Hovering near fresh 52-week highs, several financial sector stocks are appealing among the Zacks Rank #1 (Strong Buy) list.

To that point, the proponents of a more stable inflationary environment has helped support the continued post-pandemic recovery of prominent banks and other financial firms. Fiscal policies for most of the major global economies have been aimed at inflation control including interest rate cuts that are supportive of economic growth.

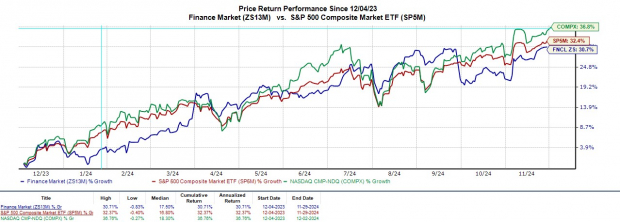

Considering these factors, it’s noteworthy that the Zacks Finance Market is up over +20% year-to-date which is near the stellar performances of the S&P 500 and Nasdaq.

Benefiting from positive earnings estimate revisions, these highly ranked finance stocks should have more upside and have generous dividend yields that are over 3%.

Image Source: Zacks Investment Research

Janus Henderson Group – JHG

YTD Performance: +48%

With its stock up nearly +50% in 2024, we’ll start with financial investment management firm Janus Henderson Group JHG. Seeing expansive top and bottom line growth, Janus Henderson’s assets under management (AUM) most recently increased 6% quarter over quarter and 24% year over year to $382.3 billion at the end of Q3 2024.

Janus Henderson’s growing popularity comes as its AUMs have been able to outperform many of its industry’s relevant benchmarks with the company seeing net inflows of nearly half a billion dollars during Q3. Offering a 3.45% annual dividend yield, earnings estimates are nicely up for Janus Henderson in the last 60 days. Plus, JHG still trades under $50 and at a very reasonable 13.2X forward earnings multiple with double-digit EPS growth now expected in fiscal 2024 and FY25.

Image Source: Zacks Investment Research

State Street – STT

YTD Performance: +27%

Incorporated in the 1800’s, Boston-based State Street Corporation STT doesn’t need much of an introduction. Operating through its principal subsidiary, State Street Bank, the company has stayed competitive in the investment baking landscape as well.

Rivaling other renowned financial firms such as BlackRock BLK, State Street’s valuation may appeal to investors outside of its consistency and longevity. Trading under $100, State Street’s stock is at an 11.7X forward earnings multiple compared to BlackRock shares at over $1,000 and 23.6X.

Like BlackRock, State Street’s expansion remains compelling and both have recently hit 52-week highs. That said, STT lands on the list thanks to its more attractive valuation and 3.09% annual dividend which tops BLK at 2%. Notably, State Street’s FY24 and FY25 EPS estimates have risen 3% and 4% in the last 60 days respectively.

Image Source: Zacks Investment Research

United Overseas Bank – UOVEY

YTD Performance: +26%

As the leading bank in Singapore, United Overseas Bank UOVEY is worthy of consideration. Although Singapore may not be among the elite economies, the country’s fiscal policies are heavily influenced by global markets.

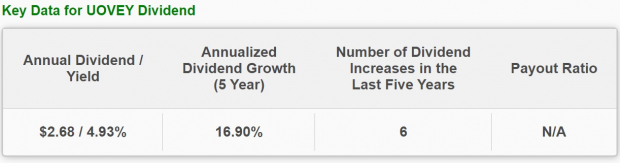

Mirroring the Federal Reserve’s decision to cut interest rates in September, lower borrowing costs are expected to provide a significant boost to Singapore’s economy. Correlating with such, EPS estimates are pleasantly higher for United Overseas in the last two months with annual earnings projected to expand 8% this year and forecasted to increase another 2% in FY25 to $5.47 per share. Plus, UOVEY trades at 10.1X forward earnings with a 4.93% annual dividend (paid semi-annually) that certainly appeals to income seekers.

Image Source: Zacks Investment Research

Bottom Line

Hitting new 52 week-peaks in November, higher highs could be in store for these highly ranked finance stocks. Now appears to be a good time to buy based on their attractive P/E valuations and the trend of positive earnings estimate revisions.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

State Street Corporation (STT) : Free Stock Analysis Report

United Overseas Bank Ltd. (UOVEY) : Free Stock Analysis Report

Janus Henderson Group plc (JHG) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report