Super Micro Computer Inc. SMCI announced the completion of an independent review on Monday. The review, conducted by an Independent Special Committee, found no “evidence of misconduct” by the company’s management or board.

What Happened: The review was initiated in response to allegations of misconduct. Following the report, the company shares popped over 30% on Monday and gained 7% during Tuesday’s premarket session.

Despite acknowledging “modest lapses,” JPMorgan analysts have highlighted two crucial aspects to watch in the aftermath of the review. The first is whether Super Micro’s newly appointed independent auditors, BDO, will accept the committee’s findings.

The server manufacturer had brought BDO on board in mid-November due to consistent delays in submitting its 2024 year-end report to the SEC, Investing.com reported.

See Also: Tesla China Sees Robust Demand In Q4, With Registrations Up 14.2% YoY So Far: Expert Says EV Giant On Track For ‘Best Quarter Ever’

The second aspect emphasized by JPMorgan is whether Nasdaq will grant Super Micro’s request for an extension to regain compliance with listing rules. The company had previously announced in November its plan to file its 2024 financials.

The independent committee’s recommendations included replacing the Chief Financial Officer, appointing a Chief Accounting Officer and a Compliance Officer, and bolstering its legal department and compliance-related training.

Why It Matters: Despite a substantial dip from their annual highs due to repeated delays in filing annual reports and allegations of accounting malpractice by short-seller Hindenburg Research, Super Micro shares have seen an increase of about 47% in 2024.

The company, a provider of servers for advanced AI programs, has reaped the benefits of its exposure to the rapidly expanding artificial industry.

See Also: Charles Schwab, Goldman Sachs Boosts MARA Stake As Stock Rallies 30% In Past 6 Months

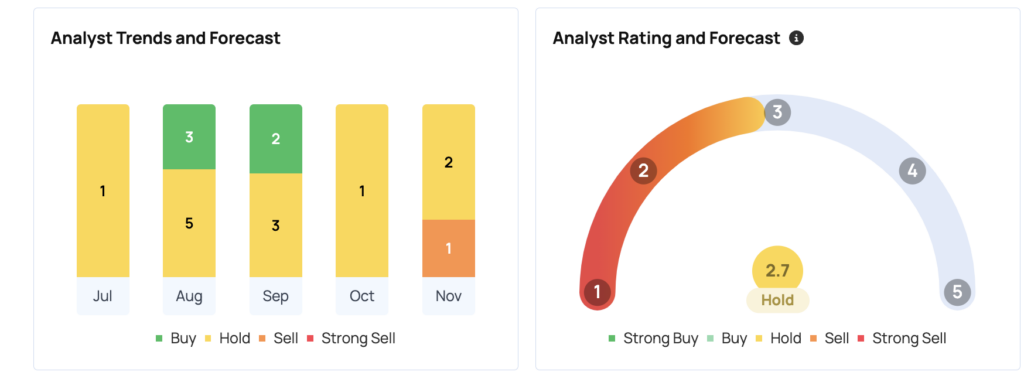

According to Benzinga Pro, based on an average price target of $27.67 between Goldman Sachs, JP Morgan, and Wedbush, there’s an implied 34% downside for Super Micro Computer. The consensus rating forecast on Benzinga, suggests a score of 2.7 out of 5 points, which implies holding the stock.

Read Next:

Image via Shutterstock

Market News and Data brought to you by Benzinga APIs