The most oversold stocks in the information technology sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

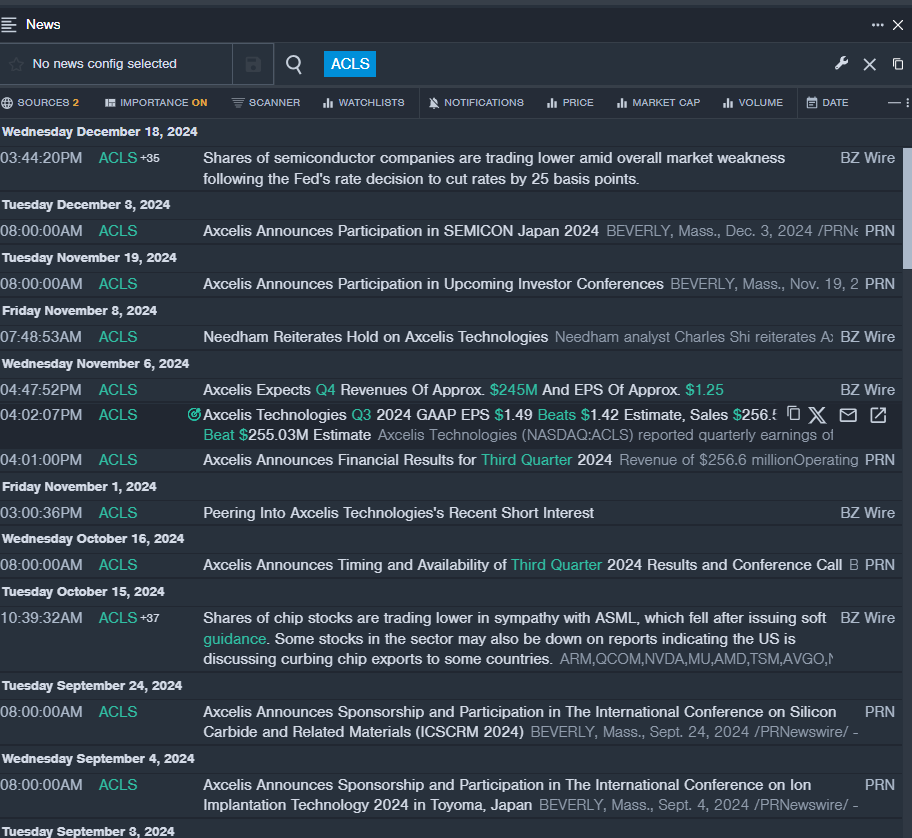

Axcelis Technologies Inc ACLS

- On Nov. 6, Axcelis Technologies posted better-than-expected quarterly earnings. President and CEO Russell Low commented, “Axcelis executed well in the third quarter with results relatively in-line with our expectations. While we anticipate a near term digestion of mature node capacity through the first half of 2025, customer engagement is strong and our long-term growth opportunity remains squarely intact highlighted by attractive secular growth in silicon carbide, a cyclical recovery in our memory and general mature markets, market share gains in advanced logic and regional penetration of the Japan market.” The company’s stock fell around 9% over the past five days and has a 52-week low of $68.79.

- RSI Value: 29.60

- ACLS Price Action: Shares of Axcelis Technologies fell 2.5% to close at $69.18 on Thursday.

- Benzinga Pro’s real-time newsfeed alerted to latest ACLS news.

Applied Materials Inc AMAT

- On Dec. 6, Wells Fargo analyst Joseph Quatrochi maintained the stock with an Overweight rating and lowered the price target from $220 to $210.. The company’s stock fell around 4% over the past five days and has a 52-week low of $148.06.

- RSI Value: 29.31

- AMAT Price Action: Shares of Applied Materials fell 2.4% to close at $161.44 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in AMAT stock.

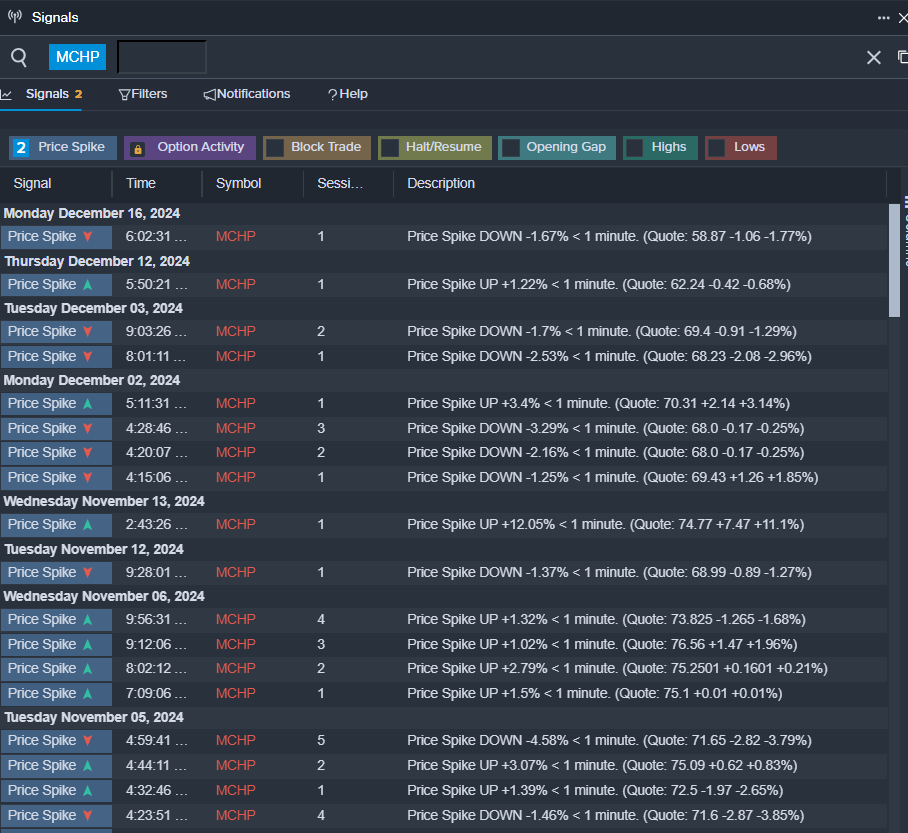

Microchip Technology Inc MCHP

- On Dec. 11, Stifel analyst Nathan Jones maintained A.O. Smith with a Buy and lowered the price target from $91 to $90. The company’s stock fell around 14% over the past month and has a 52-week low of $55.90.

- RSI Value: 27.86

- MCHP Price Action: Shares of Microchip Technology fell 0.3% to close at $55.99 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in MCHP shares.

Read More:

Market News and Data brought to you by Benzinga APIs