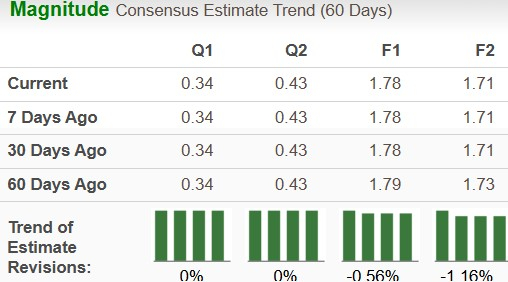

Ford F is slated to release fourth-quarter 2024 results on Feb. 5, after market close. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings and automotive revenues is pegged at 34 cents per share and $43.6 billion, respectively.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The earnings estimate for the to-be-reported quarter has remained unchanged over the past seven days. The bottom-line projection indicates year-over-year growth of 17.2%. The Zacks Consensus Estimate for quarterly revenues suggests a 0.7% uptick from the year-ago quarter’s figure.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

For 2025, the Zacks Consensus Estimate for F’s automotive revenues is pegged at $166 billion, suggesting a decline of 4% year over year. The consensus mark for full-year EPS is $1.71, calling for a 3.4% year-over-year contraction.

In the trailing four quarters, this U.S. legacy automaker surpassed EPS estimates on two occasions, missed once and matched on the other, with the average earnings surprise being 33%.

Ford Company Price and EPS Surprise

Ford Motor Company price-eps-surprise | Ford Motor Company Quote

Q4 Earnings Whispers for F

Our proven model does not conclusively predict an earnings beat for Ford this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Ford has an Earnings ESP of -2.94% and a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Ford’s Key Q4 Metrics to Watch

Ford’s U.S. sales rose roughly 9% year over year to 530,660 units in the fourth quarter of 2024. While internal combustion engine vehicle sales were up 6.8% year over year, electric and hybrid vehicle deliveries surged 16.3% and 26.5%, respectively. Retail sales increased 17% from the year-ago quarter, thanks to 25% growth in F-Series deliveries. Ford was the #4 EV brand in the country in the fourth quarter, behind Tesla TSLA, General Motors GM and Hyundai-Kia. Ford sold 30,176 EVs in the fourth quarter of 2024 in the United States.

Here’s a rundown of the estimates for Ford’s revenues and EBIT for key segments for the three months ended Dec. 31.

The Zacks Consensus Estimate for revenues from the Ford Blue unit (comprising ICE and hybrid models) is pegged at $25.7 billion, implying a decrease of 2% year over year. The consensus mark for the segment’s EBIT is $1.26 billion, up from $813 million recorded in the fourth quarter of 2023.

The Zacks Consensus Estimate for revenues from the Ford model e unit (comprising of electric vehicles) is pegged at $1.22 million, implying a decline from $1.60 billion in the corresponding period in 2023. The consensus mark for the segment’s loss before interest and taxes is $1.30 billion, narrower than $1.57 billion in the year-ago quarter.

The Zacks Consensus Estimate for revenues from the Ford Pro unit (encompassing commercial vehicles and services) is pegged at $16.5 billion, implying growth of 7% year over year. The consensus mark for the segment’s EBIT is $1.6 billion, suggesting a decline from $1.8 billion recorded in the fourth quarter of 2023.

Ford expects to report a $700 million special item gain in the quarter to be reported due to pension adjustments.

F Stock Price Performance & Valuation

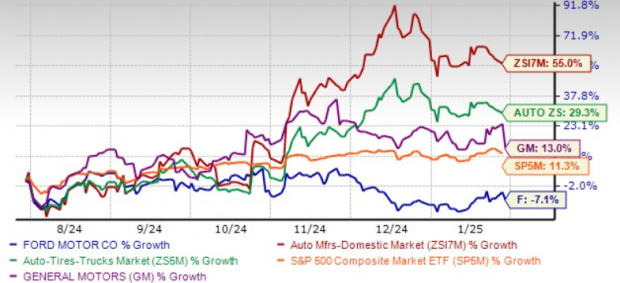

Over the past six months, Ford has underperformed the industry, sector, S&P 500 and its key competitor, GM.

6-Month Price Performance

Image Source: Zacks Investment Research

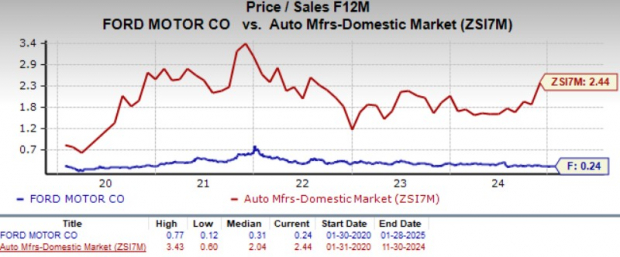

From a valuation perspective, Ford is trading relatively cheap. Going by its price/sales ratio, the company is trading at a forward sales multiple of 0.24, below its median of 0.31 over the last five years. It also trades at a discount compared to the industry’s 2.44.

Image Source: Zacks Investment Research

Better to Avoid Betting on Ford Now

While the valuation may appear tempting, it does seem the right time to place bets on this stock now. The Ford Model e business is incurring significant losses amid ongoing pricing pressure and increased investments in next-generation EVs. While Ford’s massive investments in green vehicles might prove beneficial in the long term, it is straining its near-term financials. Massive spending on modernization, including connectivity, IT and new product launches, is expected to limit cash flows. Secondly, the company is struggling with steep warranty costs. Quality issues, especially with older models, have led to elevated warranty costs. Despite efforts to address these issues, Ford has indicated that these would remain a headwind in 2025.

Although the Ford Pro business is a bright spot, and we like the company’s attractive dividend yield of over 5%, these do not outweigh the growing financial pressure and operational headwinds the company is facing. The fourth-quarter results are also expected to be soft. So, investing ahead of its upcoming results doesn’t seem a good idea. It’s better to avoid the stock for now and wait for management’s commentary on warranty costs and 2025 guidance.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.3% per year. So be sure to give these hand picked 7 your immediate attention.

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report