Advanced Micro Devices AMD is set to release its fourth-quarter 2024 results on Feb. 4.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

AMD expects fourth-quarter 2024 revenues of $7.5 billion (+/-$300 million). The mid-point of the range indicates year-over-year growth of 22% and a sequential rise of 10%.

The Zacks Consensus Estimate for AMD’s fourth-quarter revenues is pegged at $7.52 billion, suggesting year-over-year growth of 21.84%. The consensus mark for fourth-quarter earnings is pegged at $1.07 per share, unchanged over the past 60 days. The estimate indicates growth of 38.96% on a year-over-year basis.

AMD beat the Zacks Consensus Estimate for earnings in three of the trailing four quarters and met once, the average surprise being 1.86%.

Advanced Micro Devices, Inc. Price and EPS Surprise

Advanced Micro Devices, Inc. price-eps-surprise | Advanced Micro Devices, Inc. Quote

AMD’s Data Center & Client Segment Revenues to Grow Y/Y

AMD expects the Data Center segment’s revenues to significantly increase, driven by the strong sales of its data center chips that support hyperscalers, and power AI and Generative AI applications.

The Zacks Consensus Estimate for fourth-quarter Data Center revenues is pegged at $4.1 billion, indicating an impressive year-over-year surge of 79.71%.

Driven by sales of AMD’s Instinct GPU and EPYC CPU sales, the chipmaker saw record data center revenues of $3.5 billion in the third quarter of 2024, up 122% year over year. AMD’s EPYC CPUs are deployed at scale to power the services of industry leaders like Meta Platforms META, Cloudflare NET, Microsoft, Zoom, Uber and Netflix.

In the third quarter of 2024, AMD’s public cloud instances increased to more than 950 as Microsoft, Amazon and others launched or expanded their EPYC processor-powered offerings. META alone employed more than 1.5 million AMD EPYC CPUs globally to power its social media platforms. NET selected general X processors with AMD’s 3D chiplet stacking technology to power its next-generation servers.

EPYC Instance adoption with Enterprise customers also grew, highlighted by wins with Adobe, Boeing, Synopsys, Tata and others. This trend is expected to have continued in the fourth quarter of 2024.

AMD expects its client segment revenues to increase, driven by the strong demand for its Zen 5 notebook and desktop processors. The robust performance of its Ryzen series AI-powered processors is expected to have boosted AMD’s top-line growth in the to-be-reported quarter.

The Zacks Consensus Estimate for fourth-quarter Client segment revenues is pegged at $1.97 billion, indicating year-over-year growth of 35.04%.

Weak Embedded & Gaming to Hurt AMD’s Q4 Results

AMD’s near-term prospects suffer from weakness in the Embedded and the Gaming segment. On a year-over-year basis, this segment’s revenues are expected to have declined.

The Zacks Consensus Estimate for fourth-quarter Embedded revenues is pegged at $922 million, indicating a 12.77% year-over-year decline. The consensus mark for Gaming revenues is pegged at $509 million, suggesting a massive 62.79% decline.

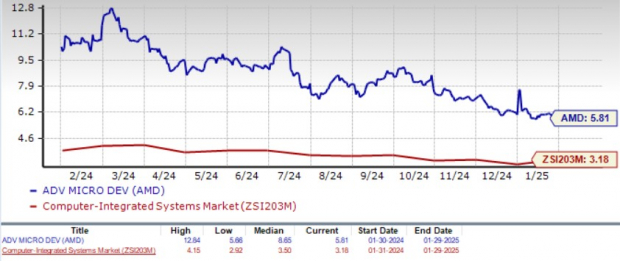

AMD Underperforms Sector & Industry

Advanced Micro Devices shares have lost 31.2% in the trailing 12 months, underperforming the Zacks Computer and Technology sector’s appreciation of 25.2% and the Zacks Computer – Integrated Systems industry’s decline of 5.3%.

One-Year Performance

Image Source: Zacks Investment Research

The AMD stock is not so cheap, as its Value Score of F suggests a stretched valuation at this moment.

In terms of the forward 12-month price/sales, Advanced Micro Devices is currently trading at 5.81X, higher than the industry’s 3.18X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

The stock is trading below the 50-day and 200-day moving averages, indicating a bearish trend.

AMD Stock Trades Below 50-Day & 200-Day SMAs

Image Source: Zacks Investment Research

Can a Rich Partner Base & Acquisitions Aid AMD in 2025?

Advanced Micro Devices benefits from a strong partner base, with Microsoft, Oracle, DELL, Hewlett Packard HPE, Lenovo and Supermicro having Instinct platforms in production.

AMD powers the El Capitan supercomputer with its Instinct MI300A APUs. Housed at Lawrence Livermore National Laboratory and built by HPE, it has become the fastest on the Top 500 list with a 1.742 exaflop High-Performance Linpack score.

In collaboration with Dell, AMD is powering Dell Pro commercial notebooks, desktops and workstations with its Ryzen AI PRO processors. AMD also recently announced a partnership with IBM to offer the AMD Instinct MI300X accelerators on IBM Cloud, advancing HPC and AI capabilities.

AMD has been on an acquisitive spree to strengthen its AI ecosystem and bridge the technological gap with NVIDIA in the race for AI dominance.

The acquisition of ZT Systems, which provides AI infrastructure to large hyperscale computing companies, is noteworthy. ZT Systems will enable AMD to simultaneously design and validate its next-generation AI silicon and systems. The move is expected to speed up the large-scale deployment of data center accelerators, which are critical for AI innovation.

Conclusion

AMD’s expanding portfolio and strategic acquisitions are expected to have improved its top-line growth in the to-be-reported quarter amid weakness in the Embedded and Gaming segments, and fierce competition from NVIDIA.

AMD has a Growth Score of D, which makes it unattractive for growth-oriented investors. Stretched valuation is another concern.

AMD currently has a Zacks Rank #4 (Sell), suggesting that investors should stay away from the stock for the time being.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

Cloudflare, Inc. (NET) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report