In 2025, quantum computing is set to be the next big thing, igniting enthusiasm on Reddit and various other social media platforms. Notably, a trio of quantum computing stocks — D-Wave Quantum Inc. QBTS, Rigetti Computing, Inc. RGTI and IonQ, Inc. IONQ — have seen mammoth gains in the past three months. Let’s see how investors should bet on these three companies –

Quantum Computing – A Growing Market

According to marketsandmarkets, the global quantum computing market is currently valued at $1.3 billion and is expected to reach $5.3 billion by 2029 at a CAGR of 32.7%.

The growing acceptance and investment in quantum computing technology are driving market growth. After all, quantum computers have an edge over the traditional ones by leveraging quantum mechanics to solve problems more rapidly and efficiently.

McKinsey expects that quantum computing, presently in its early stages, will contribute $1.3 trillion to the economy by 2035. Quantum computing is anticipated to grow mostly due to its applications in material science and pharmaceutical enhancements. Quantum computers are also crucial for training artificial intelligence (AI) algorithms.

Companies use quantum computing applications such as quantum machine learning and optimization primarily in financial services including derivative pricing and portfolio management. Moreover, technological advancements in quantum computing are expected to offer further growth opportunities to players in this field over the next year and beyond.

Quantum Computing Stocks Are Scaling Upward

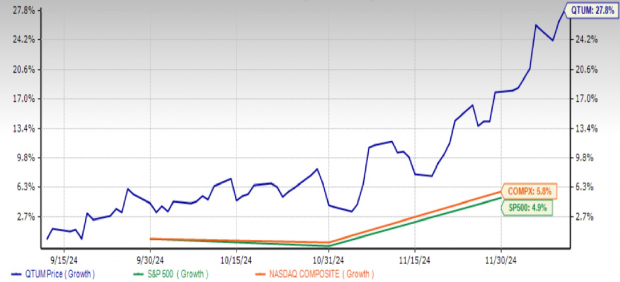

Quantum computing stocks have already gained momentum in the past three months, with the Defiance Quantum ETF QTUM soaring 27.8% in the said period, easily beating the broader S&P 500 and the tech-heavy Nasdaq Composite’s gains of 4.9% and 5.8%, respectively.

Image Source: Zacks Investment Research

Quantum computing stocks are rising due to a potential breakthrough by Alphabet Inc.’s GOOGL AI division in the field of quantum computing which could lead to a market-ready product.

Amazon.com, Inc.’s AMZN latest Quantum Embark program has already bolstered confidence among investors in the quantum computing space. With AWS’ quantum computing service, customers can minimize technology risks by accessing various quantum hardware on a pay-as-you-go basis.

2 Quantum Computing Stocks to Watch, 1 to Shun

It’s quite obvious that investors would like to make the most of the growing quantum computing trend. However, since quantum computing is a complex topic and nobody is quite sure about its long-term impact, placing bets on stocks from this space is challenging. Therefore, we have highlighted two stocks that deserve special attention and one you should avoid at any cost –

The two quantum computing stocks to watch closely are D-Wave and Rigetti Computing. D-Wave’s quantum annealing systems excel at optimizing various real-world applications like drug discovery, logistics, network performance and resource apportionment.

NTT DOCOMO, the largest mobile operator in Japan, plans to use D-Wave’s technology to reduce network congestion and lower equipment expenses. Several investment firms have also acknowledged D-Wave’s progress in the second half of this year as the company increased its expenditures on research and development (R&D). The company’s expected earnings growth for the current and next year is 31.7% and 7.3%, respectively.

Rigetti Computing, on the other hand, is believed to be the NVIDIA Corporation NVDA of quantum computing. This is because the company focuses on the infrastructure side by manufacturing quantum computers and their essential hardware.

Rigetti Computing’s Quantum Cloud Services platform aimed at providing clients remote access to quantum processors through the cloud should result in huge cost savings and a better customer experience.

Rigetti Computing’s initiatives to develop new chip methodologies also bode well in the long run. RGTI, anyhow, has a strong cash position, a prerequisite for R&D. The company’s expected earnings growth for the current and next year is 31.7% and 7.3%, respectively.

However, one should avoid investing in IonQ, a quantum computing stock. Even though the company is solving issues with quantum computers and aims to expand by providing services to AWS and Google Cloud, its current valuations are high and require caution.

IonQ’s market capitalization exceeds $6 billion, leading to a high price-to-sales ratio of 170. This makes it hard for the company to generate returns for its stakeholders. The company’s expected earnings growth for the current and next year is a negative 10.3% and 33.7%, respectively.

D-Wave and Rigetti Computing have a Zacks Rank #3 (Hold), whereas IonQ has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2025

Want to be tipped off early to our 10 top picks for the entirety of 2025?

History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2025. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Defiance Quantum ETF (QTUM): ETF Research Reports

IonQ, Inc. (IONQ) : Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI) : Free Stock Analysis Report

D-Wave Quantum Inc. (QBTS) : Free Stock Analysis Report