Each week, Benzinga’s Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Read Also: EXCLUSIVE: Top 20 Most-Searched Tickers On Benzinga Pro In October 2024 — Where Do Tesla, Nvidia, Apple, DJT Stock Rank?

Here’s a look at the Benzinga Stock Whisper Index for the week ending Nov. 29:

Simon Property Group SPG: The large real estate investment trust saw increased interest from readers during the week. This trend could point to optimism ahead of the 2024 holiday shopping season, which is expected to see records set for Black Friday.

With Thanksgiving falling later than normal, there are only 27 days from the day before Thanksgiving to Christmas Day. While this means fewer shopping weekends for retailers and malls, it could see a boost in traffic during the four main shopping holidays.

Analysts have been raising their price targets on the stock ahead of the holiday shopping season. Stifel raised their price target from $164.50 to $175.50 and Scotiabank raised their price target from $169 to $185. Recent guidance from the company was ahead of analyst estimates for the full fiscal year according to data from Benzinga Pro.

The chart below from Benzinga Pro shows the five-day trading range of Simon Property Group. The stock is up 28% year-to-date.

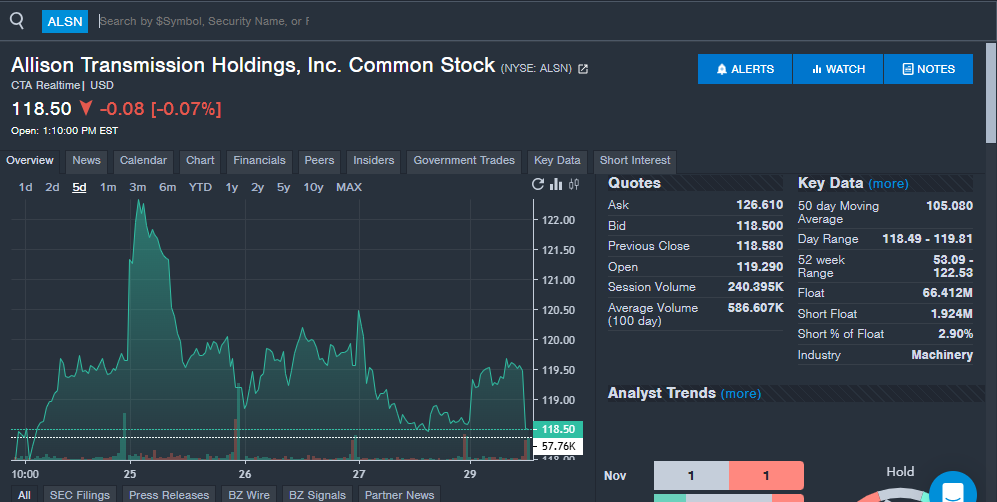

Allison Transmission Holdings ALSN: The automatic transmissions company saw increased interest from readers during the week. The company makes products mainly for the commercial vehicle sector, which could benefit from an industrial boom under President-elect Donald Trump.

The company’s recent quarterly financial results continued a streak of beating analyst estimates. Allison Transmission has beaten earnings per share estimates in nine straight quarters and beat revenue estimates in four straight quarters and eight of the last nine quarters overall.

Citigroup recently maintained a Neutral rating on the stock and raised the price target from $115 to $125. The stock was up slightly over the past week and shares are up over 100% year-to-date in 2024.

Constellation Energy Corp CEG: The energy solutions company has appeared on multiple Stock Whisper Index lists throughout the year and makes it return thanks to increased interest in nuclear power generation.

The company is one of several energy companies betting on future nuclear energy that could benefit from a boom in big companies like Alphabet (Google), Amazon and Microsoft emphasizing nuclear power.

Goldman Sachs recently said the U.S. could be in the “early stages of nuclear renaissance.” Constellation Energy was named in the analyst note, with the company’s Three Mile Island plant being brought back online highlighted as the start of other similar moves.

“Recognition of accelerated power demand growth from utilities is leading to greater willingness to consider new large-scale reactors,” Goldman Sachs said.

The company recently reported third-quarter financial results that saw revenue and earnings per share come in ahead of analyst estimates. Constellation Energy also raised full-year earnings per share estimates.

Constellation shares were up 2.2% over the past five days and shares are up over 120% year-to-date in 2024.

Ufp Industries Inc UFPI: The wooden pallet manufacturer and industrial packaging solutions company saw increased interest from readers during the week.

The company, which also supplies lumber to the manufacturer housing sector, recently announced the opening of a new 10,000-square-foot packaging design and development center at its Georgia facility. Ufp Industries said the new design center will offer new testing services to help its customers.

The stock could be one to watch with the new center potentially landing bigger deals and keeping customers. The company’s ties to the manufactured home sector could also be on watch with the potential for the housing sector to be a theme going forward.

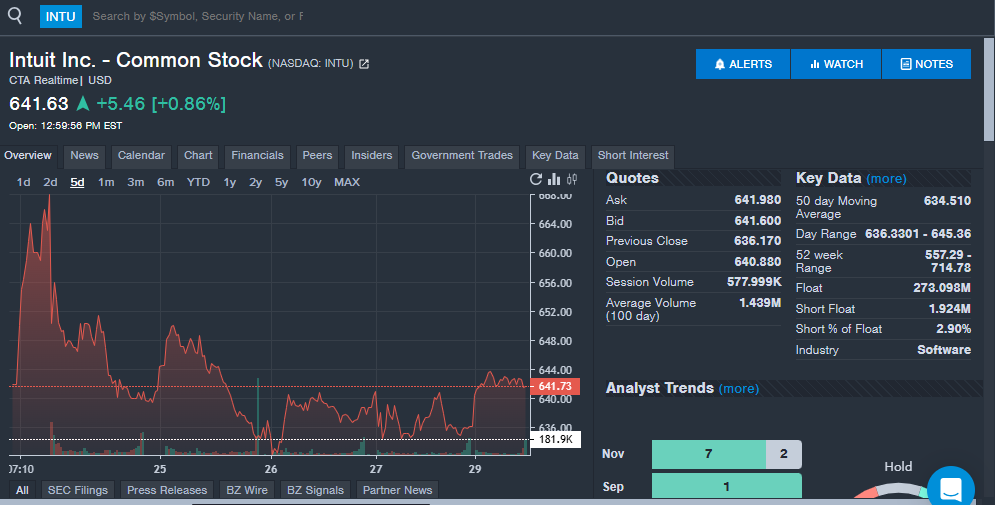

Intuit Inc INTU: The company, which owns TurboTax, QuickBooks and other financial products, saw increased interest from readers over the week.

Intuit recently reported first-quarter financial results, which saw revenue and earnings per share beat analyst estimates.

While the report beat estimates, investors are becoming concerned about how the company’s tax business could be impacted by the new White House administration. The Department of Government Efficiency, led by Vivek Ramaswamy and Elon Musk, is looking to create a mobile app for Americans to file their taxes. The move, which could see more Americans file their taxes directly, could cut down on dependance for tax software like TurboTax. Intuit shares could fall further as more details of the plan come out.

Intuit stock was down on the week and shares are up 6% year-to-date in 2024.

Stay tuned for next week’s report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.