As both JPMorgan Chase & Co JPM and Wells Fargo & Co WFC prepare to release their fourth quarter earnings on Wednesday before the market opens, the spotlight’s on their technicals.

Investors are betting big on both, but only one can come out on top when the numbers drop. Let’s take a quick spin through the charts and see who’s in the driver’s seat ahead of the big reveal.

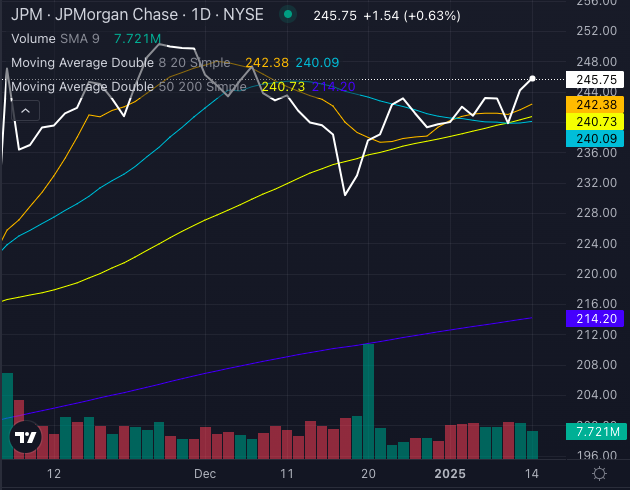

JPM Stock: Strong Bullish Momentum

JPM stock is cruising, and it’s not just the bull market that’s pushing it.

Chart created using Benzinga Pro

Trading at $245.75, JPM stock is firmly parked above its eight, 20, and 50-day simple moving averages (SMAs), signaling a roaring bullish trend. The stock has been soaking up buying pressure like a sponge, with investors clearly confident about its upcoming earnings report.

The eight-day SMA of $242.38, 20-day SMA of $240.09 and 50-day SMA of $240.73 are all flashing bullish signals – an indication that JPM stock is firing on all cylinders.

Looking ahead, analysts are forecasting strong results: $4.11 in EPS and $41.7 billion in revenue. Given the strong upward momentum and positive technicals, JPMorgan looks primed to continue its bull run post-earnings, barring any major surprises.

With its 200-day SMA sitting at $214.20, the long-term bullish trend is also clearly intact.

Read Also: Jamie Dimon Calls Elon Musk ‘An Extraordinary Talent’ — JP Morgan CEO Shares Why Trump’s Election Victory Didn’t Surprise Him

WFC Stock: Cautionary Signals Amid Long-Term Strength

Meanwhile, WFC stock is a bit more on the fence.

Chart created using Benzinga Pro

Trading at $71.17, WFC stock is still above its eight, 20 and 200-day moving averages, suggesting a bullish short and long-term outlook. But the medium-term charts aren’t quite as rosy. The 50-day SMA of $71.73 is giving off a bearish signal, indicating that WFC stock could be in for a bit of a pause, or even a minor pullback, before earnings.

The 50-day SMA trading above the price further confirms this potential weakness, even though the 200-day SMA of $61.67 continues to signal bullishness in the long run.

The Verdict: JPM Looks Stronger for Now

In the grand scheme of things, Wells Fargo’s longer-term trend is still bullish, but with technicals showing some indecision in the medium-term. So, WFC stock will need a solid earnings beat to kick things back into gear.

JPM stock, on the other hand, is looking incredibly strong across the board, and its solid bullish momentum makes it the clear technical winner going into Wednesday’s earnings report.

Read Next:

Image created using photos from Shutterstock.

Market News and Data brought to you by Benzinga APIs