On Friday, Booz Allen Hamilton Holding Corp BAH and Palantir Technologies Inc PLTR collaborated to accelerate defense mission innovation.

The partnership focuses on driving transformational information infrastructure modernization and accelerating integrated warfighting operations with coalition partners.

The partnership builds on multiple previous strategic collaborations between the companies to support signature programs for the U.S. government.

Also Read: AI Startup iGenius Taps Nvidia For AI Data Center In Italy Leveraging Blackwell Chips

It has additional potential for co-creation, IP development, and teaming across various critical missions.

Meanwhile, Donald Trump’s proposed Department of Government Efficiency (DOGE), which Elon Musk and Vivek Ramaswamy would lead, raises concerns about the future of U.S. defense contractors and government IT firms.

Trump’s DOGE could significantly impact the defense budget as part of his broader plan to restructure federal agencies and reduce wasteful spending.

Trump has long emphasized his support for a stronger U.S. military. Yet, his broader push for government efficiency could mean tough decisions for defense spending, which currently accounts for 13% of the federal budget or about $877 billion in 2023.

The risk for defense contractors is heightened, as Trump’s focus on reducing government waste may pressure the defense sector, especially since defense spending is currently at an all-time high.

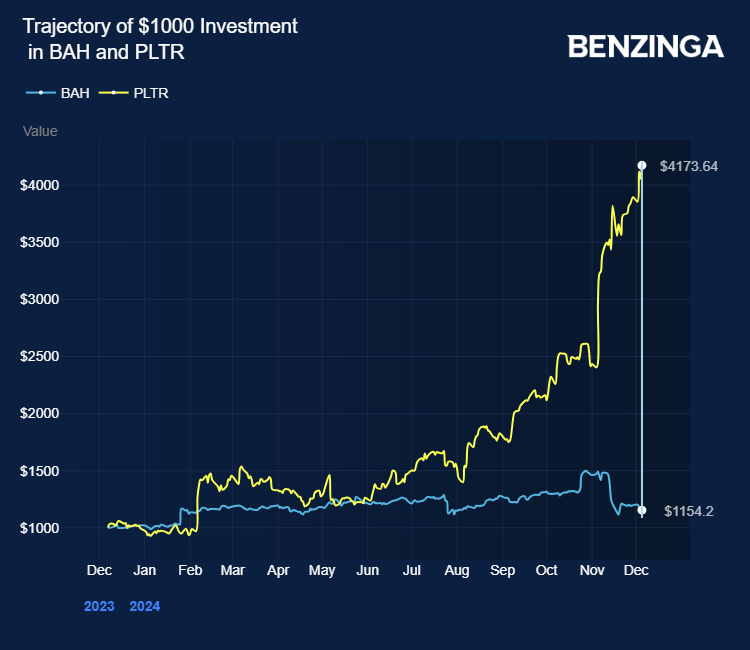

According to Goldman Sachs analyst Noah Poponak, it was nearing the peak of this spending cycle, making it difficult for defense companies to see further growth. Booz Allen Hamilton Holding stock gained 12% year-to-date.

Wedbush’s Dan Ives sees Palantir as a key leader in the AI transformation of the enterprise software industry. He notes the company’s strong position following its surge in stock price after receiving FedRAMP High Authorization.

He views the AI revolution as a broad trend affecting multiple sectors, including software, cybersecurity, and storage. Looking ahead to 2025, Ives expects Palantir to lead this transformation. Palantir Technologies stock surged over 333% year-to-date.

Price Actions: At the last check on Friday, BAH stock was up 1.84% at $145.33. PLTR is up 5.96%.

Also Read:

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs