While the long-term trajectory of the benchmark equities index may be linearly northward, deciphering next moves for individual securities can be frustrating due to behavioral dynamics. Case in point is blockchain miner MARA Holdings Inc MARA. Speculators must consider not only the kinesis of MARA stock but also where it may ultimately end up.

When it comes to broader narratives, MARA’s business profile may present some “deceiving” signals, for lack of a better word. For example, the company and one of its main rivals, Riot Platforms Inc RIOT, theoretically benefit from the same fundamental catalysts. In the current paradigm, a favorable regulatory environment should boost MARA stock and its ilke.

However, the distinction for RIOT is that the security signaled a directional bias. First, technical analysts would arguably identify a bullish flag formation in the charts. Sure enough, since the beginning of the month, RIOT has been charging higher, appearing eager to break out of its consolidation cycle.

Second, the security features a statistical catalyst in that extremely positive weekly performances yield what is known as FOMO or the fear of missing out. In other words, strength begets strength, with the odds of a long position being profitable reaching several percentage points above a coin toss.

Unfortunately, the same framework does not apply to MARA stock with equal vigor. Therefore, traders may need to pay for the extra coverage inherent in a long iron condor.

Directional Ambiguity for MARA Stock Incentivizes a Special Trade

Although MARA stock has also been a strong performer — rising over 19% since the start of the month — no clear technical signals exist. One could make the argument that since around October last year, MARA has charted a series of higher lows. However, there’s no distinct formation that provides additional directional confidence.

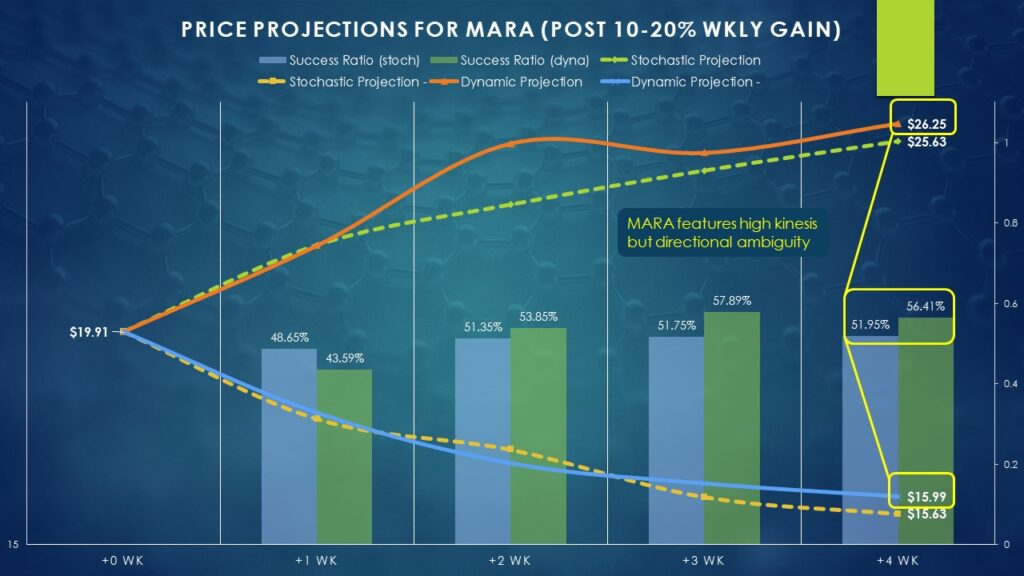

Another element that imposes some ambiguity on MARA stock is its behavioral tendencies. When weekly pricing data is viewed stochastically — that is, devoid of outside context beyond the temporal — MARA carries a neutral to slightly negative bias. Week to week, there’s a 48.65% chance that a position held at the beginning of the period will rise by the end of it. On a four-week basis, this stat improves slightly to 51.95%.

Interestingly, MARA stock also benefits from FOMO but to a lesser degree. Last week, MARA gained over 17%. During one-week periods when the security rises between 10% to 20%, the odds of a long position being profitable over the next four weeks improves to 56.41%. It’s not nothing but the improvement over coin-toss odds is minimal.

Logically, then, there’s a much higher risk relative to RIOT that MARA could tumble. Therefore, a directionally biased bull call spread might not be the sole solution. Instead, a trader may also want to cover the possibility of downside with a bear put spread.

That’s the beauty of the long iron condor, which is a combination of these two vertical strategies.

Also Read: Construction Partners Stock Cracks Under Pressure As Short Seller Warns Of Potential 50% Downside

Targeting Either Endzone for a Price

Obviously, all things being equal, it’s always better to cover the possibility of two outcomes materializing rather than one outcome. However, not everything is equal. Financially, the reason why the long iron condor should not be deployed haphazardly is that the trader pays a double premium: one to attack the north endzone with the bull spread component and another to attack the south endzone with the bear spread component.

However, the double premium is worthwhile when the potential for high kinesis is strong, but the directional impulse is not. In MARA’s case, four weeks after the anchor event (i.e. a weekly performance between 10% to 20% up), the median return under positive outcomes clocks in at 31.86% while the median loss under negative outcomes lands at 19.69%.

Armed with this intelligence, traders recognize that MARA risks either falling to $15.99 or potentially rising to $26.25 by the options chain expiring Feb. 14. Next, traders can choose an iron condor that aligns with their risk tolerance, understanding that wider condors carry greater probabilistic risk (due to added required length of travel) but far bigger payouts or rewards.

Arguably, the most aggressive long iron condor (for the Feb. 14 expiration date) that is still rational based on statistical trends is the 16P | 18P || 24C | 26C or the combination of the 16/18 bear put spread and the 24/26 bull call spread.

For more conservative traders, they may opt for the narrower 17P | 18P || 23C | 24C condor trade. This transaction requires less travel for the stock but at the expense of a lower payout.

Read Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.