (Strong Buy), with the revisions trend for its current fiscal year considerably bullish, up 46% over the last year and suggesting 60% year-over-year growth.

Image Source: Zacks Investment Research

Like those above, better-than-expected quarterly results have regularly fueled shares over the last year, gaining a remarkable 160% and widely outperforming relative to the S&P 500. The company remains optimistic about its growth trajectory, underpinned by strong backlog growth

Bottom Line

The AI frenzy continues to dominate market headlines, with companies continuing to speak on the technology in a snowballing fashion.

It isn’t just beloved NVIDIA enjoying the tailwinds, as Vertiv VRT, Arista Networks ANET, and Comfort Systems USA FIX have also seen the same.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.1% per year. So be sure to give these hand picked 7 your immediate attention.

Comfort Systems USA, Inc. (FIX) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report