Google Company Overview

Zacks Rank #3 (Hold) stock Alphabet (GOOGL), best known for its search engine dominance (owns 94% of theglobal market, is one of the most innovative companies on Earth. However, the stock has been a mediocre performer over the past few years due to its massive market cap (it’s hard to move the needle on the $2.4 trillion behemoth). Nevertheless, Google’s tentacles are beginning to reach far beyond its lucrative search business.

Google’s New Growth Avenues

Despite Google’s dominance in search and video through its YouTube platform, Wall Street already deeply understands these businesses and they are priced into the stock. Wall Street is the ultimate discounting device, and investors and analysts are constantly on the lookout for higher earnings growth in the future. Though many management teams in Google’s position would sit back and be “fat and happy,” management keeps the pedal to the metal and discovers new growth areas.

5 Future Catalysts for Google

Today, we will focus on fie fresh growth areas that will drive Google’s earnings growth and shares much higher into the future, including:

Waymo

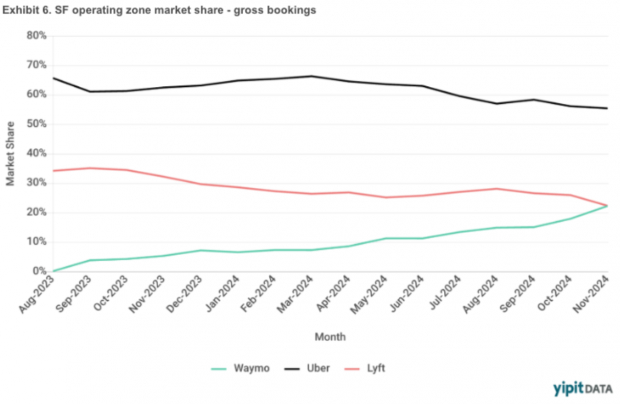

Waymo, Google’s driverless robotaxi offering has debuted in several US cities, including San Fransico. When Waymo launched in August 2023, ride share kings Uber (UBER) and Lyft (LYFT) accounted for a 66% and 34% market share, respectively. A little more than a year later, Waymo has tied Lyft at ~22% of the rideshare market (accounts for GOOGL’s geofenced zone only).

Image Source: Yipit Date

Waymo’s rapid success and LYFT and UBER’s falling stock prices hint that Google and Tesla (TSLA) have an opportunity to disrupt the massive rideshare market over the next five years.

Willow: A Ground-Breaking Quantum Computing Chip

Every so often, there’s a monumental leap in technology. Last week, Google delivered in the form of its “Willow” quantum computing chip. The company announced that Willow performed a five-minute computation that would “Take one of today’s fastest supercomputers 10 septillion years.”

For context, this number written out looks like this:

10,000,000,000,000,000,000,000,000!

Gemini Generative AI

Alphabet’s foray into the generative AI space got off to a rough start when its large language model (LLM) proved error-prone and inaccurate in many cases. However, Google’s genius tech team has fixed the issues and is now adding new features such as image capabilities, coding support, and app integration. Though the AI market is still very much up for grabs, Google has a clear advantage due to its massive cash hoard, existing technology, and integration opportunities to other sides of its business, such as its Android operating system.

Google Cloud

Google is gaining market share in the cloud computing space, driven by continued strength in its Google Cloud and Workspace platforms. As Google continues to expand its cloud footprint worldwide, the Google Cloud Platform is becoming a growing slice of the business. The Google Cloud segment generated revenues of $11.35 billion in the third quarter, which represents a 28.8% jump year-over-year. Using Amazon (AMZN) Web Services (AWS) as a precedent, investors should be excited about Google’s Cloud inroads. Many investors would be shocked that AWS represents a larger slice of Amazon business than even its wildly popular e-commerce business.

Google Nest

Google is capturing market share in the relatively new “smart home” market. The company is growing across its smart home Nest portfolio, which includes products like smart speakers, displays, streaming devices, thermostats, smoke detectors, routers, doorbells, and locks. Nest is yet another Google product that benefits from crossover into legacy products. With voice and AI emerging as the “next big thing” in computer interaction, revenue from this business is likely to gain traction.

Technical View: GOOGL Base Breakout

Google’s bullish innovation arch translates to the stock’s price action. GOOGL shares are breaking out of a long, multi-month base structure. Fibonacci extensions suggest that GOOGL could easily be a $250 stock in 2025.

Image Source: TradingView

Conclusion

Google is one of the most dominant and innovative tech companies worldwide. Though the company owns the legacy search market, inroads into new and explosive growth industries should excite investors into 2025 and beyond.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.1% per year. So be sure to give these hand picked 7 your immediate attention.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Lyft, Inc. (LYFT) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report