GE Vernova GEV has soared 140% since its April IPO as Wall Street buys stocks that will power the energy-hungry artificial intelligence age.

Investors should consider GEV for its ability to grow alongside the energy transition and the nuclear energy resurgence. More Wall Street analysts have picked up coverage of GE Vernova recently. GEV also offered bullish guidance through 2028 earlier this month and announced a dividend and stock repurchase plan.

GEV’s cooldown over the last month offers a great buying opportunity heading into 2025.

Why Wall Street Loves this Energy Transition and Nuclear Energy Stock

GE Vernova went public in April 2024 after GE completed its separation into three companies: GE Aerospace (GE), GE HealthCare (GEHC), and GE Vernova. GE Vernova is a pure-play energy transition company growing alongside electrification, nuclear energy expansion, and beyond.

GE Vernova boasts that roughly 25% of the world’s electricity is generated by its customers using GE Vernova’s technologies, including gas and wind turbines, leading-edge electrification technology, and much more.

Image Source: Zacks Investment Research

Wall Street loves GE Vernova because the U.S. government is all in on the energy transition and nuclear energy. The U.S. aims to triple nuclear energy capacity by 2050 as it attempts to wean itself off of fossil fuels. On top of that, nuclear will power energy-hungry AI growth as Meta, Amazon, and others make nuclear energy deals.

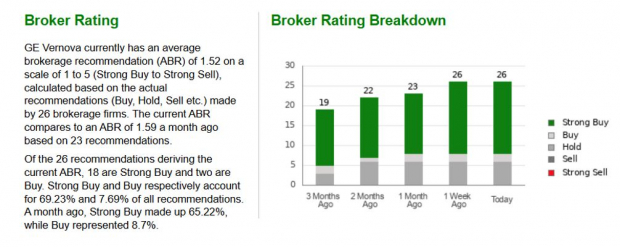

GEV has 26 brokerage recommendations at Zacks, up from 19 three months ago, with 70% at “Strong Buys.”

GE Vernova reports via three business segments: Power, Wind, and Electrification. GEV’s steam power segment has provided nuclear turbine technologies and services for all reactor types for decades.

GEV’s Hitachi Nuclear Energy division is a leading provider of advanced nuclear reactors, fuel, and nuclear services.

GE Vernova is at the forefront of next-generation small modular nuclear reactor (SMR) technologies that are viewed as the future of the industry. The U.S. Department of Energy selected GE Vernova to help build out a key part of the next-gen nuclear and uranium industry.

Outside of nuclear, GE Vernova’s growth pipeline includes electrification software, power conversion, energy storage, grid solutions, and more. GE Vernova is also streamlining its business and cutting back on its struggling offshore wind unit as inflation and supply chain challenges plague the industry.

Image Source: Zacks Investment Research

GEV made a splash on December 10 when it declared its first dividend, payable in the first quarter of 2025, and approved an initial $6 billion share repurchase plan.

GEV also provided an updated strong growth outlook through 2028. It expects its revenue to reach ~$45 billion by 2028, marking a high-single-digit compound annual growth rate for organic sales vs. the 2025 base year (an improvement from its previous mid-single-digit outlook).

Zacks estimates call for GE Vernova to grow its adjusted earnings by 194% YoY in 2025 from an estimated $2.26 a share in FY24 to $6.65 a share.

Buy GEV Stock for 2025 and Long-Term Upside?

GE Vernova is the fifth-best performing S&P 500 stock this year, putting it up there with Nivida NVDA and fellow nuclear energy stocks Vistra VST and Constellation Energy CEG.

GEV has surged approximately 140% since its market debut on April 2, crushing Nvidia’s 45%, the S&P 500’s 17%, Constellation’s 23%, and Vistra’s 93%.

Image Source: Zacks Investment Research

GEV has cooled off during the last month, consolidating around its 21-day moving average and near neutral RSI levels. GEV trades 9% below its November highs and 30% below the highest current price target at Zacks.

Any pullback to GEV’s 50-day moving average likely offers investors a solid buying opportunity.

On the valuation front, GE Vernova trades at a 60% discount to its peaks in terms of its price/earnings-to-growth (PEG) ratio at 2.9, highlighting its robust earnings growth outlook.

Zacks Naming Top 10 Stocks for 2025

Want to be tipped off early to our 10 top picks for the entirety of 2025?

History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2025. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>

Constellation Energy Corporation (CEG) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

GE Vernova Inc. (GEV) : Free Stock Analysis Report